Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 07, 2023

Nigeria cash crisis hits activity in February

In the musical Cabaret, Liza Minelli sang that 'Money makes the world go round'. The enduring truth of this lyric is evident in Nigeria at present, where a shortage of cash in circulation has had a severe halting effect on economic activity.

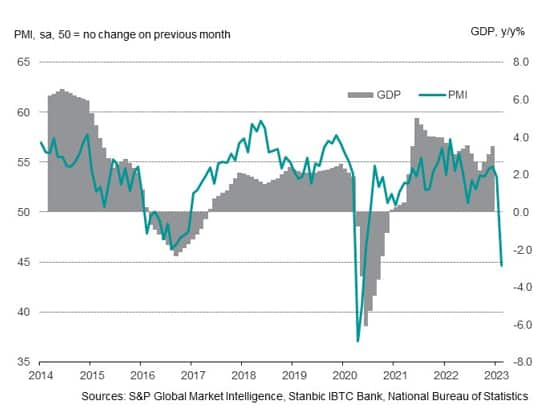

February Stanbic IBTC Bank PMI data, compiled by S&P Global, signalled the sharpest decline in business activity since the Nigeria PMI survey began in 2014, outside of the first wave of the COVID-19 pandemic. Fuel shortages exacerbated the cash-related difficulties facing firms. Coming during an election period, these challenges mean that the incoming government will have a full inbox when taking office.

Stanbic IBTC Bank Nigeria PMI

Rapid decline in output amid cash shortages

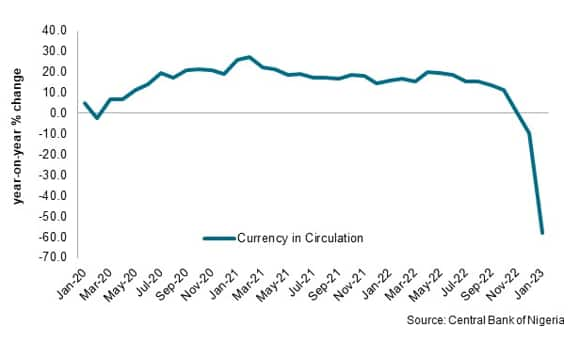

Efforts by the authorities in Nigeria to replace old banknotes with new ones have resulted in widespread cash shortages across the economy at the start of 2023. Insufficient amounts of the new notes have been available for people to access after they have handed in their old currency. Data show that the amount of currency in circulation decreased by nearly 60% year-on-year in January, with little sign that the situation has improved significantly since then.

Nigeria currency availability

The difficulties faced by customers in securing cash to pay for goods and services meant that new business - and subsequently output - decreased substantially midway through the first quarter of the year. PMI data pointed to the most severe declines in both new orders and output since the survey began in 2014, except for during the opening wave of the COVID-19 pandemic in the second quarter of 2020. Prior to February, new orders had risen for 31 successive months.

In turn, companies also scaled back their purchasing activity and employment during the month, the former not only reflecting the drop in new orders but also the difficulties of companies themselves in finding the cash needed to pay for inputs.

Fuel shortages impact supply chains

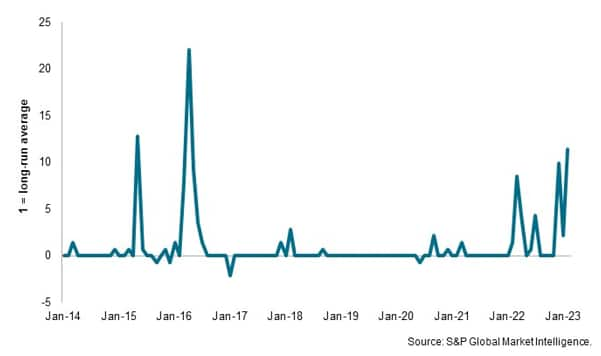

Alongside the lack of cash available in the economy at present, there are also widespread shortages of fuel which has further acted to impact business operations. Suppliers' delivery times lengthened for the first time in close to five-and-a-half years in February, and to the greatest extent since April 2016. Respondents to the survey often linked delivery delays to fuel shortages, with reports of this among the highest seen in the survey's history.

Reports of fuel issues causing supplier delivery delays

It remains to be seen how long it will take for the cash issues in particular to be resolved, but any extended period of disruption clearly will put a dent in the country's economic performance over the first half of the year.

On a more positive note, companies are optimistic that output will increase over the next 12 months, amid hopes that economic conditions will improve. Getting cash into people's pockets will be key in helping demand to recover.

Access the press release here.

Andrew Harker, Economics Director, S&P Global Market Intelligence

Tel: +44 1491 461 016

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigeria-cash-crisis-hits-activity-in-february-Mar23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigeria-cash-crisis-hits-activity-in-february-Mar23.html&text=Nigeria+cash+crisis+hits+activity+in+February+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigeria-cash-crisis-hits-activity-in-february-Mar23.html","enabled":true},{"name":"email","url":"?subject=Nigeria cash crisis hits activity in February | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigeria-cash-crisis-hits-activity-in-february-Mar23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Nigeria+cash+crisis+hits+activity+in+February+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fnigeria-cash-crisis-hits-activity-in-february-Mar23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}