Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 12, 2023

Will mainland China and India gain from the Russian-Ukrainian conflict? — Crude oil market analysis

Recently, there have been quite large changes on the world markets from the point of view of exports/imports of crude oil and petroleum products. This situation is undoubtedly influenced by the Russian-Ukrainian conflict, which changed the flows of exports and imports of this raw material.

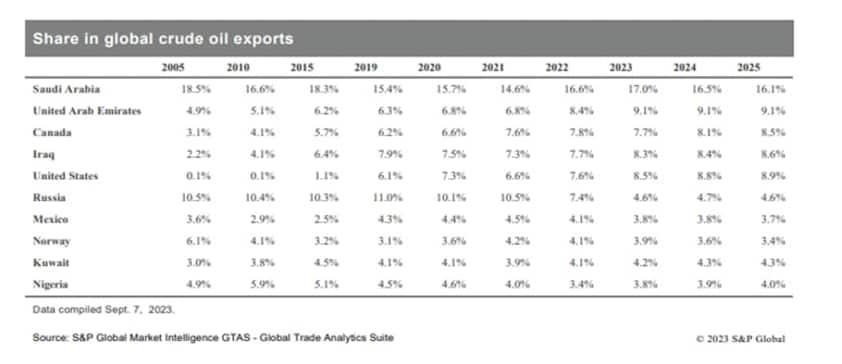

According to the Market Intelligence GTAS Forecasting, Saudi Arabia is the main oil exporter followed by the United Arab Emirates, Canada, Iraq, United States, Russia, Mexico, Norway, Kuwait and Nigeria. The total share of these countries in world exports (in nominal terms) was 71.4% in 2022 and it is forecast to decrease to 71.1% by 2025.

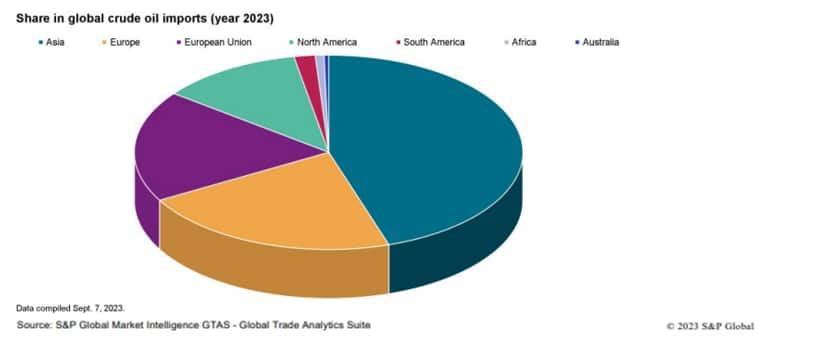

The main importer of oil is Asia; its share increased from 36.0% in 2005 to 52.1% in 2022 and it is forecast that this share will amount to 54.8% in 2025. The second world importer was Europe with a share of 32.9% in 2005.

In more detail, the main oil importers are mainland China, the United States, India, South Korea and Japan. Mainland China and India recorded the largest increase in oil imports from the perspective of shares in global oil imports and so in 2005 the share of mainland China and India was 5.6% and 4.6% respectively, while in 2022 it was 20.6% and 9.6% and it is forecast to be 22.3% and 10.0%, respectively, in 2025. The share of the United States in oil imports has a decreasing tendency.

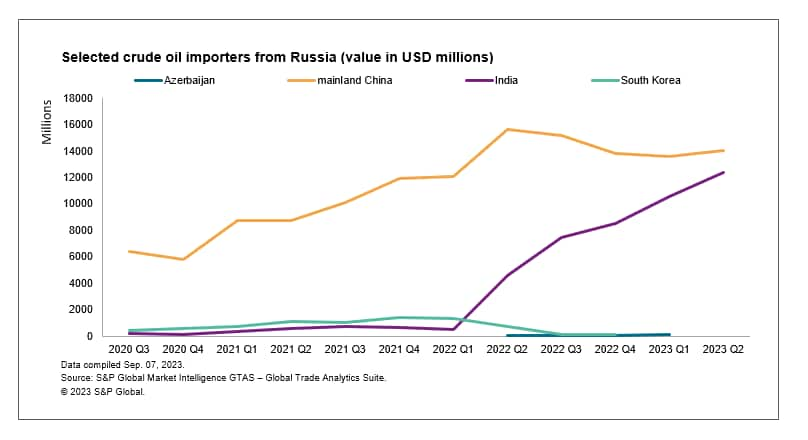

In addition, since the first quarter of 2022, when the Russian-Ukrainian conflict started, increased oil exports from Russia has been observed, mainly to India and mainland China. These two countries take advantage of the fact that most Western countries have imposed an embargo on oil imports from Russia. It is also observed that Azerbaijan started to buy oil from Russia from the beginning of the conflict, while oil from Azerbaijan is mainly bought by European countries such as Italy, Israel, Spain, India, Czech Republic, Germany, Turkey and Greece.

Undoubtedly, looking at the oil market, conflict creates new streams of trade. Both in the context of the reorientation of the EU market and the withdrawal of oil from Russia, but also in the context of Russia's export opportunities to new markets, mainly mainland China and India. The main winners in this context are mainland China and India, which can buy cheap oil from Russia, and Russia is slowly becoming a supplier to these countries, not a trading partner. In the longer term, if the conflict continues, it can be expected that mainland China and India will re-export oil from Russia, earning on the price difference between the world price and the price of oil from Russia.

This column is based on data from S&P Global Market Intelligence Global Trade Analytics Suite (GTAS) & GTAS Forecasting.

For more details about Global Trade Analytics Suite (GTAS) please visit the product page

For more details about GTAS Forecasting please visit the product page

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-china-and-India-gain-from-russian-ukrainian-conflict.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-china-and-India-gain-from-russian-ukrainian-conflict.html&text=Will+mainland+China+and+India+gain+from+the+Russian-Ukrainian+conflict%3f+%e2%80%94+Crude+oil+market+analysis+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-china-and-India-gain-from-russian-ukrainian-conflict.html","enabled":true},{"name":"email","url":"?subject=Will mainland China and India gain from the Russian-Ukrainian conflict? — Crude oil market analysis | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-china-and-India-gain-from-russian-ukrainian-conflict.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Will+mainland+China+and+India+gain+from+the+Russian-Ukrainian+conflict%3f+%e2%80%94+Crude+oil+market+analysis+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmainland-china-and-India-gain-from-russian-ukrainian-conflict.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}