Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

May 04, 2023

Securities Finance April Snapshot 2023

- US equity specials show no sign of declining

- Scandinavian equities in EMEA produce strong returns

- Fixed income assets continue to thrive

- Exchange Traded Products see declines in revenues and average fees

Financial markets experienced another action-packed month with the after-effects of the liquidation of Silicon Valley Bank and Signature Bank in the US and UBS's purchase of Credit Suisse still being digested by market participants. Despite the ongoing uncertainty created by further interest rate ambiguity and continued concerns regarding the financial sector, securities finance revenue experienced another impressive month. During April, $1.291B in securities finance revenues were generated. This is an increase of 22% YoY and 4% MoM. Average fees increased across all securities to reach 58bps (+36% YoY). This is due to lending rates moving higher across EMEA and the US. Revenues increased across all asset classes over the month (YoY) apart from ETPs which experienced a decline of 33% YoY and 19% MoM. Momentum across fixed income markets was maintained as corporate bond revenues hit $100m for the third time this year whilst government bond revenues increased 7% YoY to $156M.

Americas equities

Americas equities experienced another strong month producing securities finance revenues of $524M (+45% YoY, +13% MoM) making April the highest revenue generating month of the year to date. Average fees increased over the month to an astonishing 95bps which is an increase on the 86bps on offer during March. Average fees across Americas equities year to date are 88bps. This is notably higher than the equivalent rate for the last few years (60bps 2022, 67bps 2021, 73bps 2020) and is testament to the current specials environment that exists in this market. Over the month utilization increased 7% to 3.06%. Balances declined YoY (-8%) despite increasing MoM (+3.7%).

In Canada, revenues for April were $39.4M which equates to an impressive 63.5% increase YoY (-3% MoM). Average fees were 67bps over the month (+20% YoY, -8% MoM). Average fees YTD remain 10bps higher than at the same point during 2022 at 68bps. Utilization continues to track higher in Canada reaching 8.21% during April (+53% YoY). This is the highest level seen for at least the last four years. Average utilization only exceeded 7% during three months of 2022 and remained below 6% throughout the entirety of 2021.

Specials activity within the US equity market didn't slow down over the month generating $367M in revenues, accounting for just over 74% of all US equity revenues. This means that 74% of all revenues in this market were generated from approximately 3% of all balances. April was the second highest month of the year so far for specials revenues. February was the best performing month so far with $371M being generated. Over 2023 YTD $1.383B in specials revenues have been generated which is a 67% increase on 2022.

AMC continued to generate interest from borrowers over the month, with exceptionally strong revenues of $132M. Average fees have started to decline slightly in this name however and the percentage of shares outstanding on loan has also started to fall. This is in tandem with an increase in the stock price during the closing weeks of March.

Upstart holdings Inc (UPST) came under further pressure during the month as a result of the increased focus on financial stocks. First Republic Bank (FRC) shares also entered into the table as US regional banks continued to deal with the fallout from the demise of Silicon Valley Bank and Signature Bank.

Evgo Inc (EVGO), the electric vehicle charging stations company, remained a favourite amongst borrowers during the month despite a circa 25% increase in its share price after Q4 revenues beat forecast. Zim Integrated Shipping Services Ltd (ZIM) was a new addition to the table over the month as market participants believe that the company remains over valued considering the decline seen in profits between Q3 and Q4. Transportation companies often come under stress as recessionary fears build, as freight tends to decline during periods of lower economic activity.

Revenues from the top ten stocks generated $245M over the month which was an increase of 20% MoM.

APAC equities

APAC equity revenues increased 5% YoY to $183M. Despite declining 13% when compared with March, April was the second highest revenue generating month of the year so far for the region. Revenues increased in Japan and Hong Kong over the period but declined YoY across all other markets. Average fees matched those of April 2022 at 96bps but significant increases YoY were seen of 23% and 21% in Japan and Hong Kong. Revenues in Japan have shown real strength during 2023. Revenues to date in the country are equal to those of the first six months of 2022. Average fees, when compared YoY, have remained consistently higher every month which has helped to generate these strong returns.

In Taiwan, despite revenues falling YoY, April was the highest revenue generating month year to date. Average fees of 261bps also hit a year high. The last time average fees surpassed 260bps was during October 2022. Utilization in this market declined both MoM (-24%) and YoY (-42.5%) to its lowest level since January 2021. Lendable assets increased 37% YoY and balances declined 11% YoY.

