Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 02, 2022

Global manufacturing downturn intensifies as firms cut capacity in line with slumping demand

Global manufacturing business conditions worsened for a third successive month in November, with the JPMorgan Global Manufacturing Purchasing Managers' Index™ (PMI™), compiled by S&P Global, dropping from 49.4 in October to 48.8; its lowest level since June 2020.

The survey's sub-indices recorded an increased rate of loss of factory production which looks set to gain momentum in coming months. Order books continued to weaken at a rate far outstripping the pace at which manufacturers are cutting output, meaning firms are seeing unprecedented build-ups of unsold stock. This production decline has in turn necessitated a marked decline in input buying, a shift to inventory reduction and a renewed fall in employment, the latter representing the first time that producers have cut staffing levels for two years and an important sign of growing retrenchment among manufacturers worldwide.

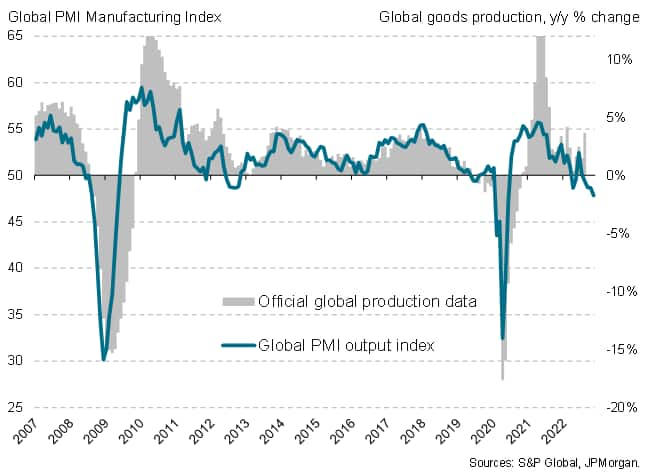

Global factory output decline accelerates

The global manufacturing PMI survey's Output Index, which acts as a reliable advance indicator of actual worldwide output trends, signalled a fourth consecutive monthly fall in worldwide factory production in November, with the rate of decline accelerating to the fastest since June 2020. Excluding the early months of the pandemic, the latest decline was the steepest since May 2009, during the global financial crisis.

