Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 21, 2023

Growth-oriented Private Equity and Private Debt Firm Achieves Operational Scalability

The resilience of private debt in the face of recent macroeconomic and geopolitical upheavals has done much to affirm its appeal, but managing complexity remains a major challenge. Private debt encompasses a much wider range of strategies than other alternative asset classes. On the plus side, this provides investors with a tremendous degree of choice. However, it also means there are extra risks and administrative requirements for asset managers. Technology is seen as a way of simplifying this complexity, reducing risk, and attracting investors. It can also help automate processes that remain heavily paper-driven, such as loan administration and valuations.

Founded as a private equity firm, this U.S.-based client launched its credit strategy following the financial crisis. Today, the firm's credit strategies include direct lending (through a public BDC and several private vehicles) and broadly syndicated loans. Members of the financial planning and analysis group originally relied on spreadsheets for portfolio monitoring and tracking the terms, balances, and amendments to its credit investments. As AUM grew, however, the firm became uncomfortable relying exclusively on shared Excel files due to concerns about data quality. With the goal of doubling AUM in three to four years, the firm realized it needed operational scale and started exploring software solutions to improve data quality and automate the administrative processes associated with portfolio monitoring.

"We were looking for a flexible solution that would relieve us from solely relying on spreadsheets for data storage but would still integrate with Excel from a data manipulation, analysis, and reporting standpoint."

Pain Points

In order to support the anticipated growth in AUM, the firm needed to automate many of the paper-based processes associated with portfolio monitoring and improve data quality. In particular, the firm needed a solution that met the following requirements:

- Ensure accurate storage of cash and transaction data, including

amended terms and pricing grids that could be adjusted over the

lives of the loans.

- Deliver flexibility and configurability with Excel for data

manipulation.

- Manage agents' administrative responsibilities toward their

loans, including calculating interest and invoicing their

borrowers.

- Ingest investment terms and conditions, along with the borrower

financial data necessary for calculating key performance

indicators, viewing historical performance data, and automating

reporting.

- Increase automation and system integration to improve

productivity and reduce duplication.

The Solution

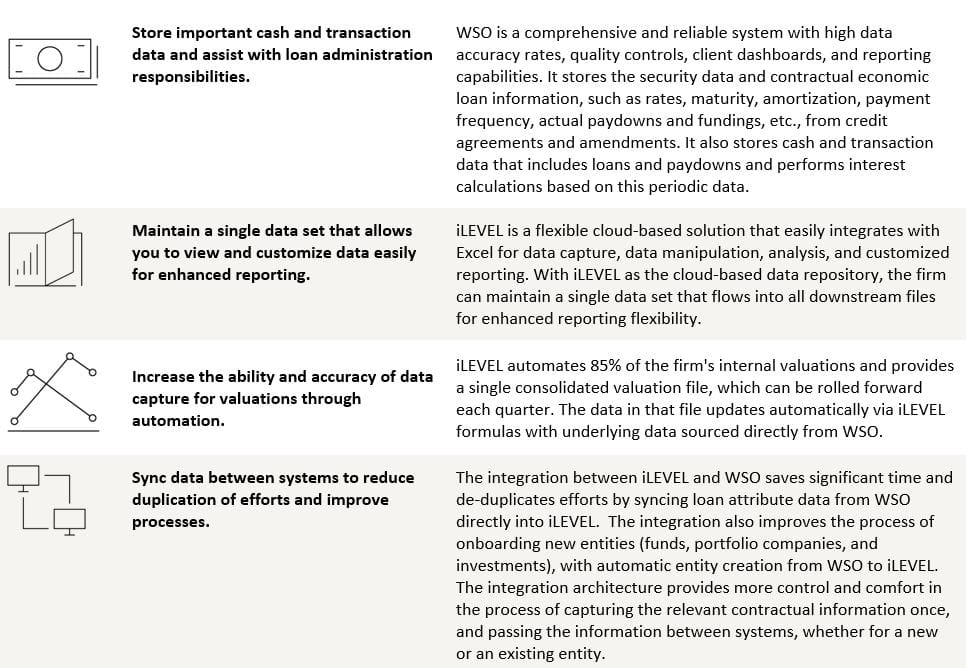

After evaluating a handful of software products, the firm chose S&P Global Market Intelligence's Private Debt Solution, which is based on an integration between the WSO and iLEVEL solutions. The solution set enables users to:

Key Benefits

The adoption of S&P Global Market Intelligence's Private Debt Solution (WSO + iLEVEL) has delivered significant levels of automation and efficiency for the firm. Reducing the number of manual data capture processes has also enabled resources to be reallocated to higher-value projects. Ultimately, the solution has helped the firm to achieve the scalability it requires to reach its ambitious growth targets.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowthoriented-private-equity-and-private-debt-firm-achieves-o.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowthoriented-private-equity-and-private-debt-firm-achieves-o.html&text=Growth-oriented+Private+Equity+and+Private+Debt+Firm+Achieves+Operational+Scalability++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowthoriented-private-equity-and-private-debt-firm-achieves-o.html","enabled":true},{"name":"email","url":"?subject=Growth-oriented Private Equity and Private Debt Firm Achieves Operational Scalability | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowthoriented-private-equity-and-private-debt-firm-achieves-o.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Growth-oriented+Private+Equity+and+Private+Debt+Firm+Achieves+Operational+Scalability++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fgrowthoriented-private-equity-and-private-debt-firm-achieves-o.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}