Activity across the rest of the APAC region remained subdued. Revenues across the other territories were down along with the majority of average fees. Utilization did increase across the region but when focusing in on individual countries, the majority of this growth was down to an increase in balances in Japan which remains by far the largest country in terms of balances. Revenues reached a year high in both South Korea and Thailand.

Specials activity revenues across the APAC region reached $75.2M over the month, approximately 43% of all revenues. This is a 2.7% decline when compared with April 2022. YTD $295.7M of specials revenues have been generated, which is a 3% decrease on 2022.

When looking at the highest revenue generating stocks across the region, Japan, South Korea and Hong Kong are all well represented. Japanese equities remained in demand over the period as dividend season continued in full swing. Sensetime Group Inc (20) was the top borrow of the month generating just over $2.5M. This investment holding company which is involved in developing and selling artificial intelligence software platforms within the China was originally blocked from trading in the US by the Trump administration and this has not been lifted. The company is also facing strict rules from the Chinese regulator in regards to the usage of AI Chatbots which has sent the company's share price lower.

Ecopro Bm Co Ltd (247540) also appears as a top borrow this month. Ecopro produces components for electric vehicle batteries. The company has been very successful for many years but recently received its first ever sell rating, sounding a note of caution to investors. This led the company's share price to fall 17% in one day. This is a small drop compared to the stock's 647% increase YoY but it has led short sellers to question whether the stock is overvalued.

Revenues in Pop Mart International Group Ltd (9992) fell to their lowest level since December. The company that is seeing some positive news flow following the end of COVID-19 restrictions across China but is still clouded by uncertainties over consumers' spending power and the impact that this may have on the company's ongoing operations. YTD this stock has generated $7.7M in securities finance revenues.

EMEA equities

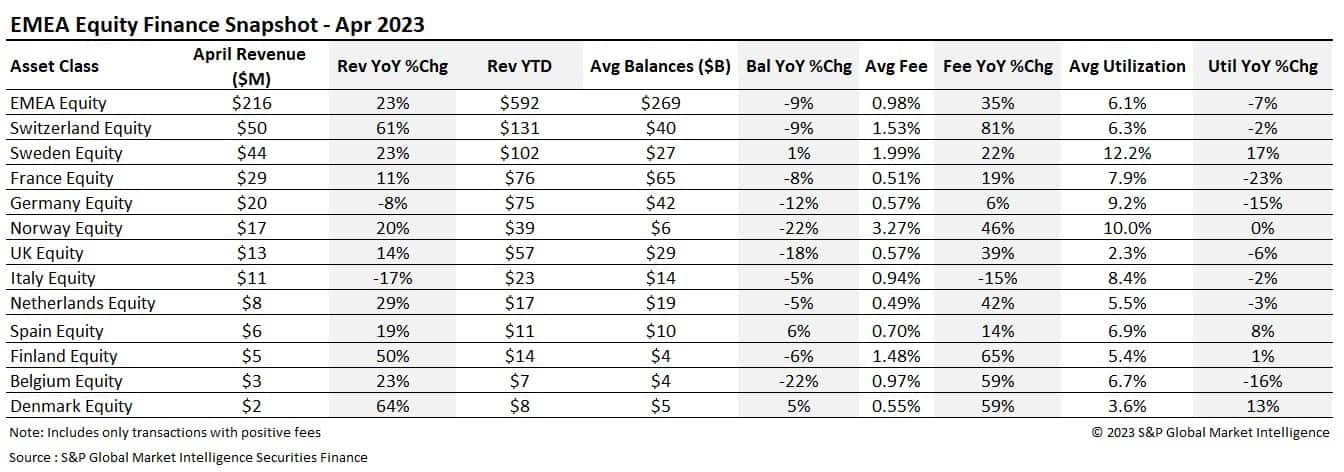

Across EMEA securities finance revenues increased 23% YoY and 26% MoM to $216M. Unsurprisingly with the increase in seasonal activity taking place across the region April is the highest revenue generating month of the year so far. This is also reflected in the average fee across the region which climbed to 98bps over the month. This represents a 35% increase on the average fee of 72bps seen during April 2022. Utilization across the region topped 6% for the first time since November last year.

