Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 16, 2022

Eurozone recession fears ease as flash PMI signals slower rate of contraction for second month

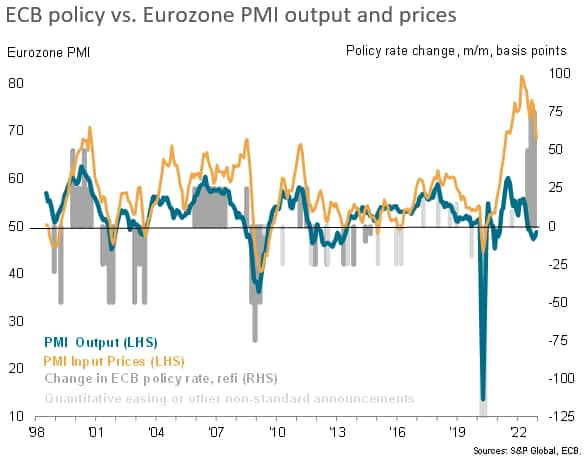

The eurozone downturn extended into its sixth successive month in December, according to flash PMI data, though the rate of decline of business activity moderated for a second month running amid a reduced rate of loss of orders, improving supply conditions, lower price pressures and an uplift in business confidence.

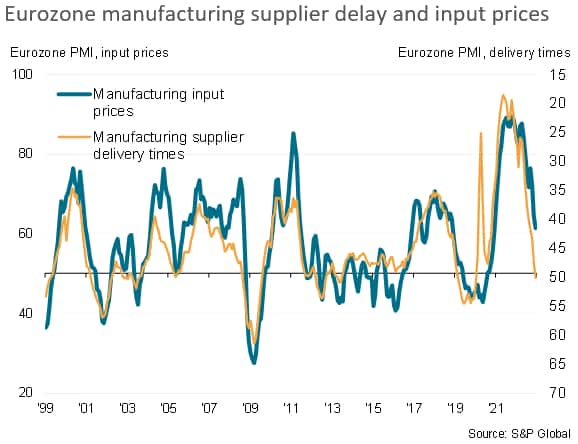

Firms' costs notably rose at the slowest rate for over one-and-a-half years, reflecting the combination of weakened demand and improved supply, the latter signalled by the first quickening of supplier delivery times since the pandemic began.

However, the overall level of business sentiment remains subdued by historical standards, reflecting the challenging environment caused by the high cost of living, rising interest rates, concerns over energy supply and the Ukraine war. Companies reported only a modest increase in payroll numbers again as a result, underscoring the cautious mood that prevails.

Fourth quarter contraction

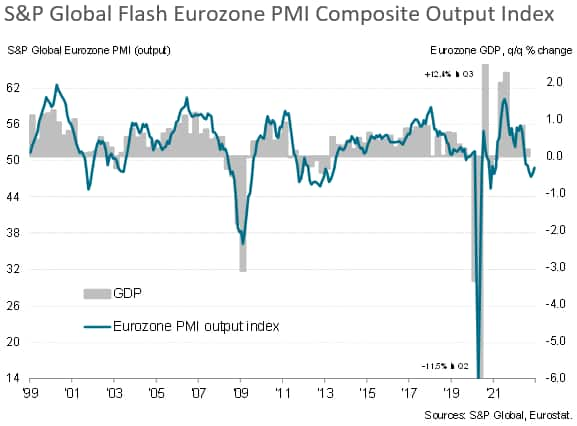

The seasonally adjusted S&P Global Eurozone PMI® Composite Output Index rose for a second successive month in December, increasing from 47.8 in November to a four-month high of 48.8, according to the preliminary 'flash' reading based on approximately 85% of usual survey responses. Although remaining below the neutral 50.0 level to indicate a sixth successive fall in business activity, the PMI has now signalled an easing in the rate of contraction for two months in a row.

The subdued level of the PMI nevertheless means that the fourth quarter as a whole has seen a worse performance than the third quarter, with the average PMI for the three months to December indicative of the sharpest economic contraction since 2013 if pandemic lockdown months are excluded.

