Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 20, 2022

Global PMI: What to watch in the flash PMIs for June

A Wile E. Coyote moment for the global economy?

The upcoming June flash PMI data for the US, UK, Eurozone and Japan will be eagerly assessed for clues as to the persistence of elevated inflation rates and the resilience of economic growth in the face of current headwinds.

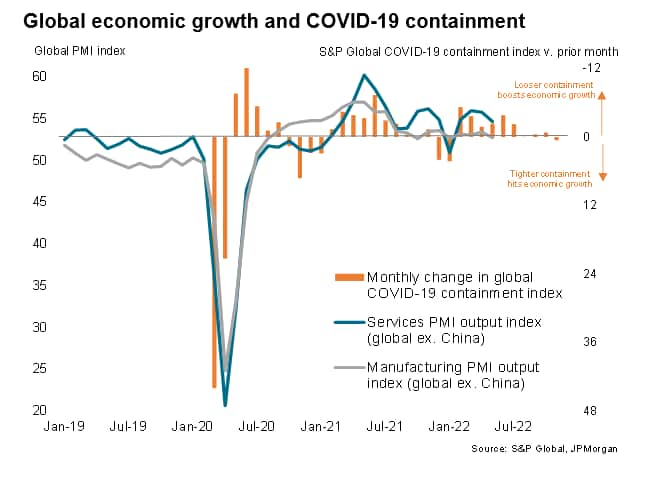

May's PMI data indicated that, if mainland China is excluded, global growth retained encouraging resilience. Although losing some momentum, the global PMI's output index excluding China remained indicative of annualized GDP of around 3.5%. However, there's a big question as to whether the global economy is experiencing something of a Wile. E Coyote moment, whereby the cartoon character defies gravity by running on air momentary having sped off a cliff, only to then plummet down.

The concerns rest on the fact that global manufacturing growth has weakened amid ongoing supply constraints and soaring prices, leaving growth reliant on the service sector. Detailed PMI data in fact reveal how the main impetus to global growth is coming from a revival in spending on consumer-oriented services such as tourism and recreation, as many of the world's largest economies reopen from Omicron related restrictions.

As our chart shows, we can expect some further support to service sector growth from a further loosening of global COVID-19 containment measures in June and, to a lesser extent, July. But this stimulus is clearly fading, and is also being countered by various headwinds, most notably the cost-of-living crisis, falling consumer confidence and rising interest rates. Hence, flash PMI data, updated on 23rd June, will provide all-important steers on the latest health of the service sectors of the major developed economies, and help assess the risk of recession.

We look at the major developed economies below in terms of what to look out for from the flash PMIs, both in terms of growth and inflation.

