Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

May 23, 2024

UK flash PMI signals sustained economic recovery, price pressures fall to lowest in over three years

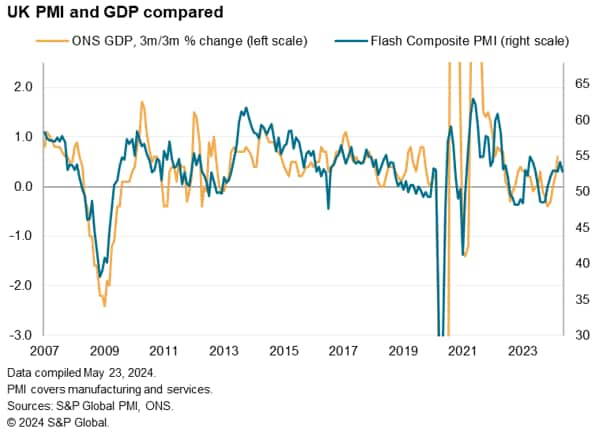

Flash PMI survey data for May signalled a further expansion of business activity halfway through the second quarter, suggesting the economy continues to recover from the mild recession seen late last year. GDP looks likely to rise by around 0.3% so far in the second quarter, with an encouraging revival of manufacturing accompanied by sustained, but slower, service sector growth.

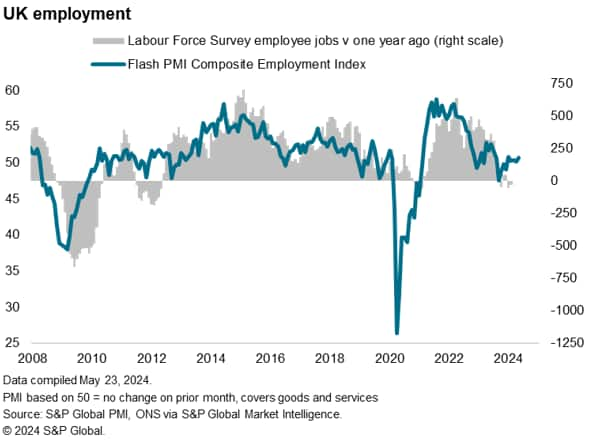

With business confidence having picked up in May, the survey data suggest output will continue to rise in the coming months, in turn helping to drive further jobs growth.

The survey also brings welcome news on inflation. Average prices charged for goods and services rose in May at the slowest rate for over three years, the pace of inflation weakening as a temporary surge in wage-related cost growth seen in April showed signs of fading. Importantly for policymakers, there was a further notable cooling of inflationary pressures in the service sector, which has seen the most stubborn price rises in recent months.

Sustained growth in business activity

Business activity continued to rise in May, according to early PMI survey indications, though the rate of growth cooled from April's 12-month high. The headline economic growth indicator from the flash PMI surveys, the seasonally adjusted S&P Global UK PMI Composite Output Index, fell from 54.1 in April to 52.8 in May. The latest reading signals a seventh successive monthly expansion of output, albeit with the rate of growth dropping back to a pace equal to that seen in March.

May's expansion is broadly consistent with GDP growing at a quarterly rate of just under 0.3%.

The sustained growth of the economy signalled by the PMI so far for the second quarter of 2024 follows official estimates of GDP having risen by a strong 0.6% in the first quarter. Both the survey and official data therefore point to the UK rebounding from the shallow recession seen late last year.

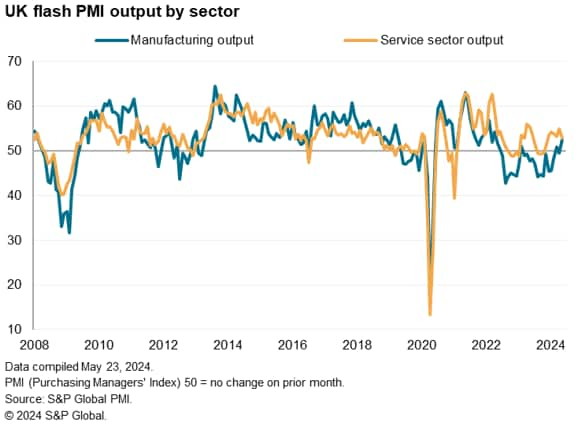

Manufacturing revival helps offset slower service sector expansion

Contrasting trends were seen across the major sectors of the economy. Although service sector business activity grew at the slowest rate since last November, subdued by a substantial easing in growth of new business to a six-month low, manufacturing output growth accelerated to the strongest recorded since April 2022 amid the largest rise in new orders since March 2022.

