Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 08, 2023

Quality data: the key to an efficient portfolio risk management system

This article was first published in our complimentary ebook: 'Buy Side Risktech 2.0: Solving the challenges of a risk manager'. Access the full eBook here.

Having access to accurate and relevant risk analytics enables risk managers to make informed decisions and take proactive measures to minimize potential losses for their clients.

The usefulness of the analytical outputs of risk systems can vary depending on its capabilities. Risk analytics such as VaR are well defined calculations, but often require full revaluation models to be effective. A broad pricing library covering multiple asset classes is required to be able to re-price securities over history and therefore calculate risk properly. When calculating VaR using monte-carlo simulations, this can also require a powerful and efficient simulation engine that is capable of re-pricing thousands of different types of securities over thousands of monte-carlo scenarios.

However, the analytics output of any risk system is only ever as good as the market data that goes into it. Poor quality market data inputs lead to inefficiencies and inaccurate risk statistics, inviting greater scrutiny on the effectiveness and credibility of risk management.

Fixing data issues is a burden

Risk managers typically start their day analyzing overnight risk computations. Many issues that arise originate from poor market data inputs. Risk systems operating on a batch basis require resolution and recomputing results for every fund and benchmark affected.

Repeated batch failures, persistent data spikes, and missing data can lead to delayed, incomplete, or inaccurate results. As most risk managers would agree, time wasted fixing data issues would be far better spent using the risk analytics output to deliver value for internal and external stakeholders.

Inefficiency breeds bad data

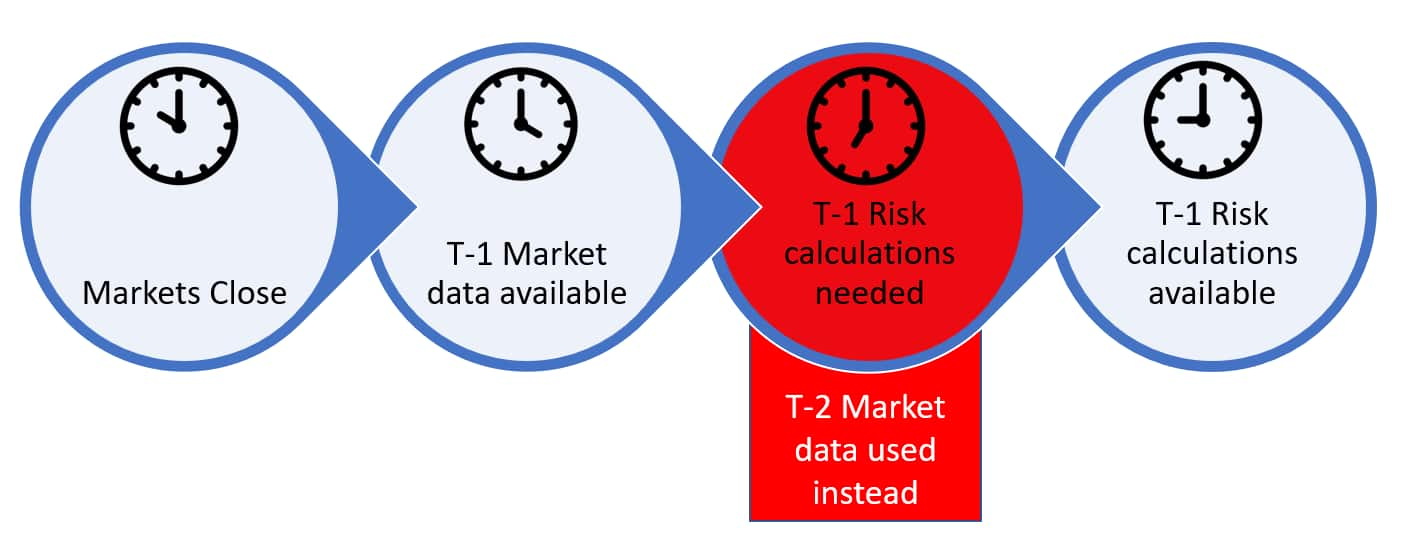

Risk computations often rely on stale market data because risk and portfolio managers need information before daily trading starts. The calculation time needed to receive, collate, and quality assure updated input data before batch runs are kicked off is often too long, which means T-2 market data is used instead of T-1. Stale data issues not only impact risk managers because they aren't on the same page as portfolio managers, but are also the cause of frustration across entire institutions.