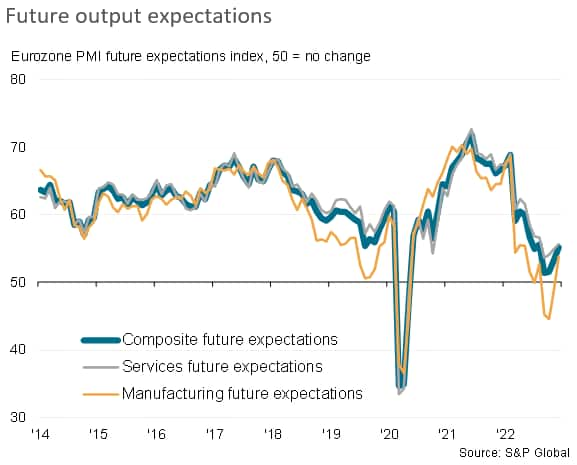

However, while the further fall in business activity in December signals a strong possibility of recession, the survey also hints that any downturn will be milder than thought likely a few months ago. The data for the fourth quarter are consistent with GDP contracting at a quarterly rate of just less than 0.2%, and - as discussed below - forward-looking indicators from the PMI survey are currently boding well for the rate of decline to ease further in the first quarter.

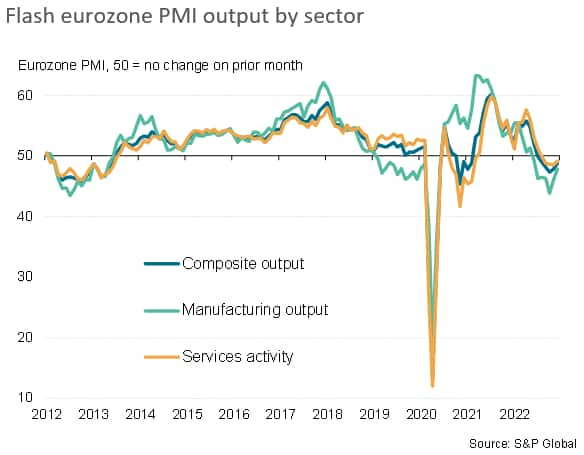

Broad-based downturn eases

While manufacturing continued to lead the downturn, with factory output dropping for a seventh straight month, the rate of production decline eased to indicate a further marked cooling in the pace of contraction compared to October's steep fall. The manufacturing output index rose to 47.9, a six-month high, against 46.0 in November.

Service sector output meanwhile fell, down for a fifth successive month, but likewise saw a moderation in the rate of decline. The sector's activity index rose from 48.5 to a four-month high of 49.1, indicative of only a modest monthly deterioration of output.

Looking in more detail by sector, the steepest downturns continued to be seen in chemical, plastics and basic resources firms (linked in part to high energy costs and destocking), and in the financial services sector. A marked fall was also again seen for transportation, but there was a notable improvement in consumer facing firms such as tourism & recreation and, to a lesser extent, household goods.