United States

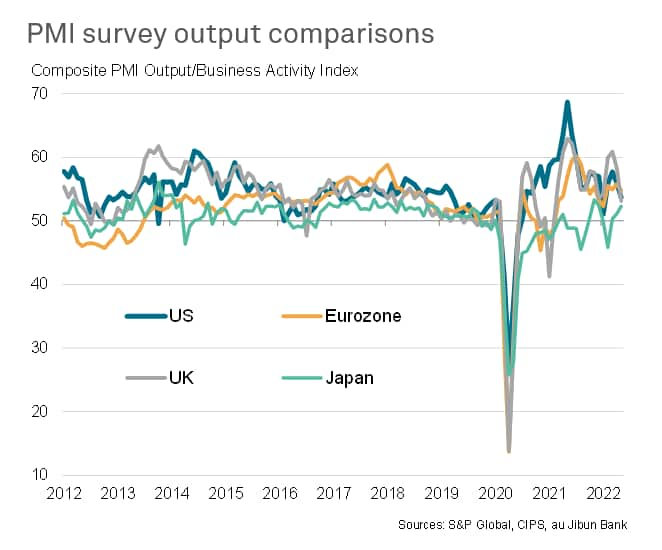

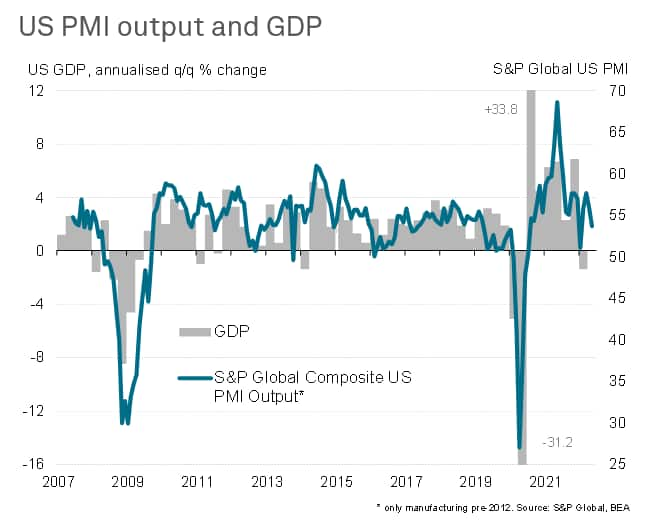

May saw the S&P Global US composite PMI fall from 56.0 to a four-month low of 53.6. The deterioration took the pace of US economic growth signalled down to the weakest so far in the pandemic recovery with the sole

exception of January's slowdown at the height of the Omicron wave. However, even with the decline, the survey reading is consistent with GDP growing at an annualized rate of just under 2%. This supports the view that GDP will return to growth in the second quarter and that the first quarter drop in GDP understated the overall health of the economy (primarily due to poor trade and inventory numbers).

However, growth has clearly slowed both in the manufacturing sector and in the vast services economy. Businesses report ongoing difficulties finding staff and sourcing raw materials, while demand growth measured by inflows of new orders for goods and services expanded in May at the slowest rate for almost one-and-a-half years, as spending power was reduced by soaring inflation.

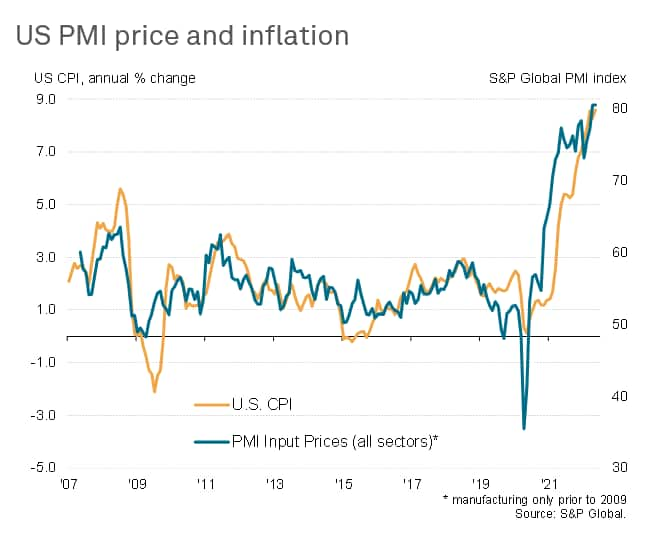

The US inflation surge meanwhile showed no signs of abating, with firms' costs soaring at yet another survey record rate, reflecting rising energy, materials and staff costs. However, there are at least some indications from the PMI that the rate of inflation may soon be peaking, albeit remaining worryingly elevated. Supply disruptions remained widespread across the US in May, not only constraining output but handing pricing power to suppliers.

With China's lockdowns and the Ukraine war exacerbating existing supply bottlenecks, these supply-driven price pressures show little signs of easing, so June's PMI data will need to be assessed for the impact on companies' costs, selling prices and supplier delivery times in relation to the likely persistence of elevated CPI readings.

