Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 07, 2024

Global PMI shows price momentum cooling for services but reviving for basic materials

Average prices charged for goods and services continued to rise worldwide at an elevated rate by historical standards in May, broadly in line with the average seen over much of the past year. Service sector inflation in particular remained stubbornly high, but the detailed sector data highlight how inflation momentum is in fact shifting away from services back towards goods, led in particular by resurgent demand for basic materials.

Stubborn global inflation

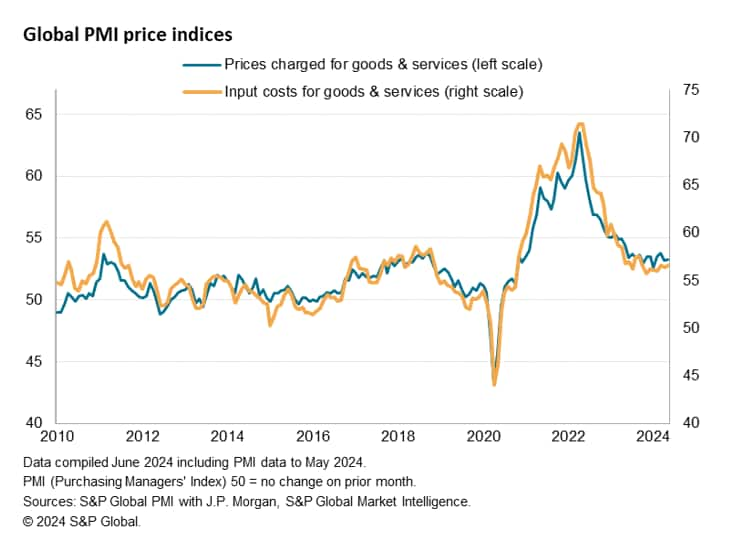

Worldwide PMI survey data compiled by S&P Global showed average prices charged for goods and services rising at a slightly increased rate in May, the pace of increase remaining above the pre-pandemic decade average to hint at persistently high inflation by historical standards. The headline prices charged index registered 53.3, with any index reading above 50 signaling a rise in prices compared to the prior month. This compares with an average of 51.2 in the ten years leading up to the pandemic.

The rise in selling prices reflected a further increase in firms' input costs, which rose worldwide in May at the joint-fastest rate seen over the past eight months.

The PMI data therefore indicate that both prices and costs are continuing to rise at rates well above the averages seen in the ten years preceding the pandemic, in turn suggesting that global consumer price inflation will likewise remain stubbornly elevated in the coming months.

Consumer services lead industry price growth

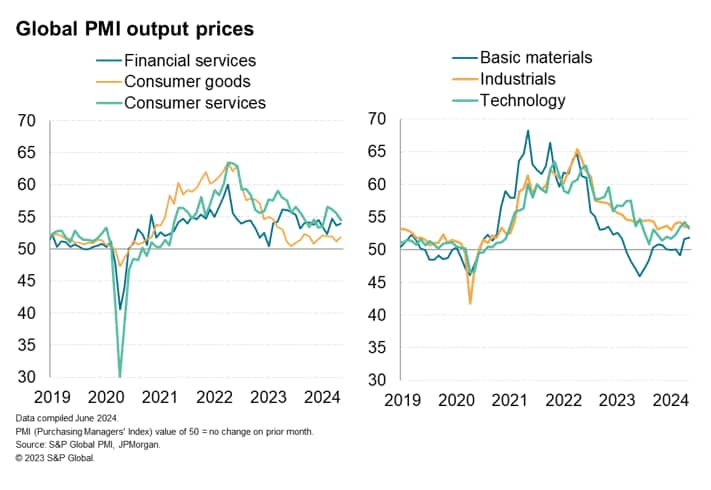

By broad industry, the global price gains were led by consumer services followed by financial services. However, while the former has cooled in recent months, financial services inflation ticked higher in May.

While the rate of inflation for basic materials remained notably modest, it has seen the largest firming of prices in recent months amid rebounding demand for raw materials and restocking in the manufacturing sector.

