Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 09, 2023

MSC prepares for delivery of Hapag-Lloyd-sized orderbook

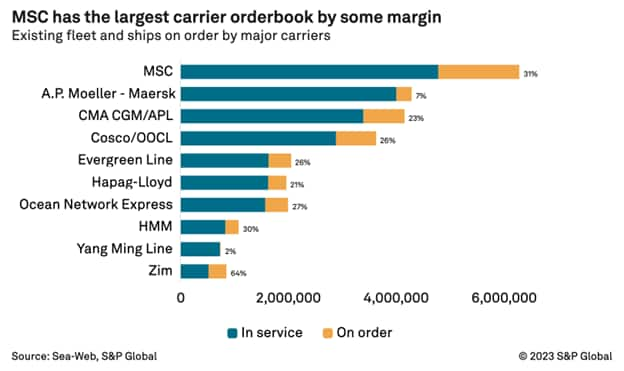

Mediterranean Shipping Co. (MSC) is scheduled to take delivery of more than 1 million TEU in capacity over the next two years with an orderbook the size of Hapag-Lloyd's total fleet, according to the latest data from Alphaliner.

Photo credit: OOCL

MSC became the world's largest container shipping company a year ago and has continued to aggressively build its fleet to a size that helped fuel its plans to exit the 2M Alliance it holds with Maersk in 2025.

At 1.8 million TEU, the MSC orderbook represents a capacity increase of almost 40 percent for the carrier, with 753,000 TEU to be delivered this year and 376,000 TEU to come online in 2024. The deliveries in 2023 are more than three times that of nearest competitor, Ocean Network Express at 220,000 TEU.

Cosco Shipping, including OOCL, has the second-largest orderbook with 888,928 TEU in capacity currently in the yards under construction, Alphaliner data shows. The list is rounded out by CMA CGM (816,476 TEU), Evergreen (463,442 TEU), ONE (422,930 TEU), Maersk (373,300 TEU), Zim (366,184 TEU), Hapag-Lloyd (362,616 TEU), and HMM (265,027 TEU).

The total global orderbook is closing on 30 percent of the existing fleet, with a record amount of capacity on order, according to data from SeaWeb, a sister company of the Journal of Commerce within S&P Global. About 2.5 million TEU will hit the water this year, 3 million TEU next year, and 1.7 million TEU in 2025.

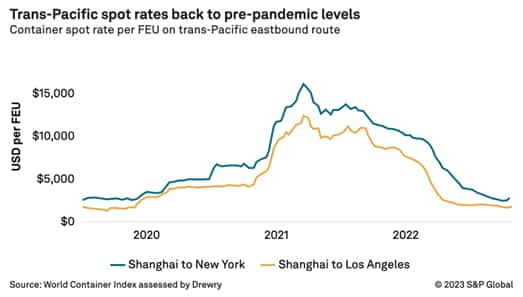

This year's new capacity will enter the fleet as container shipping moves into a down cycle and struggles to arrest rapidly deteriorating rates dropping to pre-pandemic levels, with no bottom in sight.

Average North Asia to U.S. West Coast spot rates this week were $1,250 per FEU, down sharply from $9,300 per FEU a year ago, according to Platts, a sister company of the Journal of Commerce within S&P Global. Drewry's World Container Index had the Shanghai-Los Angeles spot rate at $1,948 per FEU in early March, down 82 percent year over year.

Asia-North Europe spot rates are at $1,637 per FEU this week, down 87 percent year over year, while Asia-Mediterranean rates at $2,743 per FEU are down 80 percent, according to rate benchmarking platform Xeneta. Shanghai Shipping Exchange data shows spot rates are down almost 90 percent on China-North Europe and 78 percent lower on China-Mediterranean routes.

Mismatch between capacity, demand

The rates have tumbled as carriers have been unable, or unwilling, to match capacity with declining volume, according to Lars Jensen, founder and CEO of Vespucci Maritime. Jensen, also a Journal of Commerce analyst, said in a Baltic Exchange report Thursday that rates in some cases were already below pre-pandemic levels.

"The fact that the carriers still do not remove sufficient capacity to match the demand decline implies that some carriers favor volume increase over rate levels - and hence there is a de-facto small rate war ongoing," he said.

Jensen said judging from carrier statements, they expect a potential market rebound on the trans-Pacific during the peak season in the second half of this year, which will likely mean continuing ad-hoc and unpredictable blank sailings in the coming months. That could see conditions evolve in one of two ways.

"One where the inventory correction ends, and demand grows sharply - also prompting sharp increases in rate levels already in summer 2023, and another where the rate war intensifies, sending levels much lower," Jensen wrote.

Alan Murphy, CEO of Sea-Intelligence Maritime Analysis, noted in his Sunday Spotlight newsletter this week it is clear there is far too much capacity in the market and even more capacity coming onstream over the coming years.

"With carriers reluctant to close down services and remove capacity in a more permanent manner, we should expect high levels of blank sailings for the foreseeable future, with the many disruptions this is bound to entail," Murphy said.

By early March, carriers on the trans-Pacific had announced that 20.2 percent, or 333,667 TEU, of the total capacity on the trade would be blanked in March, with April withdrawals representing 4.2 percent of the total capacity to date, Sea-Intelligence data shows. On Asia-Europe, 326,828 TEU, or 15 percent, of the total capacity will be blanked in March, and 6.2 percent in April.

Blankings are expected to increase closer to sailing dates, with Murphy noting the "wait-and-see-what-competitors-are-doing" approach carriers are taking to blank sailings was resulting in drastic changes to scheduled capacity the closer to the actual deployment date.

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Maritime, Trade & Supply Chain newsletter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsc-prepares-for-delivery-of-hapaglloydsized-orderbook.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsc-prepares-for-delivery-of-hapaglloydsized-orderbook.html&text=MSC+prepares+for+delivery+of+Hapag-Lloyd-sized+orderbook+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsc-prepares-for-delivery-of-hapaglloydsized-orderbook.html","enabled":true},{"name":"email","url":"?subject=MSC prepares for delivery of Hapag-Lloyd-sized orderbook | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsc-prepares-for-delivery-of-hapaglloydsized-orderbook.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=MSC+prepares+for+delivery+of+Hapag-Lloyd-sized+orderbook+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fmsc-prepares-for-delivery-of-hapaglloydsized-orderbook.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}