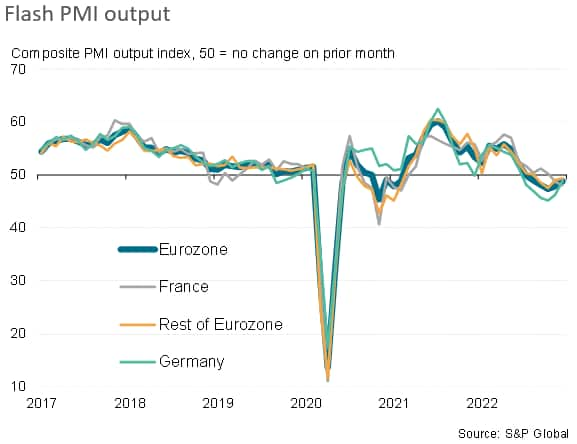

Contraction led by Germany

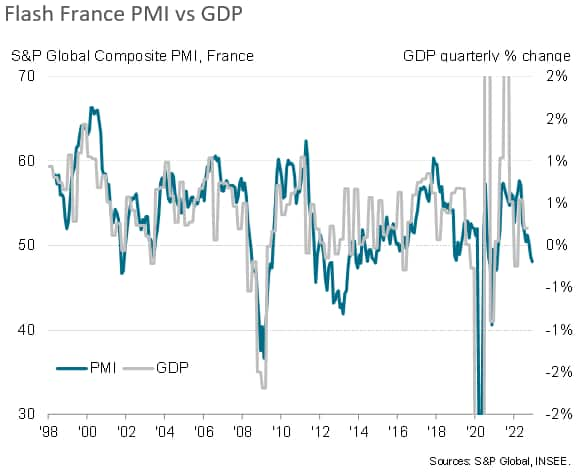

Within the euro area, the fall in output was also broad-based by region but only France saw a deepening downturn. The flash French composite PMI slipped from 48.7 to 48.0 to signal a second consecutive monthly drop in output and the largest decline since November 2014 if the pandemic is excluded. A softening of the manufacturing downturn was offset by the steepest fall in service sector activity for 22 months.

Germany meanwhile saw rates of decline moderate across both manufacturing and services, pushing the composite flash PMI up for a second month in a row from 46.3 in November to 48.9. The December reading thereby registered the smallest drop in activity recorded over the past six months.

Output fell in the rest of the eurozone for a fourth successive month, though the pace of decline slowed for a second month running to point to the smallest deterioration seen so far.

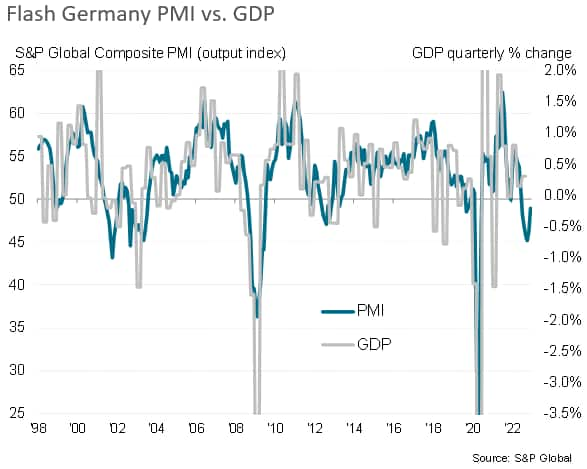

Comparing the PMI surveys to official data, the PMI for Germany is currently running at a level broadly indicative of GDP contracting by 0.4% in the fourth quarter, albeit with contraction momentum slowing sharply, while in France, the PMI is indicative of GDP barely falling in the fourth quarter yet with downward momentum gathering pace.

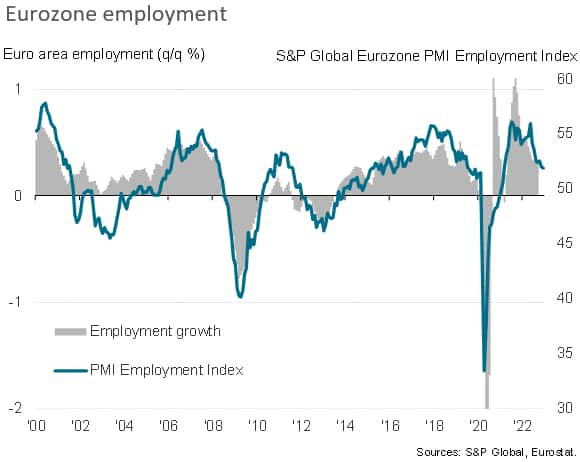

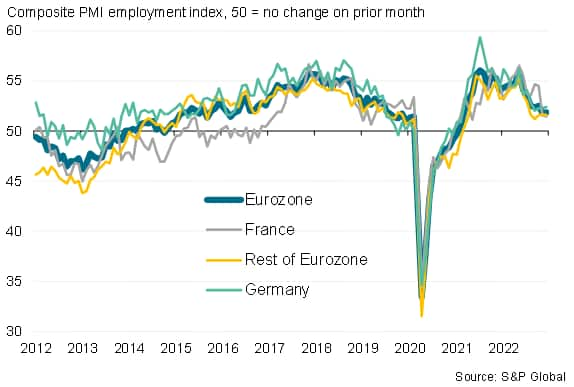

Hiring slows amid further loss of demand

An ongoing deterioration of order books meanwhile led to another month of only modest net job creation, with employment rising at a marginally improved rate compared to November yet still showing the second-smallest gain since February 2021. Similar subdued hiring rates were seen in both manufacturing and services. By country, jobs growth picked up marginally in Germany but deteriorated slightly in France and held steady across the rest of the region, in all cases remaining subdued.

