Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 23, 2024

US flash PMI data point to lower economic growth and inflation trajectories in second quarter

The US economic upturn lost momentum at the start of the second quarter, with the flash PMI survey respondents reporting below-trend business activity growth in April. Further pace may be lost in the coming months, as April saw inflows of new business fall for the first time in six months and firms' future output expectations slipped to a five-month low amid heightened concern about the outlook.

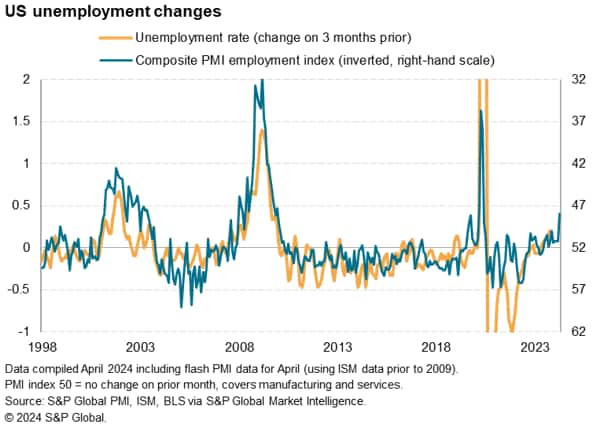

The more challenging business environment prompted companies to cut payroll numbers at a rate not seen since the global financial crisis if the early pandemic lockdown months are excluded.

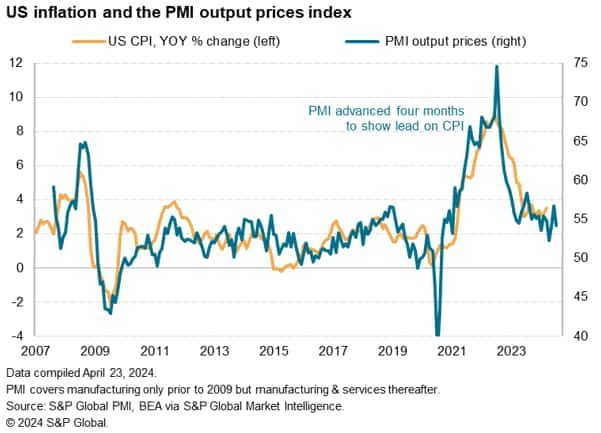

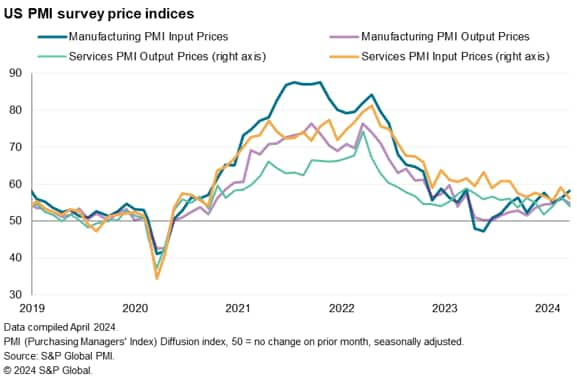

The deterioration of demand and cooling of the labor market fed through to lower price pressures, as April saw a welcome easing in rates of increase for selling prices for both goods and services.

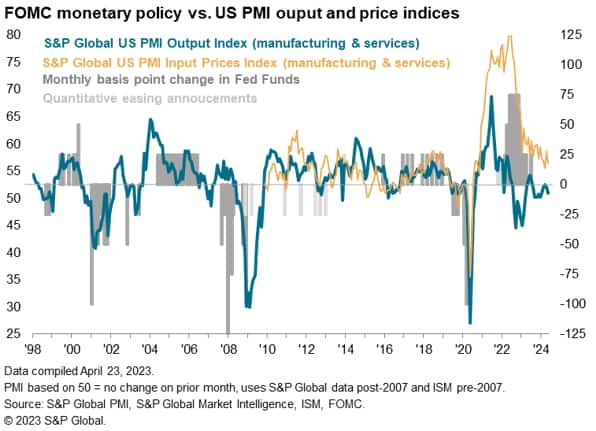

The cooling pace of output growth plus fresh falls in new orders and employment points to downside GDP risks for the second quarter. Together with the weaker price pressures evident in April, the flash PMI data therefore help keep alive expectations that the FOMC may be able to deliver two rate cuts in 2024.