The reviving demand picture seen in manufacturing represents a potential end to a two-year period of near-continual decline suffered by the sector since the post-pandemic boom. A reduced rate of decline of goods orders over the past year has been led by lower export losses. Good export orders came close to stabilising in May, showing the smallest decline for 26 months, reflecting a combination of rising final demand and reduced inventory reduction policies.

In the service sector, the softer rate of expansion was due to a combination of weaker activity and demand in consumer-facing businesses, as well as slower growth of financial services. Demand for business services showed further signs of improvement, in part linked to the upturn in manufacturing.

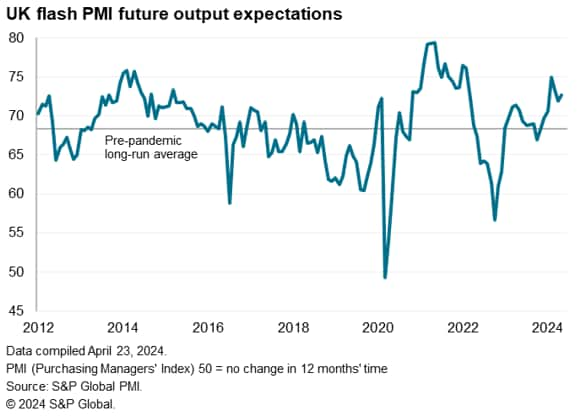

Higher confidence at manufacturers

Although current output growth slowed on the whole, business expectations for the year ahead edged higher, running well ahead of the pre-pandemic average to signal historically elevated levels of confidence. However, marked sector variations were again evident.

In the service sector, business expectations for the year ahead edged down to a four-month low, with companies citing geopolitical uncertainty surrounding the Middle East and Ukraine, as well as high interest rates, the cost of living, general election uncertainty and low levels of customer confidence. However, despite the decline, the overall level of optimism in the services economy remained well above the pre-pandemic average.

Manufacturers' optimism about the outlook meanwhile jumped to its highest since February 2022, buoyed by expectations of improved economic prospects, higher customer demand and new product development and marketing.

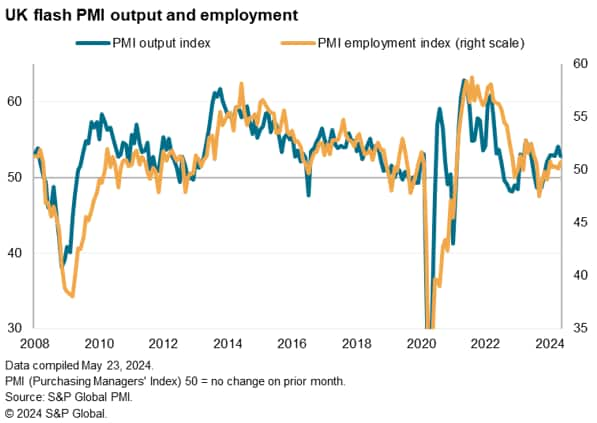

Hiring curbed by skill shortages

Employment rose as firms expanded capacity in line with the sustained growth of demand, though the rate of job creation remained subdued, in part reflecting ongoing difficulties in finding suitable staff and replacing leavers. Employment has now nevertheless edged higher for five successive months after the four months of decline seen at the end of last year.

Selling price inflation at 39-month low

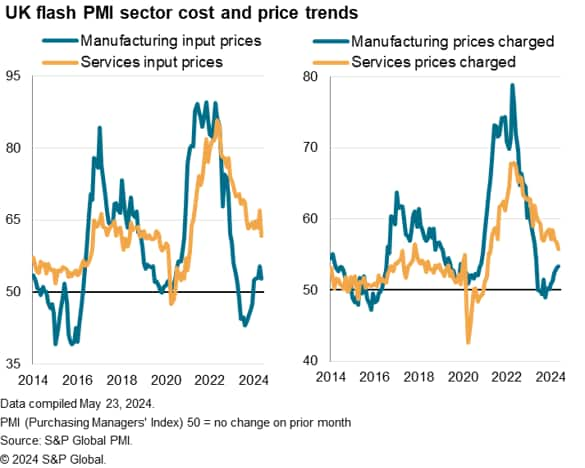

The May survey brought encouraging news on inflation. Having risen at a sharply increased rate in April thanks in part to the introduction of the higher National Living Wage, firms' input costs rose in May at the slowest rate for seven months. Rates of increase slowed in both manufacturing and services, albeit the latter remaining relatively more elevated.