All markets experienced increased revenues during the month when compared YoY except for Italy and Germany. Switzerland maintained the strong momentum seen during March with a 61% increase in revenues YoY. The Nordics remained popular countries amongst borrowers with stronger revenues when compared with April 2022. Denmark and Finland witnessed increases of +50% and Sweden and Norway saw impressive but more restrained increases of +20% on last year. Average fees remained very healthy and increases on 2022 were also seen across the board apart from Italy where fees decreased 15% YoY to 94bps. Average fees in Norway topped 300bps over the month, representing the highest level since May 2022 (348bps). Utilization also topped 10% in two Scandinavian countries during the month with utilization in Norway reaching 10% and 12% in Sweden.

Across EMEA revenues tend to be the strongest during the month of May. With revenues already 23% higher YoY during April, lenders of European assets are likely to see very strong returns over the course of 2023.

Specials activity also increased across the region over the month. Specials revenues were $43.9M over the month (21% of revenues), generated from approximately 1.6% of on all loan balances. Year to date specials revenues are $192M across the region which is 36% greater YoY and the highest cumulative value since 2008.

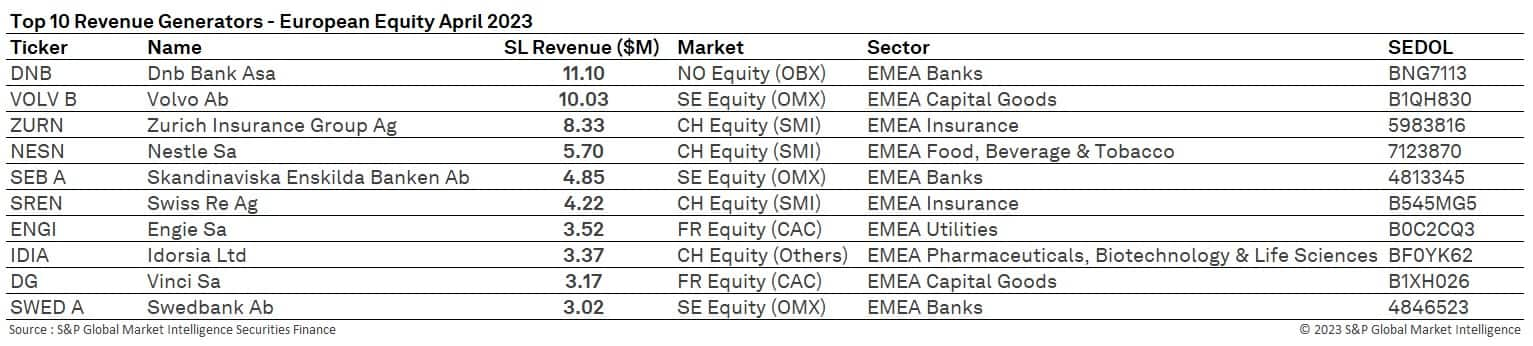

Top borrows across the month remain representative of the overall revenue table. DNB Bank ASA (DNB), a Norwegian bank, was the highest revenue generator over the month producing $11M of revenues. The vast majority of other stocks were linked to ongoing seasonal activity across the region.

Depositary Receipts

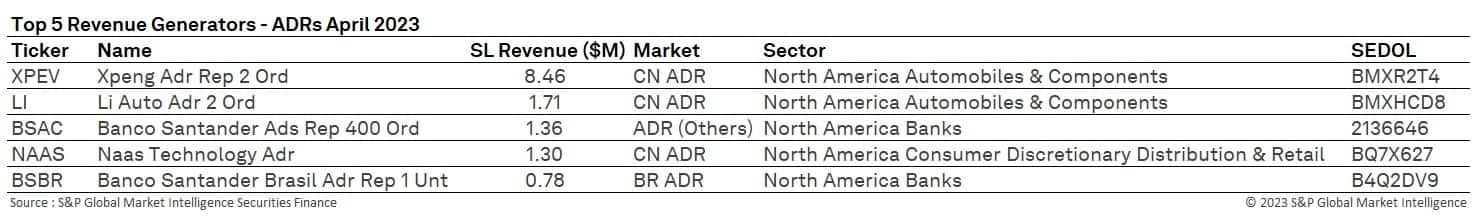

American Depositary Receipts continued to generate stronger revenues over the course of the month when compared on a YoY basis. The asset class generated $32M over the month which was an increase of 40%. Both revenues and average fees did decline MoM (revenues -13% and fees -5%) but activity in the asset class is recovering from the lower levels of activity that were seen throughout 2022. Average fees increased to 132bps (+38% YoY).

