Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 01, 2023

Sourcing shift from China pulls US import share to more than a decade low

Efforts by U.S. importers to reduce their reliance on China to mitigate the risks of pandemic-driven disruption and rising geopolitical tensions are finally showing up in containerized trade flow, reaccelerating a decades-long bleed of production out of the so-called world's factory.

China, including Hong Kong, still dominates the sourcing landscape, supplying 40.7 percent of U.S. imports last year. But that market share was down from 42.4 percent in 2021 and was nearly as low as in 2006, when the share was just 0.1 percentage point higher, according to data from PIERS, a sister product of the Journal of Commerce within S&P Global.

"Our sourcing and production base remains open and is operating with greater diversification, stemming from a concerted effort to move production closer to consumption where it makes sense," Matt Puckett, CFO of apparel conglomerate VF Corporation, told investors in early January. "We are still feeling the effects from the eight weeks of large-scale lockdowns in China during the first quarter as the impacts work through the system."

Clothing importers such as VF Corporation, along with shippers of furniture, home goods, electronics, toys, and athletic equipment, are driving the shift out of China, according to the PIERS analysis. Chinese-made goods accounted for 35.1 percent of U.S. imports of apparel and accessories in 2022, down from 37.1 percent in 2021 and a peak of 44.2 percent in 2018. China's share of couches, lamps, and other furniture and home goods coming into the U.S. shrank to 52.6 percent last year from 55 percent in 2021; in 2010, that number was 71.6 percent.

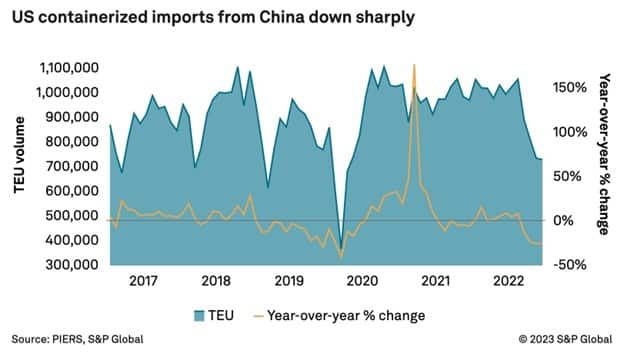

While total U.S. containerized imports ticked up 0.3 percent last year, overall shipments from China fell 3.7 percent. That's about 435,500 fewer TEU moving off Chinese docks to US ports.

'Balancing' act

In terms of containerized ocean trade, the decline in sourcing out of China has most favored Vietnam, followed by South Korea and India. Vietnam, the second-largest source of U.S. containerized imports, saw its share rise from 8.2 percent to 8.7 percent last year, thanks to increased sourcing of electronics, footwear, and apparel. South Korea's electronics and auto parts industries benefited from increased U.S. sourcing, expanding the country's share of total U.S. imports to 4.1 percent in 2022 from 3.8 percent the previous year. The share of U.S. imports from India inched up to 3.9 percent last year from 3.8 percent in 2021, driven by increases in apparel and iron and steel components.

Although it's not captured in the PIERS analysis because much of the volume does not move by container ship, anecdotal evidence, coupled with strong reported trade growth, suggests Mexico has also benefited from increased sourcing of U.S. goods and components. The total value of U.S. imports from Mexico via truck, rail, ocean, and air jumped 19.2 percent year over year to $418.9 billion in the first 11 months of 2022, according to the latest available data from the U.S. Bureau of Transportation Statistics.

"We've spoken a lot about balancing between China sourcing and the rest of the world sourcing, including in the Americas and especially, Mexico, which leads to near-shoring for the U.S. and Canadian market and even the Latin American markets," Julien Miniberg, CEO of Helen of Troy, said during the company's fiscal third-quarter earnings call in early January.

Sourcing from Mexico and, to a lesser degree, other Latin American countries, has cut lead times for Helen of Troy, an importer of housewares and health and beauty products, allowing it to keep inventories lower and reducing its exposure to volatile ocean freight prices, Miniberg said.

Cross-border trucking rates rise and fall on seasonal demand, but those fluctuations pale in comparison to the rollercoaster ride container spot rates have been on for the past two-plus years. Average Asia-U.S. West Coast rates, for example, rocketed from $1,400 per FEU prior to the COVID-19 pandemic to as high as $14,000 per FEU, and then back down again. Excluding Mexico, Honduras was the only Latin American country last year to increase its share of U.S. sourcing, accounting for 0.8 percent of total imports, up from 0.7 percent, according to PIERS.

Who has capacity to handle new volumes?

With importers acting on their desire to shift some sourcing out of China — as opposed to just "looking at options" — the question becomes exactly where the volumes currently produced in China can go. The sheer size of China's market share means minor shifts equate to hundreds of thousands of TEU, but Vietnam and India are hardly brimming over with the kind of high-quality manufacturing capacity China is known for, and their ports and inland infrastructure have neither the scale nor the resilience of the Chinese export shipping system.

From a pure procurement standpoint, Vietnam, India, and other alternatives to China stand to see rising labor wages, as new factory entrants try to lure workers away. They also lack China's established industrial clusters, which offer the convenience of having components located just a truck haul away, rather than an ocean journey.

Procon Pacific is looking at sourcing more industrial packaging supplies out of Southeast Asia and possibly in Nigeria, Ethiopia, and Turkey. But Daniel Krassenstein, global supply chain director hasn't ruled out tapping Chinese vendors more, either.

"Some of the large Chinese vendors have reduced their capacity, partly because of COVID and partly because of demand going down," Krassenstein told the Journal of Commerce. "But the Chinese vendors are still large players that can handle our volume, and they can scale up without difficulty, as long as (free on board] costs are in line."

JOC analyst Cathy Roberson contributed to this report

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Subscribe to our monthly Maritime, Trade & Supply Chain newsletter.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsourcing-shift-from-china-pulls-us-import-share-to-more-than-a.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsourcing-shift-from-china-pulls-us-import-share-to-more-than-a.html&text=Sourcing+shift+from+China+pulls+US+import+share+to+more+than+a+decade+low+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsourcing-shift-from-china-pulls-us-import-share-to-more-than-a.html","enabled":true},{"name":"email","url":"?subject=Sourcing shift from China pulls US import share to more than a decade low | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsourcing-shift-from-china-pulls-us-import-share-to-more-than-a.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Sourcing+shift+from+China+pulls+US+import+share+to+more+than+a+decade+low+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fsourcing-shift-from-china-pulls-us-import-share-to-more-than-a.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}