Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2023

Q1 2023 Sustainability Muni Recap

S&P Global Market Intelligence Global Markets Group's municipal bond analysts have reviewed Q1 2023 municipal bond new issue data and analytics to identify the quarter's sustainable issuance trends. Our data indicates that sustainable municipal bonds issuance (including corporate issues) grew 13% from $7.94B in Q1 2022 to $8.96B in Q1 2023 against a tough backdrop where the overall muni issuance dropped by 22% Y/Y, from $100.6B in Q1 2022 to $78.1B in Q1 2023.

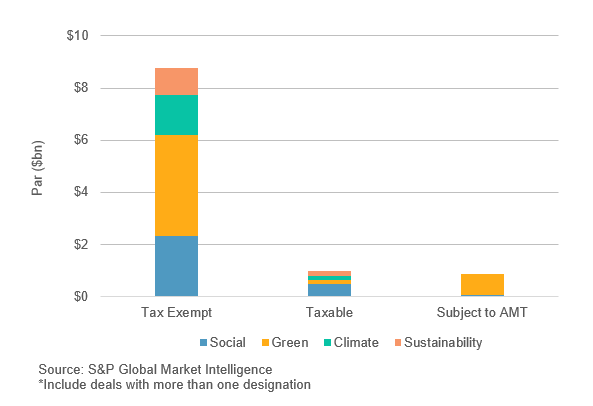

Sustainable Issuance by Type

Green Bonds represented the majority of Sustainable issuance, accounting for $4.9B, or 46% of Sustainable issuance in Q1 2023. The largest green bond issued during 1Q23 was The California Community Choice Financing Authority's $998.8M Clean Energy Project Revenue Bonds, Series 2023C (Green Bonds) sold on 2/15/2023.