As during previous months, the top revenue generators continue to be dominated by the electric vehicles sector. During the month of April, Banco Santander Ads Rep (BSAC) and Banco Santander Brazil (BSBR) collectively generated just over $2M. This stock paid a dividend on April 20th.

Exchange Traded Products

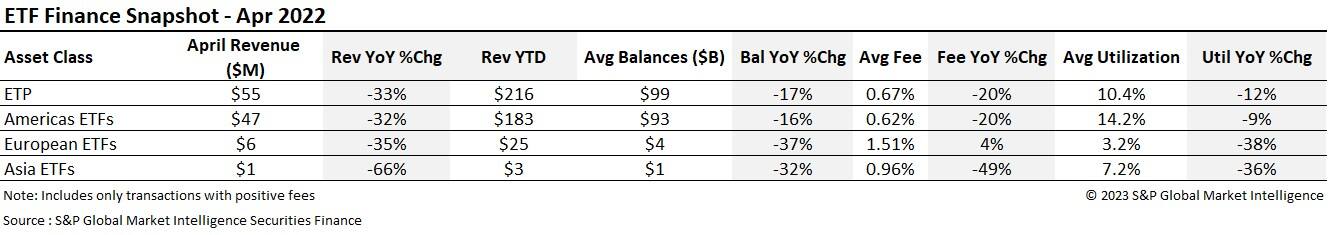

During the month, Equity exchange-traded funds saw more than $12.6 billion of inflows during April, the largest seen since January and more than twice as much as in February and March. After the fallout seen across the financial sector during the month of March, investors grew in confidence and started to move money out of cash and short duration products back into stocks. ETFs were one of the big winners of this transfer of risk given their ability to offer diversified exposure through a single asset.

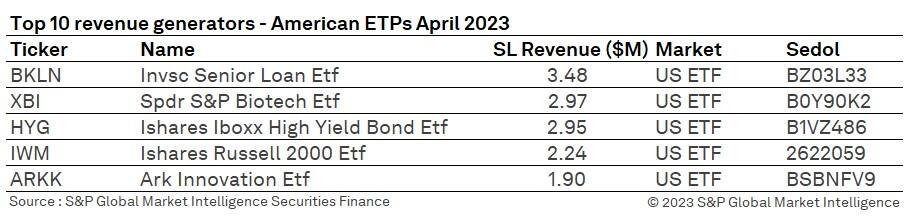

Securities finance revenues across all exchange traded products continued to decline over the month. This is an ongoing trend across the asset class and is unsurprising given the strong revenues that were generated throughout 2022. During the month ETPs generated $55M in securities lending revenue. 85% of these revenues were generated by US ETFs, with European ETFs generating just $6M. Despite the 35% decline in revenues YoY, average fees across European ETFs increased 4% to 151bps. Average fees across the asset class maintained the Q1 average of 67bps.

The top revenue generating ETFs all remained familiar names over the month. Revenues from HYG continued to decline and the Invesco Senior Loan ETF (BKLN) took the top spot generating over $3.4M during the month. This ETF aims to index the leverage loan market and remains a favourite amongst short sellers given the uncertainty regarding any future moves in interest rates. The SPDR S&P Biotech ETF (XBI) is a newcomer to the most borrowed list. Short interest across the Biotech sector has been increasing recently as uncertainty regarding profitability is becoming an issue for the sector. Increased interest rates often make it difficult for companies to raise funds and it also diminishes the value of future profits. The majority of biotech companies are expected to generate the bulk of their revenues in the future which puts them under the spotlight.

Across the European highest revenue generating ETFs High yield and corporate bond trackers dominate the table.

Government Bonds

Investors witnessed more interest rate volatility throughout the month as further issues in the banking sector and the anticipation of further interest rate increases translated into a very choppy trading environment. Despite US job vacancies falling below 10M for the first time since May 2021, inflation easing and an increase in unemployment rates, investors still remain uncertain as to what the Fed needs to see before assuming a more dovish tone.