Price pressures cool amid easing supply constraints and weaker demand

Factories meanwhile reported the first - albeit marginal - improvement in supplier delivery times since January 2020. However, delivery times were often faster only because suppliers were less busy due to lower demand for inputs, which fell sharply again in December.

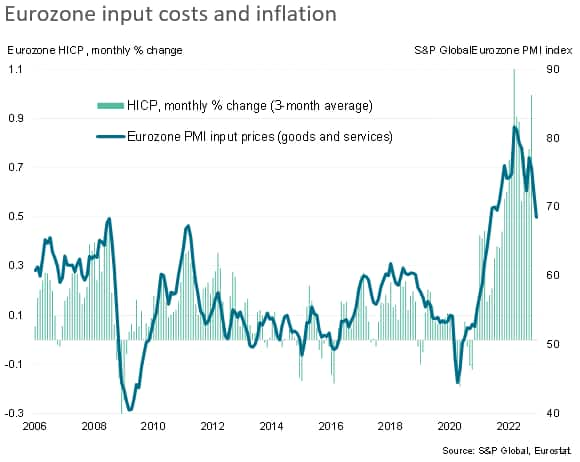

An upside of improving supply and falling demand was a marked cooling of input cost inflation in manufacturing to the weakest since December 2020, and in services to the weakest since January 2022. Measured overall, input costs consequently rose at the slowest rate since May 2021, albeit still rising at an historically elevated rate.

Prices charged for goods and services also continued to rise at a steep rate, though the rate of inflation moderated to the lowest for a year, reflecting weaker rates of increase in both main sectors. Slower selling price inflation was linked often to the slower growth of costs, but also in some cases to the need to offer discounts to help stimulate sales.

The outlook for inflation is therefore especially encouraging. With supply chains now improving for the first time since the pandemic began and firms' costs growing at a sharply reduced rate, feeding through to lower rates of increase for prices charged for both goods and services, CPI inflation looks set to fall further in the coming months.

Confidence up but mood remains gloomy

The downside is that this improving inflation outlook is primarily a symptom of falling demand, which has removed pricing power from many companies and their suppliers, and the business environment remains one in which confidence remains very subdued by historical standards. Sentiment for the year ahead remained subdued by historical standards. Although up further from October's recent lows, the PMI's future output index is running at 55.1 compared to a long-run average of 60.8. Confidence continues to be dogged in particular by worries over the impact of the rising cost of living, the energy crisis, the war in Ukraine and rising interest rates, as well as a broad concern over the darkening economic outlook both at home and internationally.

Thus, while the downturn is looking likely to be less steep this winter than previously anticipated by many, there remain few signs of any meaningful return to growth evident as 2022 comes to an end.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recession-fears-ease-as-flash-pmi-signals-slower-rate-of-contraction-December2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recession-fears-ease-as-flash-pmi-signals-slower-rate-of-contraction-December2022.html&text=Eurozone+recession+fears+ease+as+flash+PMI+signals+slower+rate+of+contraction+for+second+month+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recession-fears-ease-as-flash-pmi-signals-slower-rate-of-contraction-December2022.html","enabled":true},{"name":"email","url":"?subject=Eurozone recession fears ease as flash PMI signals slower rate of contraction for second month | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recession-fears-ease-as-flash-pmi-signals-slower-rate-of-contraction-December2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Eurozone+recession+fears+ease+as+flash+PMI+signals+slower+rate+of+contraction+for+second+month+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2feurozone-recession-fears-ease-as-flash-pmi-signals-slower-rate-of-contraction-December2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}