Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Mar 05, 2024

Securities Finance February Snapshot 2024

February revenues continue on a downward trend

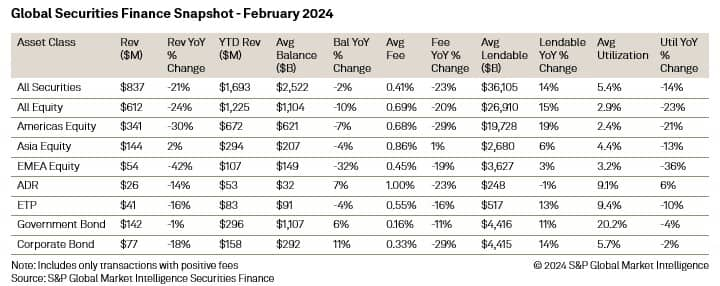

- Monthly revenues decline by 21% YoY to $837M

- Asia Equity revenues increase 2% YoY

- Fixed income assets continue to experience a decline in fees

- Lendable value surges as equity markets touch all-time highs

Pockets of improvement start to appear but lower average fees, despite a general increase in balances, impact monthly revenues.

The month of February started once again with central bankers warning markets that March would be too early to start cutting rates. At the conclusion of the Feds meeting on January 30th, Fed Chair Jerome Powell stated that "Based on the meeting today, I would tell you that I don't think it's likely that the committee will reach a level of confidence by the time of the March meeting." This uniform message was also shared by policymakers from the European Central Bank and the Bank of England, who also stated that the first quarter timing that markets had previously priced in was far too soon. Despite ECB President Christine Lagarde mentioning summer as the potential timing for the first rate cut, markets simply moved their expectations to April and rolled their bets on any Fed move to the next FOMC meeting which is currently scheduled for May. In relation to the Bank of England, traders remained cautious as continued signs of inflationary pressures remain across the UK economy, moving their expectations to June.

The soft-landing narrative continued to dominate during the month with the most compelling signs being seen across the US where a sustained decline in inflation continued as both the economy and labor market remained resilient. Despite this, a desire for greater confidence that inflation continues to fall was a common remark by central bankers. Concerns of supply chain issues as a result of conflict in the Red sea and increased shipping costs as a result, remains firmly on policy makers radars and continues to cast a shadow over the possibility of imminent rate cuts.

In the equity markets the S&P 500 continued to hit record highs, surpassing the 5000 mark, following strong earnings and a blowout January employment report which boosted confidence in the US economy. Global shares also hit their highest levels in over a year as the MSCI All-World index reached its highest level since mid-January 2023. This move higher was supported by both strong earnings in the US and a rally in Chinese blue-chip stocks as regulators announced further curbs on short selling and state investors expanded their stock buying programs. In Japan, the Nikkei 225 also hit its highest level since 1989 as solid valuations and buybacks continued to boost confidence that growth across the country was sustainable. In Canada the TSX also closed at a 22-month high buoyed by gains in technology and healthcare stocks.

Despite the strong moves seen across equity markets, a degree of bank angst returned to markets following sharp declines in the share prices of New York Community Bancorp (NYCB), Japan's Aozora Bank (8304) and Germany's Deutsche Pfandbriefbank (PBB) as concerns continued to grow regarding their exposure to US commercial real estate. Rising interest rates continue to make loan repayments challenging and the risk of further write downs on commercial property valuations remain a strong possibility.

Across Asia, China continued to dominate the headlines given the continued sell off across the country's equity markets. Equity valuations experienced volatility throughout the month as the country's state team reportedly intervened in markets through the buying of ETFs in an attempt to add a floor to prices. China's regulator repeated its pledge to stabilize markets but failed to offer any specific details. The regulator did step up its efforts to curb short selling as a result. On top of falling stock prices and on-going problems within the country's property sector, former President Donald Trump also said in an interview that he might impose a tariff greater than 60% on Chinese goods if re-elected.

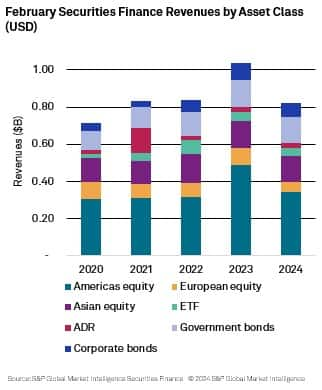

In the securities lending markets, the downward trend in revenues continued. Record equity market valuations seen during the month squeezed utilization lower and reduced average fees YoY.

In the equity markets, securities lending revenues declined by 24% YoY with the largest declines in revenues, once again, being seen across European equities ($54M -42% YoY). Many markets within the region continued to witness double digit YoY declines in revenues with large YoY declines also seen across average fees. Across Americas equities, YoY revenues declined by 30% to $341M. Canada offered a glimmer of hope in the region, however, with YoY revenues increasing by 18% and average fees increasing by an impressive 31% YoY. Average fees across the country increased to 86bps. APAC equity revenues also increased YoY during February (+2%, $144M) as Japan and Taiwan continued to push monthly returns higher.

Despite a decline in revenues across global equities, average fees have started to increase when compared MoM, reaching 69bps during February following an average of 66bps during January and 68bps during December. When compared MoM balances also increased 2.8%. An increase in both average fees and on loan balances, if sustained, should start to feed through to the revenue numbers in the coming months. Average daily revenues have been reflecting this improvement over the month increasing from circa $20M on February 1st to $24.5M on February 29th.

Looking across ETFs, despite a 16% YoY decline in revenues, when compared MoM, revenues fell by a more modest 5%. Average fees also declined over the month to 55bps (down from 59bps during January) which offset potential revenues from the $6.5B increase in on loan balances.

In the fixed income markets revenues declined YoY across both government and corporate bonds. Both asset classes continued to experience a steady decline in average fees whilst increasing on loan balances. Government bond revenues fell to their lowest monthly total since November ($140.3M) as average fees remained flat on those seen during January. Corporate bond average fees continued their decline, reaching their lowest level for many months (33bps). Balances increased by $14.5B during February however which increased utilization from 5.42% during January to 5.73% during February.

Whilst some pockets of improvement can be found in specific markets, this month's securities lending revenues, as can be seen by the graph above, remain low in comparison to previous years (lowest since 2020). As with previous months, the concentration of revenues can be found across government bonds, corporate bonds, and Americas equities. As suggested in previous editions, the lack of conviction surrounding moves in interest rates and the increase in equity market valuations across the globe continues to impact borrowing demand. It appears that the US economy may not as fragile as initially thought leading to speculation that interest rates in the US may stay higher for longer. Whilst this uncertainty is not currently translating into market volatility, it is translating into positive momentum for asset valuations which is reducing price dispersion and borrowing opportunities.

SAVE THE DATE

The S&P Global Market Intelligence Securities Finance Forum will once again be taking place in London on the 16th May at One Moorgate Place EC2R 6EA. The forum will consist of an afternoon of discussion and insights from market experts, guided by the Securities Finance team. An official "save the date" will be sent in the coming weeks but we are looking forward to hosting an afternoon of lively discussion and topical debate with our clients, friends, and partners.

If you would like to attend the forum, you can do so by registering HERE.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2024.html&text=Securities+Finance+February+Snapshot+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2024.html","enabled":true},{"name":"email","url":"?subject=Securities Finance February Snapshot 2024 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Securities+Finance+February+Snapshot+2024+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsecurities-finance-february-snapshot-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}