Growth slows at start of second quarter

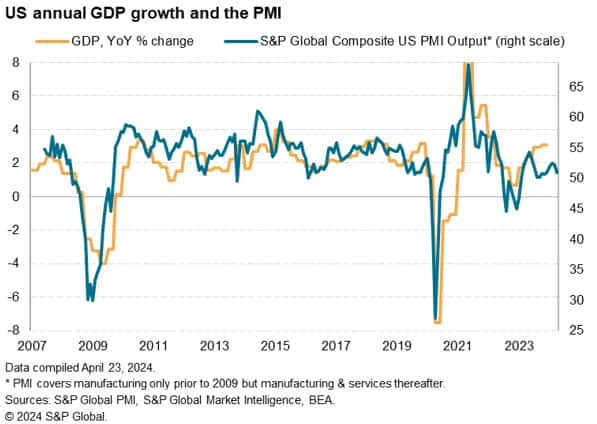

The headline S&P Global Flash US PMI Composite Output Index dropped to 50.9 in April from 52.1 in March. Although continuing to signal an increase in business activity for fifteenth successive month, the latest data indicated the slowest growth since December. The data are historically consistent with annual GDP growth falling below 2%.

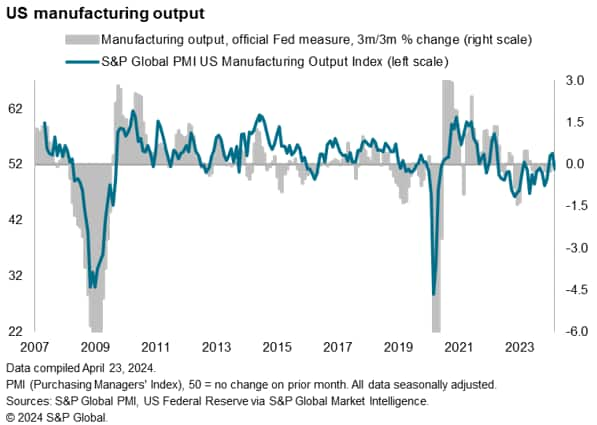

Slower increases in activity were recorded across both the manufacturing and services sectors, with rates of growth easing to three- and five-month lows respectively.

Weaker leading indicators

Output growth cooled in line with demand weakness as new orders decreased for the first time in six months, albeit dropping only modestly. Falling new business was signalled among manufacturers and service providers alike.

Some service providers suggested that elevated interest rates and high prices had restricted demand during the month. Meanwhile, manufacturers often linked lower new orders to inflationary pressures, weak demand and sufficient stock holdings at customers.

Concerns about their ability to secure new orders dampened firms' confidence in the year-ahead outlook for business activity in April. Business sentiment dipped to a five-month low, down in both manufacturing and services.

Employment hit by caution

Signs of demand weakness impacted hiring plans, causing employment to fall at the strongest pace since June 2020.

The overall reduction in workforce numbers was centered on services, where employment decreased solidly and to the largest extent since mid-2020. In fact, excluding the opening wave of the COVID-19 pandemic, the decline in services staffing levels in April was the most pronounced since the end of 2009. In contrast, manufacturing employment continued to increase modestly.

It remains to be seen if the job market weakness seen in April is a one-off or if it persists into the coming month, as any such deterioration is likely to feed through to higher unemployment and lower pay growth.

Inflation pressures fall back after March rise

Average prices charged for goods and services increased at a slower rate during April, the pace of inflation cooling again having accelerated to a ten-month high in March. Prices charged inflation was in line with the series long-run average, though still elevated by pre-pandemic standards to hint at consumer price inflation running moderately above the Fed's 2% target.

Notably, the drivers of inflation have changed. Manufacturing has now registered the steeper rate of price increases in three of the past four months, with factory cost pressures intensifying in April amid higher raw material and fuel prices, contrasting with the wage-related services-led price pressures seen throughout much of 2023. These factory-led price pressures will arguably be of less concern to policymakers than wage-related price hikes, as the latter pose greater risks of engrained wage-price spirals developing.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-point-to-lower-economic-growth-and-inflation-trajectories-in-second-quarter-April24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-point-to-lower-economic-growth-and-inflation-trajectories-in-second-quarter-April24.html&text=US+flash+PMI+data+point+to+lower+economic+growth+and+inflation+trajectories+in+second+quarter+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-point-to-lower-economic-growth-and-inflation-trajectories-in-second-quarter-April24.html","enabled":true},{"name":"email","url":"?subject=US flash PMI data point to lower economic growth and inflation trajectories in second quarter | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-point-to-lower-economic-growth-and-inflation-trajectories-in-second-quarter-April24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=US+flash+PMI+data+point+to+lower+economic+growth+and+inflation+trajectories+in+second+quarter+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-data-point-to-lower-economic-growth-and-inflation-trajectories-in-second-quarter-April24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}