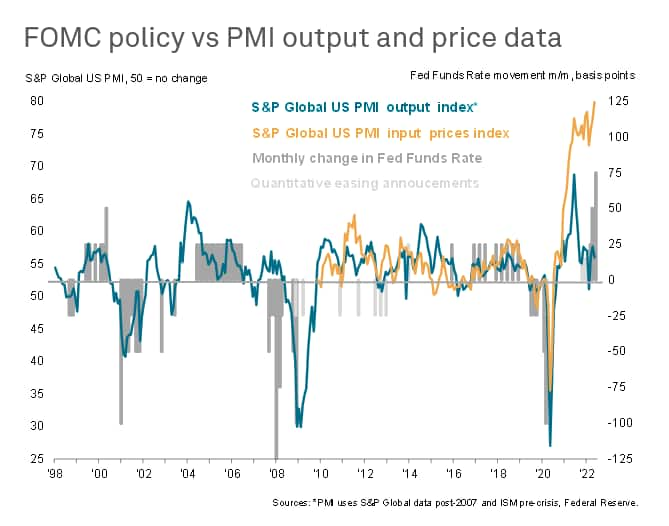

Since the May PMI data, the FOMC hiked the Fed Funds Rate by 75 basis points (bp), the largest rise since 1994 and taking the current tightening cycle to 150bp, as it sought to tame inflation. More rate hikes are signalled, but any cooling of the PMI output indices and in particular the price gauges could provide some ammunition to the doves. In particular, any rapid cooling of demand for services could add to recession risks, which would usually in turn take some of the heat out of inflation via reduced demand.

Eurozone

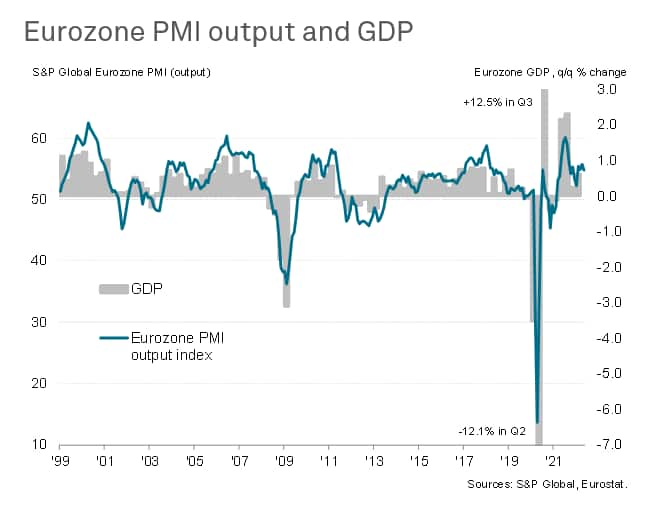

The eurozone economy retained encouragingly resilient growth in May, as a beleaguered manufacturing sector was offset by a buoyant service sector. At 54.8, the headline eurozone PMI for May suggested the eurozone is expanding at an underlying rate equivalent to GDP growth

of just over 0.5% in the second quarter, which follows a solid 0.6% gain in the first quarter (note that official first quarter GDP growth was revised up from 0.3% to a level more in line with the PMI readings for the first three months of the year).

June's data will therefore be assessed for the durability of this service sector rebound, especially as risks appear skewed to the downside for the coming months. The rising cost of living threatens to reduce consumers' propensity to spend on non-essential services, and has already caused a slump in consumer sentiment. Business confidence in the sector has likewise deteriorated markedly since the invasion of Ukraine. Perhaps most importantly, any initial boost from the reopening of the economy has also naturally begun to fade, as evidenced already by a drop in the services PMI from 57.7 in April to 56.1 in May.

The weakness of manufacturing also remains a concern. Eurozone factories continued to report widespread supply constraints and diminished demand for goods amid elevated price pressures in May, exacerbated by the Ukraine war and China's lockdowns. The survey's output gauge is already indicative of official manufacturing production falling slightly in the second quarter, and forward-looking indicators such as the orders-to-inventory ratio suggest the rate of decline will have accelerated in June. The May survey also saw an undercurrent of growing uncertainty about the economic outlook among manufacturers, linked to Russia's invasion of Ukraine, persistent inflationary pressures and supply disruptions, that is in turn driving increased risk aversion and caution among customers, which points to deeper underlying downside risks to the economic outlook.