In the UK and Eurozone, a similar situation existed. The Fed does seem to be closer to being able to pause any further rate rises where the Bank of England and the Eurozone do still seem to be playing catch up. In the UK inflation increased over the month and in the Eurozone the composite PMI increased to 54.4 which was above expectations. In all three territories inflation remains well above the 2% target and a soft landing is still the firm objective. This is easier said than done however as economic data remains historic in nature and any overtightening is unlikely to be seen until it's too late. In Canada, the central bank increased interest rates by 25bps over the month and declared a resting period to enable a full review of economic data.

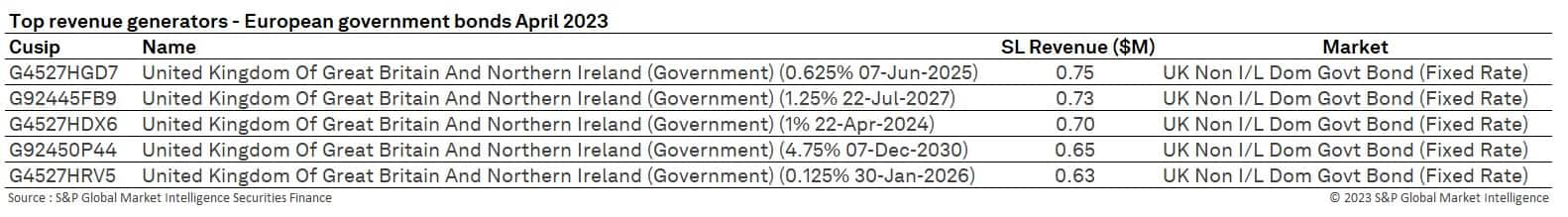

The volatility in the government bond markets continues to generate opportunities for securities lenders. Over the month $156M in revenues were generated representing a 7% increase YoY and a decrease of 8% MoM. Average fees fell by 1bps over the month to 17bps and utilization declined back below 21% (20.4%). Utilization now stands at its lowest level for many months.

Across the highest revenue generating government bonds, as we have seen previously, short dated issues are commanding the highest fees and generating the strongest revenues. The only exception to this is Canada where the 1.75% 1st Dec 2053 (135087M68) generated the strongest returns for lenders. The pause in any future rate increases may be impacting those bonds with higher duration risk hence the exception to the general trend.

As we head into May, conversations regarding the upcoming debt ceiling will no doubt continue to impact this sector of the securities finance markets. Please read our recent piece on how this is already having an impact upon US T Bills.

Corporate Bonds

It was reported during the month that corporate bonds are now being cut to junk at their fastest rate since 2020 and that during Q1 of 2023, $11.4B of bonds were downgraded to high yield. This may be whetting the appetite of short sellers as corporate bonds continue to generate impressive returns for lenders.

Over the month of April $100M of revenues were generated by the asset class and average fees maintained a very respectable 45bps. Despite the impressive returns generated during 2022, the asset class continues to improve when compared YoY. Uncertainty regarding future interest rate moves, along with the impact of one of the quickest and steepest tightening cycles in history continue to produce opportunities for investors.

Across the western hemisphere, the impact of a sharp increase in interest rates has placed commercial real estate companies in the spotlight along with retail and finance company bonds. Non-investment grade and private placement bonds continue to generate the strongest revenues.

Conclusion

April proved to be another strong month for securities finance markets. Ongoing seasonal activity in Europe and a strong specials market in the US continued to push revenues for lenders ever higher. In the fixed income markets, continued volatility produced opportunities for borrowers. A slowdown in the interest rate hiking cycle, further pressures in the financial sector in the US and additional risks posed by the fast-approaching US debt ceiling will continue to produce volatile markets going forward. As seen previously, these conditions are very likely to produce an advantageous market environment for securities lenders. All market participants will therefore be looking towards May with cautious optimism.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-snapshot-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-snapshot-2023.html&text=Securities+Finance+April+Snapshot+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-snapshot-2023.html","enabled":true},{"name":"email","url":"?subject=Securities Finance April Snapshot 2023 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-snapshot-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+April+Snapshot+2023+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-april-snapshot-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}