Insurance shows steepest price rise

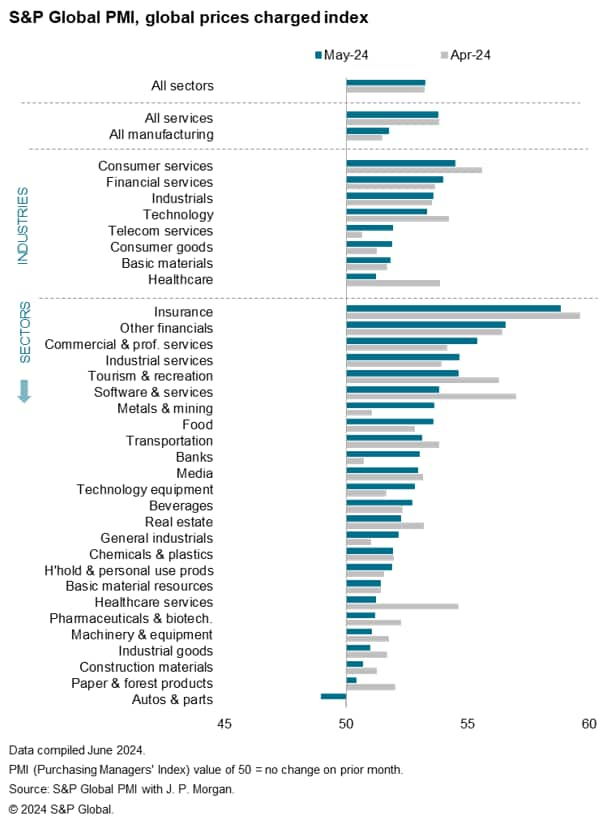

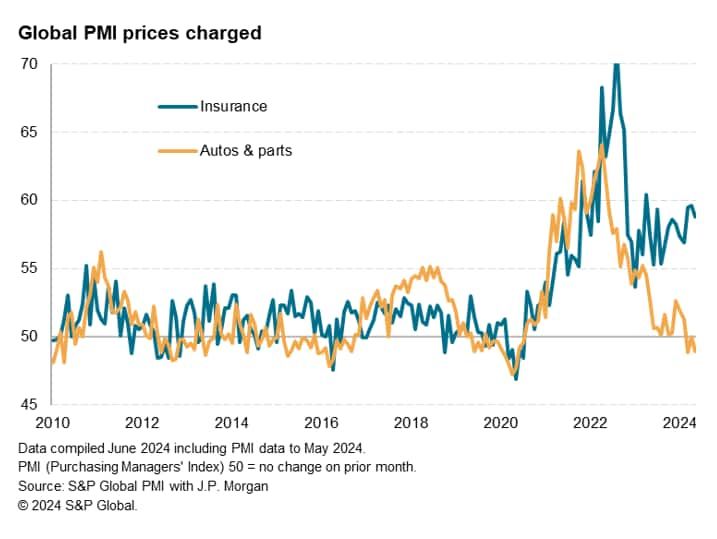

Looking in more detail, the detailed sector PMI data allow us to see where the main upward inflation pressures are persisting, ahead of comparable official data. The sharpest price rise in May was recorded in the insurance sector, followed by 'other' financials and commercial & professional services. In fact, all top six price-setting sectors were operating in the services economy. The steepest price rise outside of the service sector was recorded in the metals & mining sector, where the rate of increase accelerated to a 23-month high, alongside the food sector.

At the other end of the scale, falling prices were reported solely in the autos & parts sector.

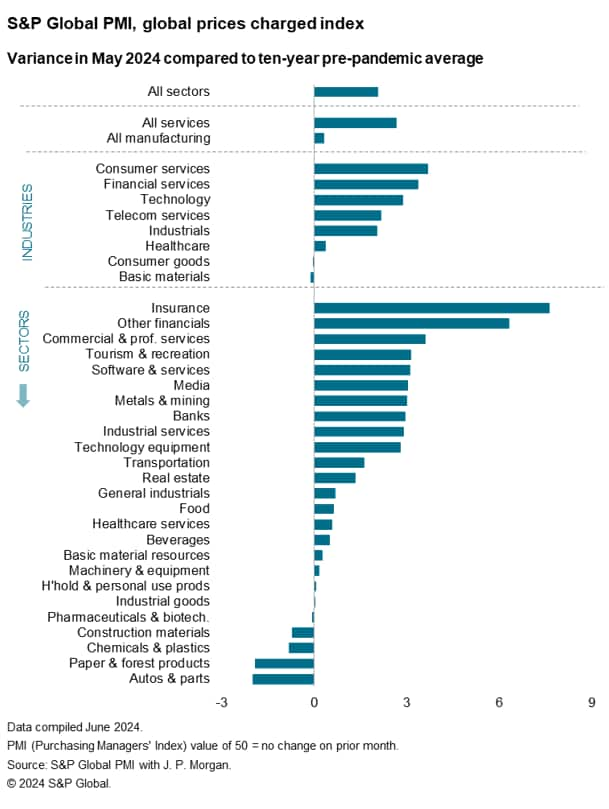

Sector prices vs. pre-pandemic averages

To assess how elevated the rates of inflation are by historical standards, we can compare with pre-pandemic ten-year averages. While the PMI index for prices charged for all goods and services was 2.1 index points above its 2010-2019 average in May, services inflation was 2.7 points higher compared to just 0.3 points for manufactured goods.

