Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 15, 2022

Has pharmaceutical goods trade changed due to COVID-19?

Key observations:

- During COVID-19 pandemics trade in pharmaceutical products significantly increased despite a considerable drop in international trade as a whole.

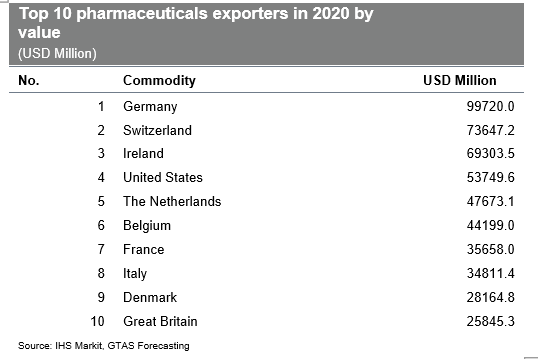

- World exports of pharmaceuticals are geographically concentrated, which can be attributed to the spatial distribution of the largest pharmaceutical companies. From this perspective, key players on the market are Germany and Switzerland.

- In line with Global Trade Analytics Suite (GTAS) Forecasting data, we expect the growth of pharmaceutical trade to slow down after the 2020-2021 period and stabilize with the CAGR equal to 2.5% over 2022-2035.

On March 11th, 2020, World Health Organization declared COVID-19 a pandemic, which in the next months has changed labor markets, global value chains, and world trade among others. Nearly two years into pandemics it is worth taking a look at the prospects for one of the most important product groups recently, which is pharmaceuticals.

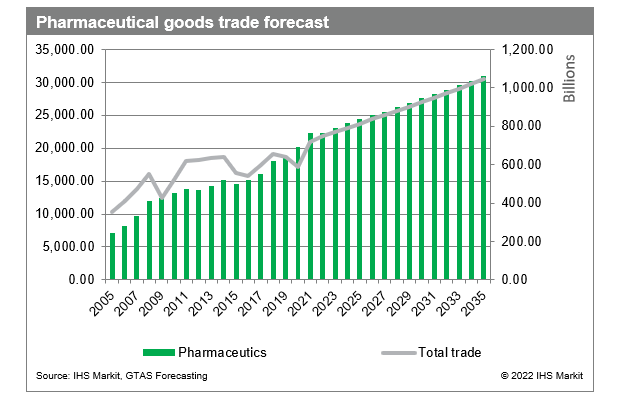

In line with GTAS Forecasting data, in 2020 the value of traded pharmaceutical goods was 3rd highest among all product groups (behind electronic valves, semiconductors and components, and motor vehicles, tractors and works trucks). World trade in pharmaceuticals amounted to $694.1 billion, almost three times more than in 2005 ($244.4 billion) with CAGR equal to 7.2% versus 3.4% for the total world trade over the same period 2005-2020. In the analyzed years trade in pharmaceutics increased monotonically, regardless of economic circumstances, such as the financial crisis of 2007-2008. More recently, the trade in pharmaceutical products increased by 8.4% in 2020 (despite the drop in world total trade by 7.8%) and is expected to grow by 10.5% in 2021.

Despite the increasing role of emerging markets (in terms of both, sales and research and development expenditures) in the pharmaceutical industry, world trade is to a large extent dominated by developed countries, primarily European and the U.S. Not surprisingly, the most exporting countries in terms of value are the states where the largest pharmaceutical companies are domiciled - Germany (Bayer, Merck), Switzerland (Roche, Novartis), or the U.S. (Johnson & Johnson, Pfizer). An interesting exemption on the podium is Ireland - one of the most important off-shore destinations for pharmaceutical giants' production. Over one-third of the total Ireland exports value was related to pharmaceuticals trade in 2020.

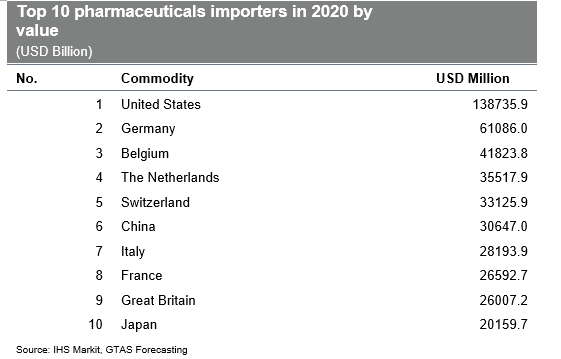

At the same time, 8 of 10 top exporters are present among the largest pharmaceutical importers worldwide, which indicates a relatively high intensity of intra-industry trade. From this perspective, the World market of pharmaceutical goods is concentrated - in 2020 nearly one-fifth of total imports was related to the U.S., while almost two-thirds of total imports could be assigned to the top 10 countries.

Over the last 15 years, pharmaceuticals were transported primarily by land, however recently airborne trade is gaining momentum. Seaborne trade remains constantly responsible for c.a. 18% of trade in terms of value. At this point, the growing role of airborne trade can be attributed primarily to specific conditions needed to transport some of the pharmaceutical goods, as well as its perishability and delivery time.

In line with GTAS Forecasting data, the value of trade in pharmaceutical goods will steadily increase with a CAGR of 2.5% in 2022-2035 and will exceed 1 trillion for the first time in 2033 according to our base scenario. It should be highlighted though, that the growth of trade and its directions may differ, depending on the pandemic situation worldwide and national government measures taken in the next few years.

For more details about Global Trade Analytics Suite (GTAS), please visit the product page here.

Note:

In line with the GTAS Forecasting commodity table, as

pharmaceutical goods, we consider the following HS4 codes: 3001

(Glands and other organs, dried, and their extracts, etc. for

therapeutic, etc. use; heparin and salts; human, etc. substances

for therapeutics, etc. nesoi), 3002 (Human and animal blood,

prepared; antisera other blood fractions immunological prod;

vaccines, toxins, cultures of micro-organisms (except yeasts) &

like prod), 3003 (Medicaments (except vaccines, etc., bandages or

pharmaceuticals), consisting of mixtures for therapeutic, etc.

uses, not in dosage or retail sale form), 3004 (Medicaments (except

vaccines, etc., bandages or pharmaceuticals), of products (mixed or

not) for therapeutic, etc. uses, in dosage or retail sale form),

3005 (Bandages and similar articles, impregnated or coated with

pharmaceuticals or put up for retail sale for medical, surgical,

dental or veterinary uses), 3006 (Pharmaceutical goods) and 3000

(Pharmaceutical products, n.e.s.)

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhas-pharmaceutical-goods-trade-changed-due-to-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhas-pharmaceutical-goods-trade-changed-due-to-covid19.html&text=Has+pharmaceutical+goods+trade+changed+due+to+COVID-19%3f++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhas-pharmaceutical-goods-trade-changed-due-to-covid19.html","enabled":true},{"name":"email","url":"?subject=Has pharmaceutical goods trade changed due to COVID-19? | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhas-pharmaceutical-goods-trade-changed-due-to-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Has+pharmaceutical+goods+trade+changed+due+to+COVID-19%3f++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fhas-pharmaceutical-goods-trade-changed-due-to-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}