Slower cost growth took some pressure off selling prices. Average prices charged for goods and services rose in May at the slowest rate since February 2021. Although prices charged for goods rose at the fastest rate for a year, the rate of increase remained below the pre-pandemic average and was accompanied by a moderation of service sector inflation to the lowest since April 2021.

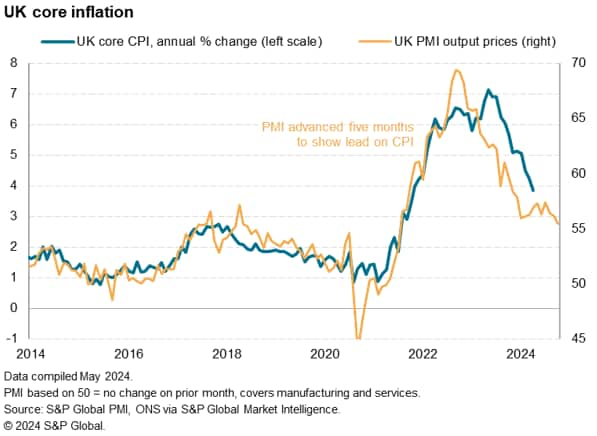

Although the rate of increase of selling price inflation for goods and services remains above the average seen in the decade prior to the pandemic, the latest cooling in the rate of inflation brings the overall PMI price gauge down to a level broadly indicative of consumer price inflation running close to 3%, according to historical comparisons, boding well for a further moderation of the all-important official core inflation measure in the coming months.

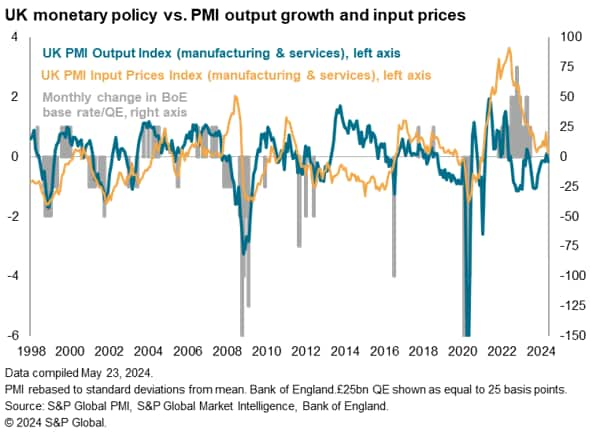

A shift towards a rate cutting environment

The slower rates of price and cost growth signalled by the May flash PMI will be of particularly welcome news to policymakers seeking to reduce interest rates. April's accelerated rate of input cost inflation appears to have been temporary, linked to the introduction of the National Living Wage, and the cooler rate of cost growth seen in May opens the door to some loosening of monetary policy, especially in light of the relatively modest output growth currently being recorded by the survey data.

Access the press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-sustained-economic-recovery-price-pressures-fall-to-lowest-in-over-three-years-may24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-sustained-economic-recovery-price-pressures-fall-to-lowest-in-over-three-years-may24.html&text=UK+flash+PMI+signals+sustained+economic+recovery%2c+price+pressures+fall+to+lowest+in+over+three+years+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-sustained-economic-recovery-price-pressures-fall-to-lowest-in-over-three-years-may24.html","enabled":true},{"name":"email","url":"?subject=UK flash PMI signals sustained economic recovery, price pressures fall to lowest in over three years | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-sustained-economic-recovery-price-pressures-fall-to-lowest-in-over-three-years-may24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=UK+flash+PMI+signals+sustained+economic+recovery%2c+price+pressures+fall+to+lowest+in+over+three+years+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fflash-pmi-signals-sustained-economic-recovery-price-pressures-fall-to-lowest-in-over-three-years-may24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}