Data issues hinder the success of

risk managers as they waste time identifying and fixing issues and

rerunning cumbersome batches. This inefficiency should not be

underestimated. In severe cases, risk managers can spend entire

working days investigating and resolving issues in overnight

batches.

Data issues hinder the success of

risk managers as they waste time identifying and fixing issues and

rerunning cumbersome batches. This inefficiency should not be

underestimated. In severe cases, risk managers can spend entire

working days investigating and resolving issues in overnight

batches.

A Modern Approach

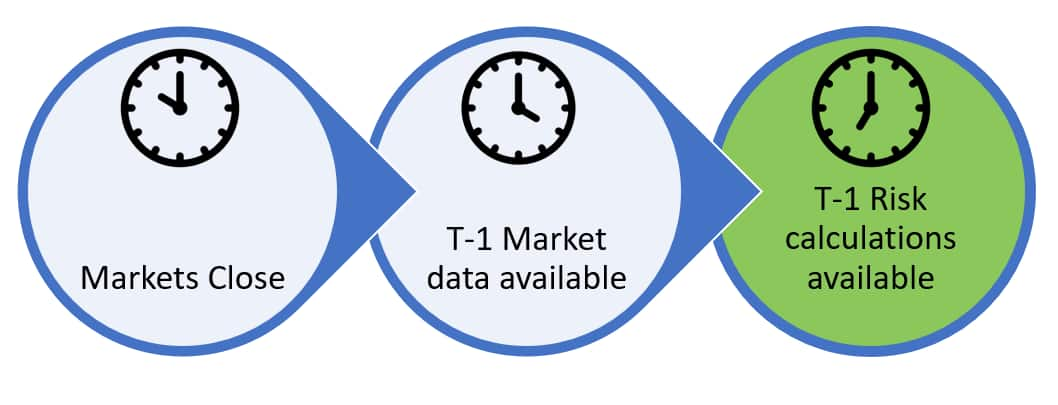

Up-to-date, accurate, and timely risk analytics are integral in day-to-day investment management activities. A consequence of using T-2 market data is that risk managers struggle to challenge portfolio managers who are trading on the most recently available market data. This is avoidable, by implementing a modern tech stack that improves the efficiency of risk calculations and enables firms to make risk analytics calculated using T-1 market data available to portfolio managers for the start of trading.

Data has become central to the success of Risk Managers and can create significant opportunities for those who invest in, manipulate, and handle it effectively.

The following should be included as part of your risk management infrastructure, to ensure the data going into and out of your risk management system is fully quality assured:

- Data validation: Validate the data to ensure accuracy and completeness, using methods such as data reconciliation, data checking, and data cleaning.

- Data standardization: Ensure that data is consistent and in the same format, so that it can be easily used and compared across different systems and applications.

- Data monitoring: Regularly monitor data quality to detect and correct any errors or inaccuracies, and to ensure that data remains relevant and up-to-date.

As expectations on risk managers evolve and increase, they need to spend their time meeting the demands of internal and external stakeholders, not fixing data. A trusted and fully integrated risk team can lead to greater alpha generation.

Modern risk systems are changing the game by putting quality checks on market data going into risk models as well as on the outputs. These systems will store intermediate results, so that additional checks can be carried out and fixed mid-run. Using trusted, curated market and reference information, data issues can be better managed or avoided entirely.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fquality-data-key-to-efficient-portfolio-risk-management-system.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fquality-data-key-to-efficient-portfolio-risk-management-system.html&text=Quality+data%3a+the+key+to+an+efficient+portfolio+risk+management+system+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fquality-data-key-to-efficient-portfolio-risk-management-system.html","enabled":true},{"name":"email","url":"?subject=Quality data: the key to an efficient portfolio risk management system | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fquality-data-key-to-efficient-portfolio-risk-management-system.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Quality+data%3a+the+key+to+an+efficient+portfolio+risk+management+system+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fquality-data-key-to-efficient-portfolio-risk-management-system.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}