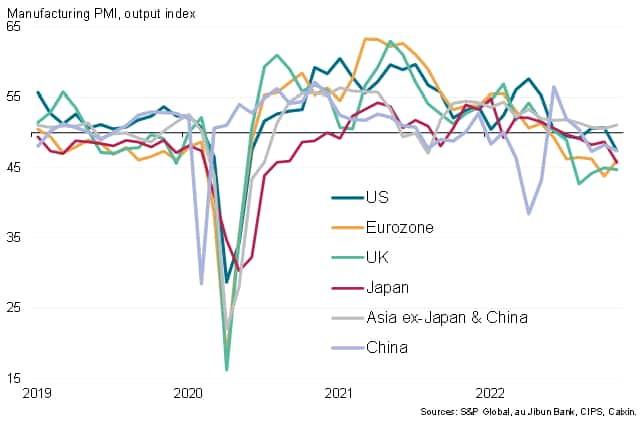

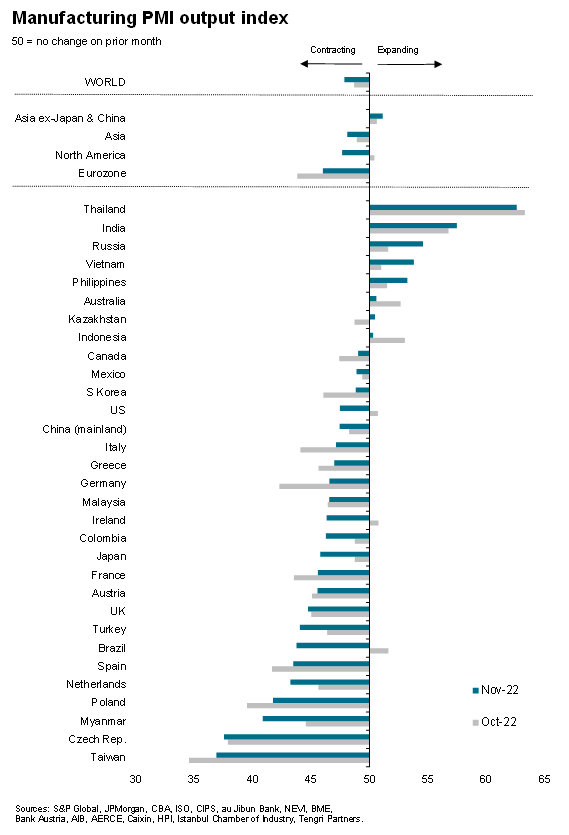

Asia leads manufacturing, but trends vary markedly across the region

Of the 31 economies for which S&P Global PMI data are available, only eight reported higher production volumes in November, down from ten in October, and - of these - only marginal growth was seen in three economies. Thailand reported the strongest output growth followed by India, helping Asia outperform the global economy, albeit still declining. Four of the top five performing manufacturing economies were found in Asia in November, but both China and Japan saw increased rates of contraction, the former hit by further COVID-19 related restrictions.

Global manufacturing output

Manufacturing output in key economies

Output fell for a third successive month in China, with the rate of decline gathering pace to end the worst three-month spell since 2015. COVID-19 restrictions in mainland China also showed a knock-on effect in Taiwan, which reported the sharpest downturn of all economies surveyed, albeit also reeling from a downturn in export demand.

Across broad regions of the world, Europe saw the steepest downturn in manufacturing during November, with a deepening downturn in the UK contrasting with signs of the rate of contraction easing in the eurozone. Companies in Germany in particular benefitted from improved supply conditions. Both the UK and eurozone are nevertheless reporting some of the worst performances seen since the global financial crisis and 2012 debt crisis respectively.

The US also slipped into contraction, a downturn which - barring the initial COVID-19 lockdowns - was the steepest since the global financial crisis. Brazil likewise saw a renewed fall in production, and manufacturing remained in decline across Canada and Mexico.

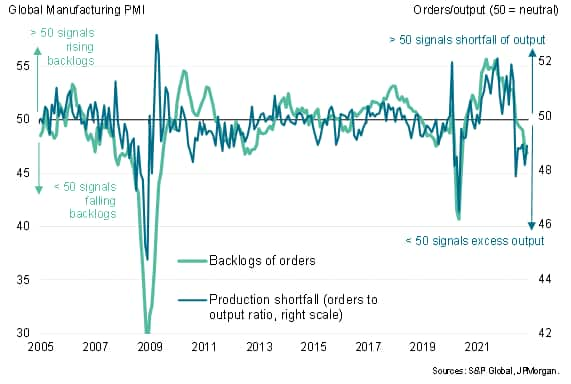

Falling demand

One of the key concerning metrics from the PMI surveys in terms of the near-term outlook was the extent to which new orders fell compared to production. New orders have been falling at a notably faster pace than output in recent months, in fact more quickly than at any time since the global financial crisis, barring initial pandemic months. This divergence suggests that, despite recent production cuts, manufacturers continue to operate with excess capacity relative to current demand.

This dearth of demand was likewise reflected in an increased rate of decline of backlogs of orders at manufacturers. These outstanding orders are now also falling at a rate not seen since 2012 (excluding the downturn seen at the start of the pandemic), to hint strongly at the development of excess operating capacity.

Global manufacturing order books

Two worrying inventory signals

The PMI survey's two gauges of manufacturing inventories meanwhile moved in different directions, both providing further worrying signals on the health of the factory sector.

First, inventories of raw material inputs fell in November for the first time since March 2021, as increasing numbers of factories deliberately reduced their input buying for cost considerations in line with reduced production requirements. November's drop in input buying was in fact the fifth quickest since comparable global data for this series were first available in October 2009, exceeded only by the declines seen during the initial phase of the pandemic in early 2020.

Global manufacturing inventories

Second, November saw the largest increase in inventories of finished goods stock recorded since comparable global PMI survey data were available in 2007, representing a fifth consecutive month of unusually high stock-piling. While some periods can see inventories rise as companies build stock to meet strong demand in coming months, this has not been the predominant factor behind the rise in inventories in recent months. Instead, and in contrast, the survey has seen a sharp rise in firms reporting higher inventories due to weaker than anticipated sales.

