Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Aug 09, 2023

Global upturn loses further momentum at start of third quarter, hiring spree cools

The global economy continued to lose growth momentum in July, according to the S&P Global PMI surveys, based on data provided by over 27,000 companies. A further cooling of a recent revival of service sector growth, which had been buoyed by a post-pandemic tailwind of increased spending, waned for a second month in a row, accompanied by a deepening manufacturing downturn.

The month also saw companies pull back on their hiring to result in only modest jobs growth, reflecting increasingly depleted order books as well as a slump in business expectations for the year ahead.

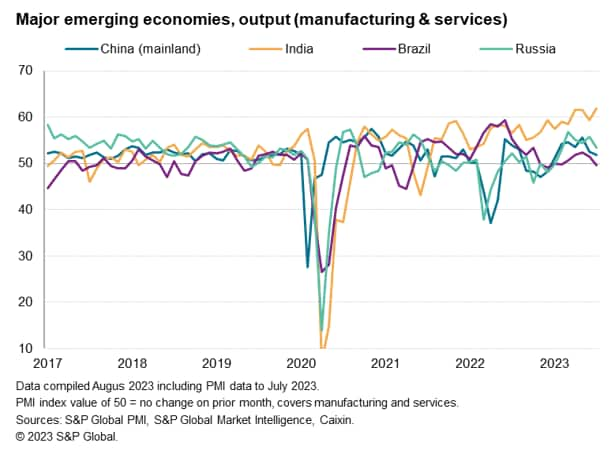

Europe led the deteriorating picture, but growth also slowed in the US, mainland China and Russia, while Brazil saw a renewed fall in output. India, in contrast, reported the strongest expansion for 13 years and Japan reported a resilient, albeit moderate expansion.

Global output growth wanes to lowest since February

Global economic growth slowed for a second successive month in July, down to its lowest since the current upturn began in February, according to the Global PMI data - compiled by S&P Global. The headline PMI, covering manufacturing and services across over 40 economies and sponsored by JPMorgan, fell from 52.7 in June to 51.7.

The current reading takes the PMI further below the survey's long-run average of 53.3 and broadly consistent with annualized quarterly global GDP growth of around 2% at the start of the third quarter, below the long-run average of 2.9%.

Slowing service sector accompanies factory downturn

The slowdown was led by manufacturing, which saw output decline for a second consecutive month and at the steepest rate since January. In a sign that production will likely fall at an increased rate in August, new orders for goods declined at a steeper rate during July, led by the sharpest drop in global goods export orders seen so far this year. The decline in global goods exports was among the quickest seen since the global financial crisis, albeit far smaller than the losses seen in the early days of the pandemic. Companies often reported falling customer demand, exacerbated by the unwinding of inventories.

The manufacturing downturn was accompanied by a second month of slowing service sector activity, which registered the smallest expansion since February. New business inflows into the service sector rose at the slowest rate since January, rising at a softer rate than business activity to hint at a further slowing of activity in August.

Broad-based demand downtrend evident as consumer upturn

fades

Broad-based demand downtrend evident as consumer upturn

fades

Looking further into demand growth, the strongest improvement among the broad categories of goods and services monitored by the PMI was recorded for financial services, though even here growth continued to cool from May's recent peak.

Although demand for consumer services continues to grow, sustaining the expansion that has been recorded over the year-to-date, the rate of improvement was the weakest since January, pointing to a waning of this recent global growth driver.

A sharp slowing was also recorded in demand for business services, which registered the smallest increase since February to round off a broad-based weakening of demand for services.

In the manufacturing sector, a broad-based deterioration was likewise evident in July, with demand for consumer goods sliding into decline for the first time this year, joining investment goods and intermediate goods manufacturers in their soft patch. Demand for investment goods, such as plant and machinery, has now fallen for 13 out of the past 14 months, and demand for intermediate goods (inputs sold to other firms) has now fallen for 16 straight months.

Business confidence slumps

Looking ahead, the survey data underscore the gloomy outlook. Expectations of growth in the year ahead fell to their lowest since December, down markedly compared to the first six months of the year. Although business confidence lifted off June's seven-month low in manufacturing, it remained the second-weakest seen so far this year and well below the survey's long-run average. Confidence meanwhile slumped in the services sector, sliding to its lowest so far this year and likewise now running below the long-run average.

Employment close to stalling

The deterioration in growth of new orders fed through to a further reduction in companies' backlogs of work, which fell at the fastest pace since January.

Falling backlogs of work are generally a precursor to a cooling labour market, as companies adjust headcounts lower in line with the lower capacity requirements. Hence overall global employment growth slowed in July to the lowest since January, registering only a very modest increase.

A near-stalled manufacturing employment situation was joined by only weak service sector jobs growth, which sank to the lowest since January.

Japan remains resilient in developed world slowdown

Few economies managed to buck the global slowdown. In the developed world, where output rose at the slowest rate since growth was resumed in February, the eurozone recorded the worst performance of the major economies. Euro area output fell for a second successive month, with the rate of decline accelerating to the fastest since last November. A near-stalling of service sector activity was accompanied by an increasingly severe manufacturing downturn.

The UK meanwhile reported a near-stalling of output growth, registering the weakest increase since the current upturn began six months ago. Slower service sector growth was joined by a steepening factory downturn.

Growth also slowed in the US, down to a five-month low, a deteriorating expansion in the services economy was recorded alongside a near-stalled manufacturing sector.

Of the four largest developed world economies, only Japan avoided a growth slowdown, with output growth ticking slightly higher compared to June, albeit remaining below recent peaks. However, the upturn masked an ongoing decline in Japan's manufacturing economy and a slight cooling of the recent strong service sector expansion.

India bucks emerging market malaise as growth hits 13-year high

In the emerging markets, where output growth slipped to the lowest since January, it was India that avoided a slowdown, ratcheting up its strongest expansion for 13 years. India's services economy grew at a rate not seen since June 2010 and manufacturing growth also remained very strong by historical standards.

In contrast, growth slowed to a six-month low in mainland China, as a renewed manufacturing downturn dampened a further expansion of services activity, the latter having cooled markedly compared to the post-pandemic surge seen in February through to May. Measured across goods and services, China's mainland expansion was the weakest since January.

Growth also slowed in Russia, down to a five-month low, and Brazil slipped into decline for the first time since February, as an ongoing manufacturing downturn was accompanied by a near-stagnation of service sector activity growth.

Broad-based pullback in hiring bar China

The deteriorating labour market picture was more broad-based across the world, with only mainland China reporting an increased rate of hiring, though even here the gain was only marginal. Eurozone employment growth sank to the lowest since February 2021, while similarly modest UK and US jobs growth hit four and six-month lows respectively. An especially meagre jobs gain in Japan was meanwhile the smallest for six months.

Access the global PMI press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2023, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-upturn-loses-further-momentum-at-start-of-third-quarter-hiring-spree-cools-Aug23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-upturn-loses-further-momentum-at-start-of-third-quarter-hiring-spree-cools-Aug23.html&text=Global+upturn+loses+further+momentum+at+start+of+third+quarter%2c+hiring+spree+cools+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-upturn-loses-further-momentum-at-start-of-third-quarter-hiring-spree-cools-Aug23.html","enabled":true},{"name":"email","url":"?subject=Global upturn loses further momentum at start of third quarter, hiring spree cools | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-upturn-loses-further-momentum-at-start-of-third-quarter-hiring-spree-cools-Aug23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+upturn+loses+further+momentum+at+start+of+third+quarter%2c+hiring+spree+cools+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-upturn-loses-further-momentum-at-start-of-third-quarter-hiring-spree-cools-Aug23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}