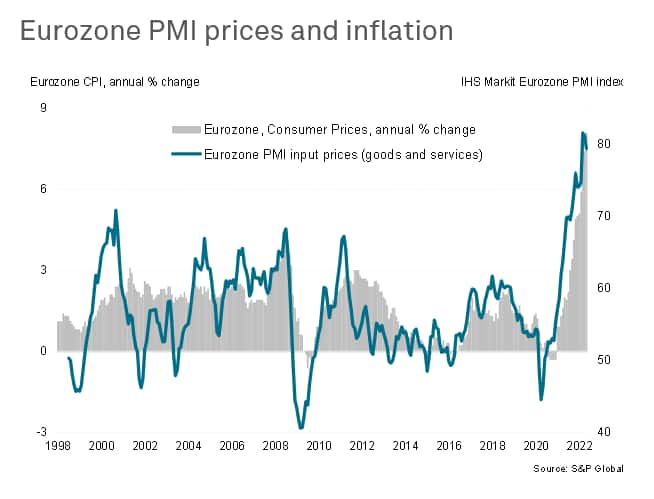

Although there were signs that inflationary pressures could be peaking in May, with input cost inflation down for a second successive month and supply constraints starting to be less widely reported, inflationary pressures remained elevated at previously unprecedented levels. Consumer price inflation meanwhile rose to a record 8.1% annual rate in May, though the monthly increase slowed from 0.9% to 0.7% to likewise hint at a peak but nonetheless remaining worryingly high.

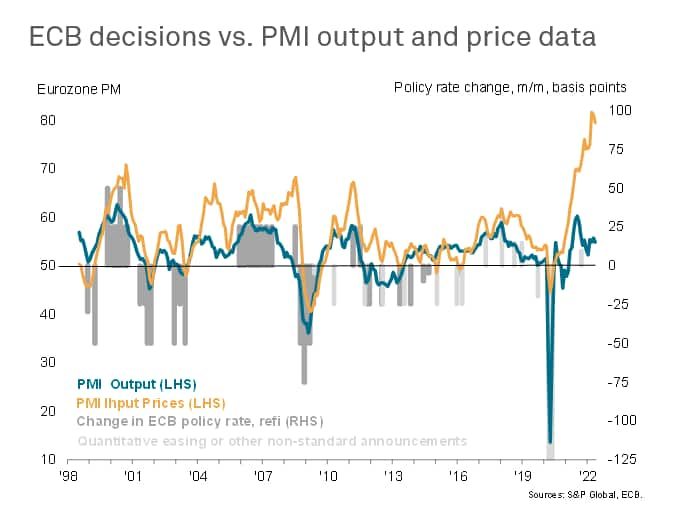

We argued that such high price pressures, accompanied by the reassuringly resilient GDP growth signalled by the May PMI surveys, looked set to tilt policymakers at the ECB towards a more hawkish stance. The ECB has since not only provided an unprecedented heads-up of a 25bp rate hike in July, with a potentially larger hike in September, but also convened a special meeting to discuss how to deal with financial fragmentation in the form of widening bond spreads as policy is tightened.

The June flash PMI data will therefore be watched to gauge the extent to which a fading tailwind of pent-up demand is being offset by the headwinds of geopolitical uncertainty amid the Ukraine war, supply chain disruptions and the rising cost of living, the latter likely exacerbated by tightening monetary conditions.

At the same time, supply chain and price indices - which correctly signalled the acceleration of CPI inflation to unprecedented heights in recent months - will be key in assessing the inflation outlook, especially in terms of any spill-over from manufacturing to services.