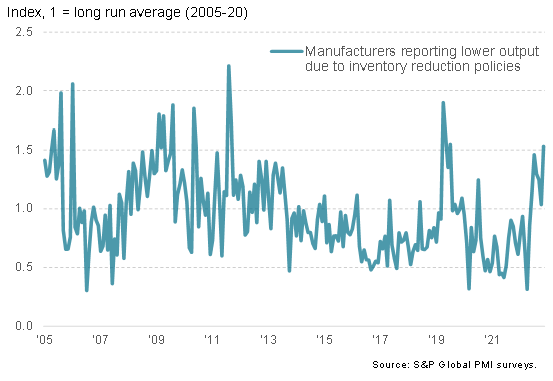

With companies deliberately reducing inventories of raw materials, and becoming increasingly worried about the build-up of unsold warehouse post-production stock, November saw a commensurate spike upwards in the number of companies worldwide reporting that output was being cut as part of deliberate efforts to reduce inventories. This therefore indicates that the detrimental impact of falling final demand from customers is being exacerbated by a switch from inventory building to inventory reduction.

Worldwide manufacturing output cuts due to inventory reduction policies

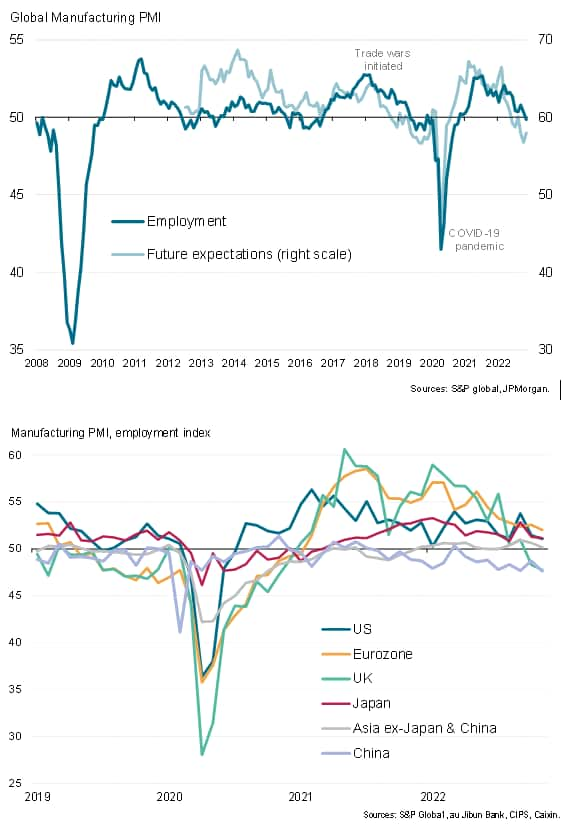

Lacking confidence, producers start cutting employment

Two other survey sub-indices brought discouraging news on the outlook for manufacturing. First, expectations of output over the year ahead remained among the lowest recorded since comparable data were available in 2012, picking up slightly from October amid signs of improving supply chains and reduced fears over the recent energy market crisis, yet continuing to run at a distressed level.

Second, producers cut headcounts on balance in November, often citing the lack of demand, concerns over excess capacity, rising costs and gloom about future prospects. Although only marginal, the reduction in employment was the first recorded since October 2020 and potentially represents a shift to a more cost-reduction focus for global manufacturing, which the future output expectations index suggests has further to run.

Future output expectations

Read the accompanying press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-downturn-intensifies-as-firms-cut-capacity-in-line-with-slumping-demand-Dec22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-downturn-intensifies-as-firms-cut-capacity-in-line-with-slumping-demand-Dec22.html&text=Global+manufacturing+downturn+intensifies+as+firms+cut+capacity+in+line+with+slumping+demand+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-downturn-intensifies-as-firms-cut-capacity-in-line-with-slumping-demand-Dec22.html","enabled":true},{"name":"email","url":"?subject=Global manufacturing downturn intensifies as firms cut capacity in line with slumping demand | S&P Global&body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-downturn-intensifies-as-firms-cut-capacity-in-line-with-slumping-demand-Dec22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+manufacturing+downturn+intensifies+as+firms+cut+capacity+in+line+with+slumping+demand+%7c+S%26P+Global http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-manufacturing-downturn-intensifies-as-firms-cut-capacity-in-line-with-slumping-demand-Dec22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}