Insurance, which led the global price increase rankings, is also the sector where price growth is the most elevated by historical standards, running some 7.6 index points above its pre-pandemic average.

Autos & parts, paper & forest products, chemicals & plastics and construction materials (as well, to a marginal extent) pharmaceuticals & biotech are all notably running lower than their pre-pandemic averages.

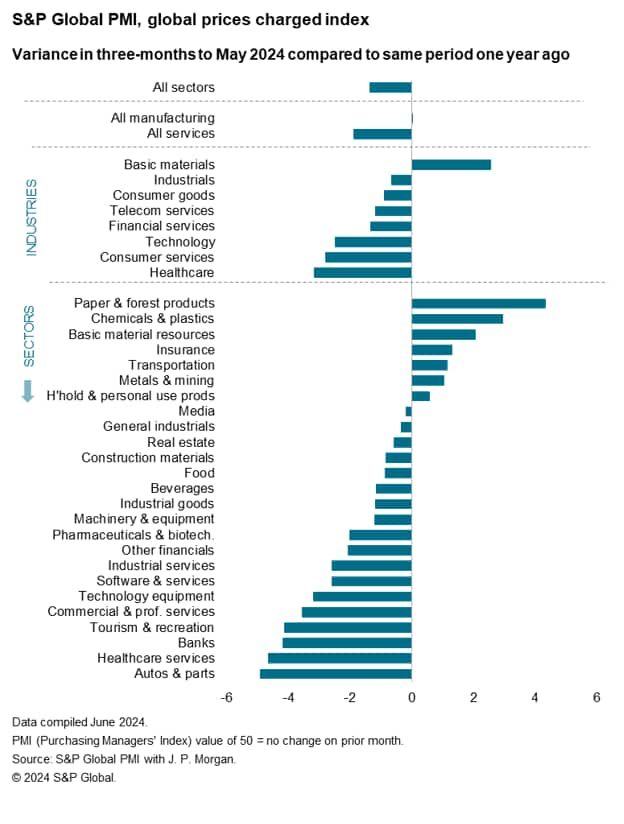

Sector inflation momentum

It is also useful to compare how price trends have varied over the course of the past year, to thereby gauge where inflation momentum is either building or fading. This analysis, based on the global PMI prices charged index for three months to May 2024 compared to the same period in 2023, shows price momentum fading in services but picking up marginally in manufacturing.

By industry, the strongest upward price momentum is being signaled for basic materials. This is being led by upward price momentum for paper & forest products, chemicals & plastics and other basic material resources. These products are seeing renewed demand growth as manufacturers have started to ramp up production in recent months and reported a commensurate increase in input buying and inventory building.

Price growth pressures have meanwhile moderated over the course of the past year in all other broad industries. The cooling of consumer services inflation is particularly notable, having been exceeded only by the moderation recorded for healthcare. Consumer services have led the global inflation rise seen over much of the past two years, as resurgent post-pandemic demand combined with staff shortages to result in both demand-pull and cost-push inflation in labour-intensive sectors such as travel, tourism and recreation.

Key to the near-term future path of inflation will be the extent to which these softening labour-cost related inflation pressures can over-ride any manufacturing-driven price increases.

Access the Global Sector PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-shows-price-momentum-cooling-for-services-but-reviving-for-basic-materials.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-shows-price-momentum-cooling-for-services-but-reviving-for-basic-materials.html&text=Global+PMI+shows+price+momentum+cooling+for+services+but+reviving+for+basic+materials+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-shows-price-momentum-cooling-for-services-but-reviving-for-basic-materials.html","enabled":true},{"name":"email","url":"?subject=Global PMI shows price momentum cooling for services but reviving for basic materials | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-shows-price-momentum-cooling-for-services-but-reviving-for-basic-materials.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+shows+price+momentum+cooling+for+services+but+reviving+for+basic+materials+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-shows-price-momentum-cooling-for-services-but-reviving-for-basic-materials.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}