United Kingdom

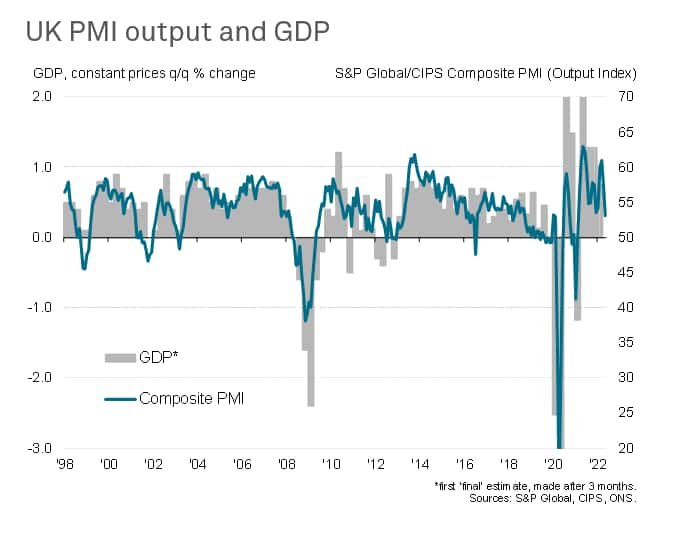

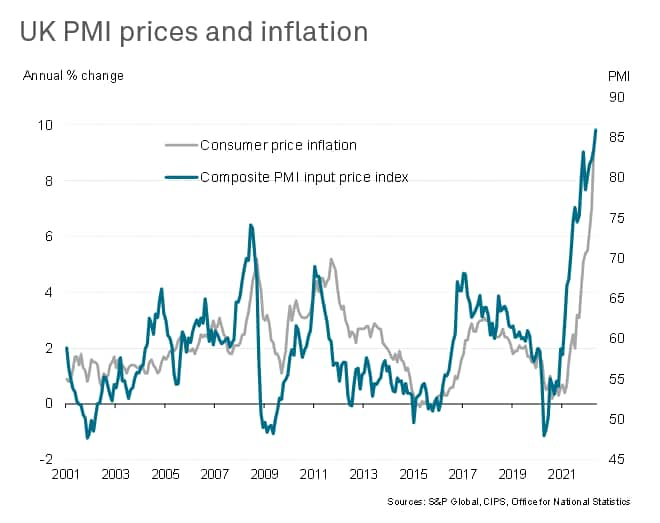

The June UK flash PMI number will come on the heels of disappointing May data, which had signalled a severe slowing in the rate of UK economic growth with forward-looking indicators hinting that worse is to come. The inflation picture also worsened as the rate of increase of companies' costs hit yet another all-time high.

The UK composite PMI slumped from 58.2 in April to a 15-month low of 53.1 in May, registering the worst performance since February 2021. Growth waned especially sharply in the UK's service sector, but factories also reported a slower rate of expansion.

The May data therefore brought signs that the tailwind from the reopening of the economy has faded, having been overcome by headwinds of soaring prices, supply delays, labour shortages and increasingly gloomy prospects. Companies cited increasingly cautious moods among households and business customers, linked to the cost-of-living crisis, Brexit, rising interest rates, China's lockdowns and the war in Ukraine.

At 9%, the UK is grappling with the highest CPI inflation rate of the major developed economies, and while there are some signs that the rate of inflation could soon peak, with companies reporting price resistance from customers, May's PMI data nevertheless signalled a further acceleration of UK firms' input costs, suggesting intensifying pipeline inflationary pressures.