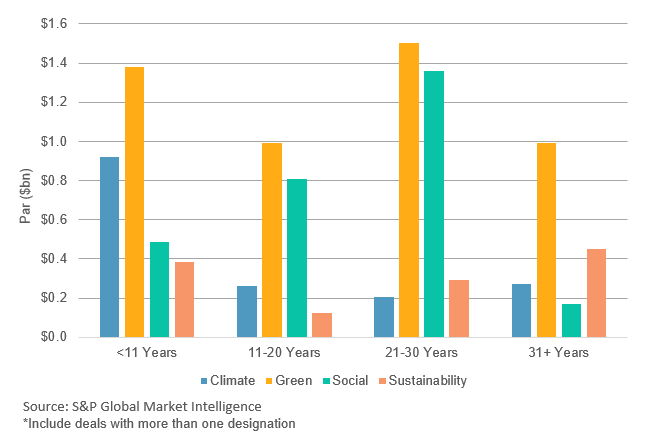

Sustainable Issuance by Maturity

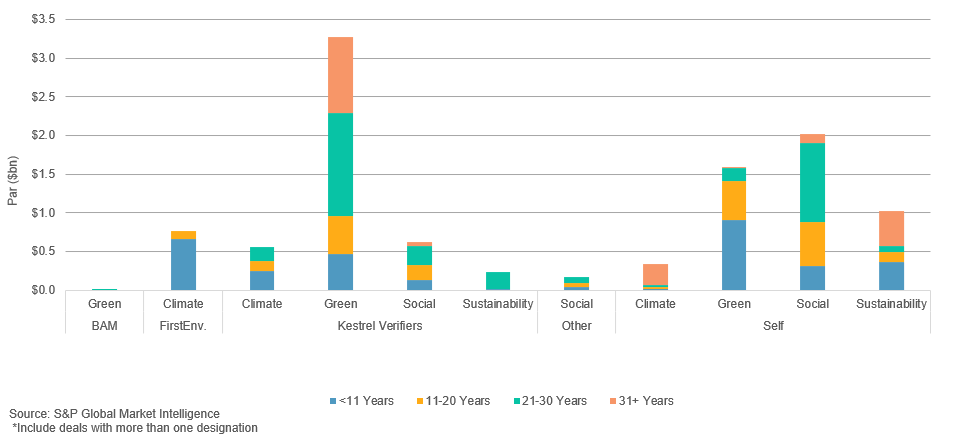

Sustainable Issuance by Verifier, Type, and Maturity

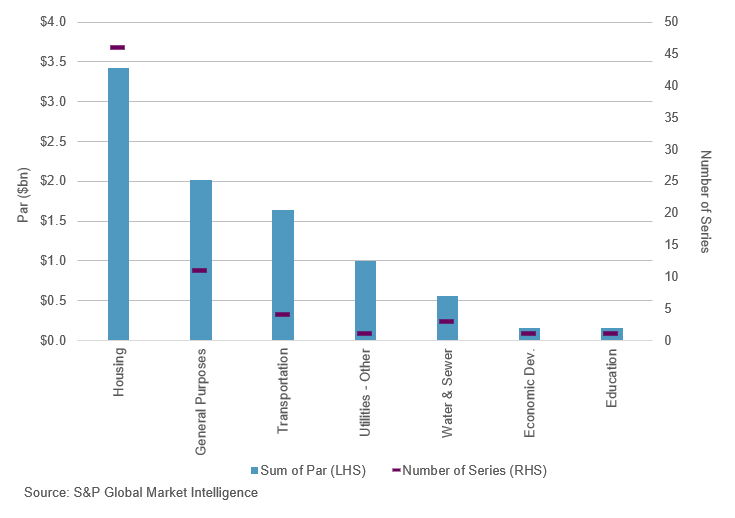

Sustainable Issuance by Sector

The Housing sector represented the greatest portion of Sustainable bonds by sector with $3.4B issued led by the $502.7M New York State Housing Finance Agency, Affordable Housing Revenue Bonds, 2023 Series A-1 (Climate Bond Certified/Sustainability Bonds), 2023 Series A-2 (Climate Bond Certified/Sustainability Bonds), 2023 Series B-1 (Sustainability Bonds), 2023 Series B-2 (Sustainability Bonds).

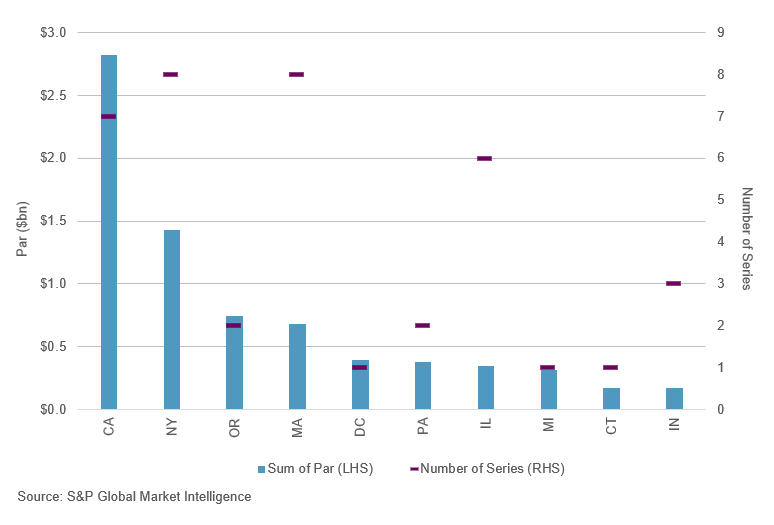

Sustainable Issuance by State

CA led the Sustainable issuance with over $2.8B of issuance.

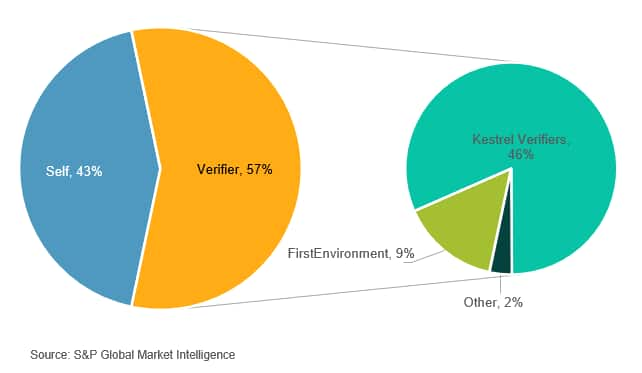

Verifier vs Self

Majority of Sustainable issuance was validated by verifiers during the quarter, with Kestrel Verifiers accounts for the bulk of it. Meanwhile, 43% of issuance was self-verified.

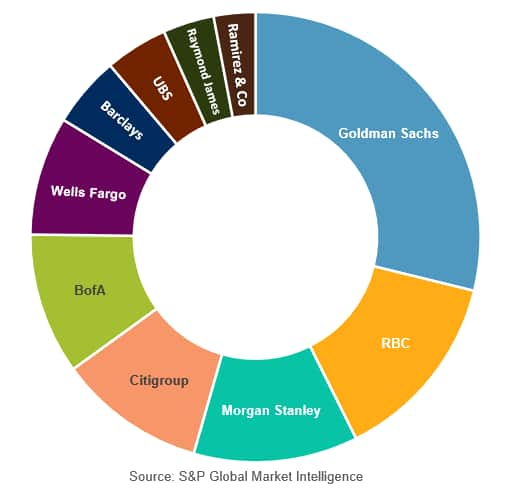

Top 10 Underwriters for Sustainable Issuance by Par Amount

Sustainable Issuance by Tax Status

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-2023-sustainability-muni-recap.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-2023-sustainability-muni-recap.html&text=Q1+2023+Sustainability+Muni+Recap+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-2023-sustainability-muni-recap.html","enabled":true},{"name":"email","url":"?subject=Q1 2023 Sustainability Muni Recap | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-2023-sustainability-muni-recap.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Q1+2023+Sustainability+Muni+Recap+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq1-2023-sustainability-muni-recap.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}