Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 13, 2023

Q2 2023 Global Markets Group US Equity Capital Markets Summary

US New Issuance Market Update

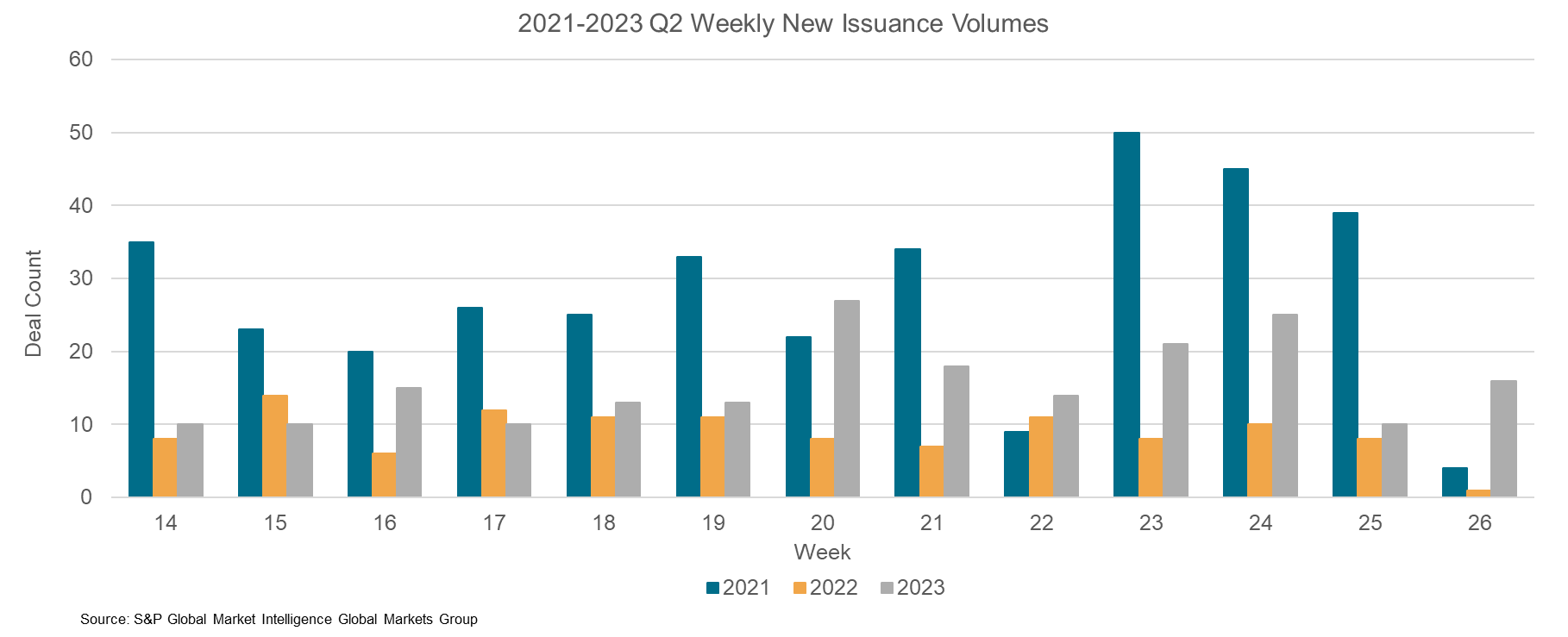

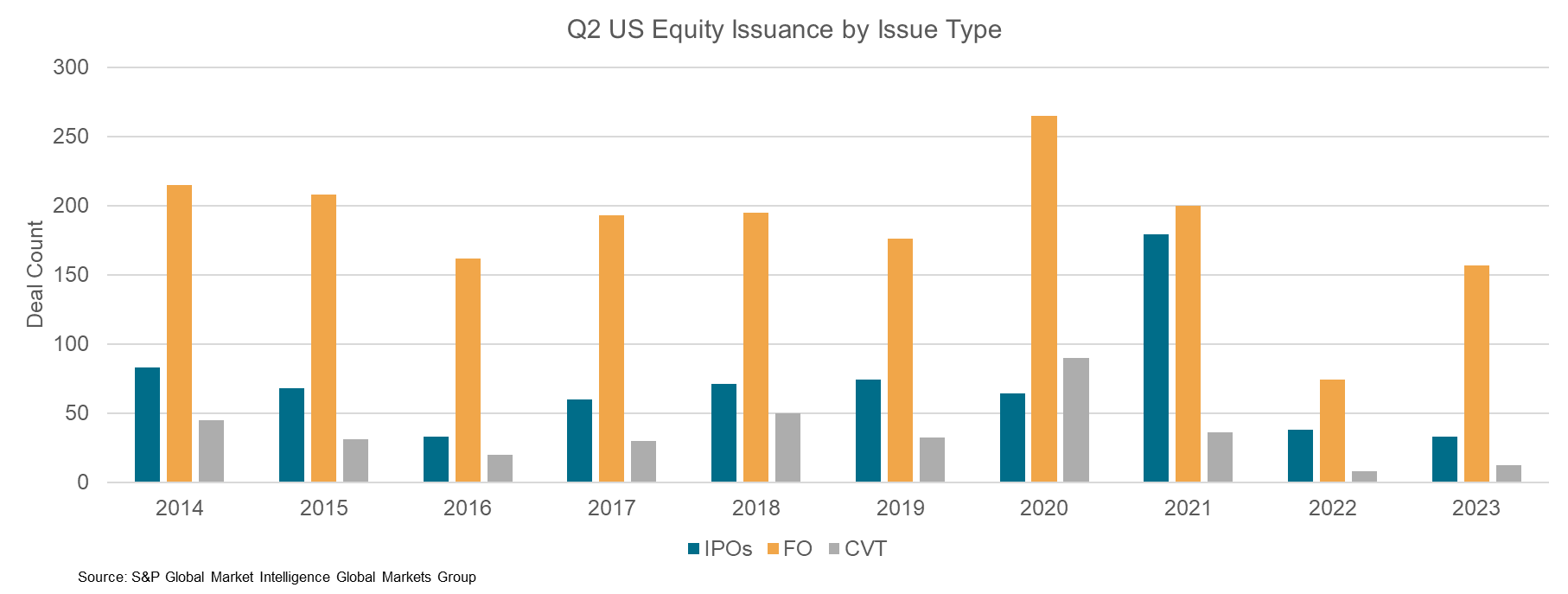

The US equity new issuance market priced 202 deals (33 IPOs, 157 FOs, 12 CVTs) for $42.1B in aggregate proceeds, up 68% from the 120 deals seen during the same period the prior year.

- The largest deal of the quarter came from Kenvue Inc. with the consumer services company raising $4.4B from its IPO offering in May. The issue priced at $22 per share, which was within its initial filing range and saw a 22% uptick during its first day of trading

- Kenvue marks the largest IPO since Rivian Automotive, Inc. raised $13.7B in November 2021 and the third largest consumer services IPO since 2001.

- Overall, 33 IPOs hit the market during the quarter for $7.9B in combined proceeds, down marginally from the 38 IPOs that raised $4.0B in proceeds during Q2 2022.

- Volumes were driven again this quarter by follow-on offerings, as 157 deals priced, which was more than double the 74 deals issued in Q2 2022.

- Agilon Health, Inc. priced a $2.0B healthcare offering in May, which was the largest deal from the sector. Healthcare remained the most active sector in Q2, with 82 deals coming to market for $12.8B in proceeds.

US IPO Pipeline

- Currently there are 126 IPOs in the 12-month backlog, with the healthcare and tech sectors appearing to be the most active with 26 and 23 issuers, resepctively, in the pipeline.

- The semiconductor company Arm Holdings confidentially filed for its IPO in late-April, paving the way for a possible second half deal and joining other noteworthy filings like Navan, Stripe, and Instacart that could potentially to go public later this year.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq2-2023-global-markets-group-us-equity-capital-markets-summary.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq2-2023-global-markets-group-us-equity-capital-markets-summary.html&text=Q2+2023+Global+Markets+Group+US+Equity+Capital+Markets+Summary+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq2-2023-global-markets-group-us-equity-capital-markets-summary.html","enabled":true},{"name":"email","url":"?subject=Q2 2023 Global Markets Group US Equity Capital Markets Summary | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq2-2023-global-markets-group-us-equity-capital-markets-summary.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Q2+2023+Global+Markets+Group+US+Equity+Capital+Markets+Summary+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fq2-2023-global-markets-group-us-equity-capital-markets-summary.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}