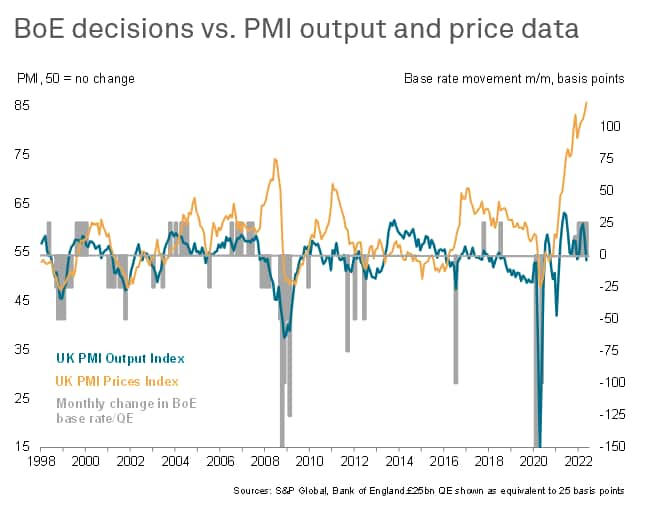

Since the May PMI data were released, the Bank of England has hiked its policy rate for a fifth consecutive time at its scheduled meetings, the latest 25bp hike on 16th June taking the Bank Rate to 1.25%. While markets had been pricing in the chance of a larger rise at its June meeting, it seems that some policymakers have erred towards caution, given the deteriorating growth picture in the UK, as any imminent downturn in the economy will itself help ease some demand-pull inflationary pressures.

The June flash PMI data for the UK will therefore provide some crucial guidance on whether a GDP contraction appears imminent (not that official GDP data are already falling, principally reflecting the drop in public sector activity relating to the pandemic which is not covered by the PMI), and whether inflationary pressures continue to build. The Bank of England is expecting inflation to rise to 11%.

Japan

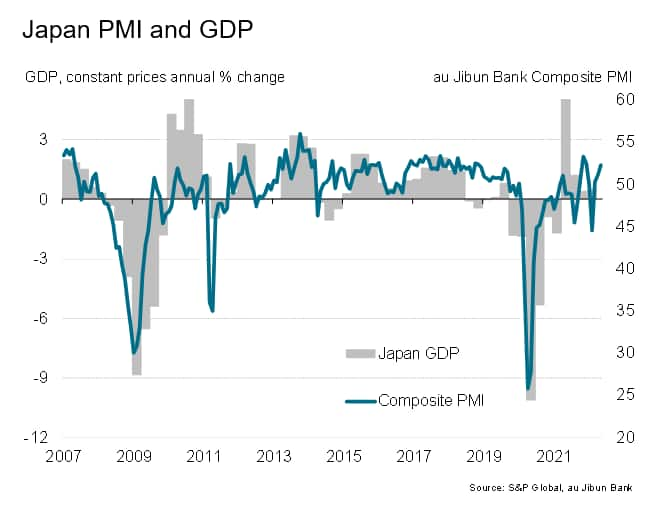

A lifting of COVID-19 restrictions continued to facilitate faster economic growth in Japan during May. Bucking the major developed world economy slowdown trend, the au Jibun Bank composite PMI rose from 51.1 to 52.3, its highest since December, thanks in particular to a resurgent service sector. Absent of a marked deterioration in June, the PMI therefore points to solid GDP growth in Japan during the second quarter.

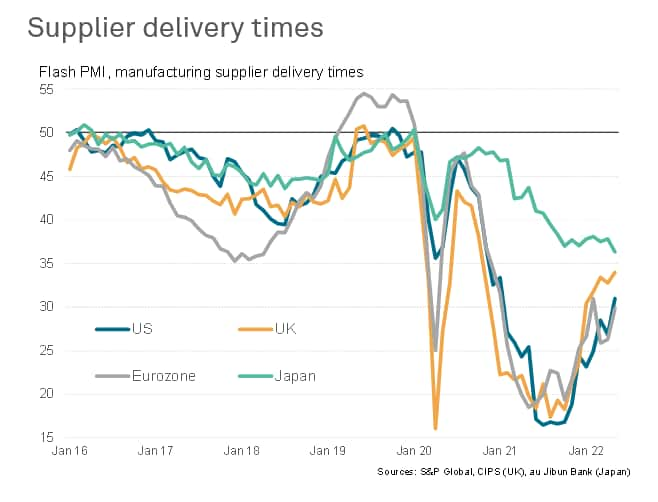

However, something to note was that supplier delivery times lengthened at an increased rate in Japan during May, contrasting with an easing of supplier lead-time delays in other major economies, due to the trade impact from China's lockdowns. Price pressures also intensified, linked to these shortages plus rising energy and food prices - all factors which the recent weakening of the yen has exacerbated.

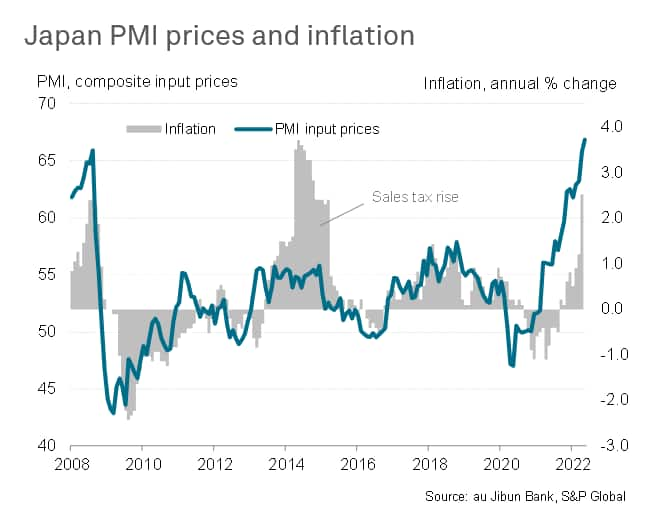

The PMI's input price gauge has provided a very early signal of rising inflationary pressures in Japan, with the official CPI data lagging behind but now showing an acceleration to 2.5% in April, its highest since the sales tax hike of 2014 and very elevated by recent historical standards for Japan. Core inflation also breached the Bank of Japan's 2% target.

Looking to the June data, we will be eager to assess the extent to which the weaker yen may help to boost exports, but also the extent to which supply delays are constraining output and aggravating price pressures. If growth accelerates and price pressures continue to mount, markets expectations will build of a reassessment of ultra-loose policy at the Bank of Japan.

Summary

The latest PMI data therefore encapsulated the challenges facing central banks around the world, and in particular those in Europe and the US. Although economic growth is showing signs of slowing, price pressures showed no signs of abating as surging energy costs due to the Ukraine war add to the inflationary impact of raw material and labour shortages. The risk of tighter monetary policy leading to recessions has therefore increased, albeit arguably more so in the UK and eurozone than the US.

Several factors are blurring the picture for policymakers, causing decision making to be unusually difficult.

First, while China persists with its zero-covid policy there are downside risks to global growth and supply chain performance. However, there are signs of restrictions being eased in June. Although this should support growth and help ease some supply-driven price rises, any upsurge in demand may aggravate global commodity price pressures.

Second, economic growth in the US and Europe is being driven by demand recoveries for consumer services such as travel and tourism. There is a great deal of uncertainty as to how long these rebounds can persist for, especially in the face of the rising cost of living, and to what extent this temporary economic boost is masking underlying economic conditions.

Third, the extent to which labour markets continue to be affected by the pandemic remains unclear, and further COVID-19 waves cannot be ruled out.

Fourth, the path of the Ukraine war remains highly uncertain, posing the risks for volatile energy prices in particular.

Upcoming PMI data will therefore be eagerly awaited, with the next flash PMI data for the major developed economies released on 23rd June.

Sign up to receive updated commentary in your inbox here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

chris.williamson@spglobal.com

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-what-to-watch-in-the-flash-pmis-for-june-Jun22.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-what-to-watch-in-the-flash-pmis-for-june-Jun22.html&text=Global+PMI%3a+What+to+watch+in+the+flash+PMIs+for+June+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-what-to-watch-in-the-flash-pmis-for-june-Jun22.html","enabled":true},{"name":"email","url":"?subject=Global PMI: What to watch in the flash PMIs for June | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-what-to-watch-in-the-flash-pmis-for-june-Jun22.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI%3a+What+to+watch+in+the+flash+PMIs+for+June+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-what-to-watch-in-the-flash-pmis-for-june-Jun22.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}