Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 08, 2023

Streamlining Sustainability Reporting Through Effective Data Management

Regulatory authorities in different jurisdictions are developing disclosure requirements to increase transparency in relation to sustainability claims and prevent greenwashing. In Europe, this includes the requirements of the Taskforce on Climate-Related Financial Disclosures (TCFD), the Sustainable Finance Disclosure Regulation (SFDR), Corporate Sustainability Reporting Directive (CSRD) and EU Taxonomy, which are intended to enhance transparency, standardize reporting, and promote sustainable investments, while also supplying a clear framework for businesses and investors to integrate sustainability considerations into their decision-making. Regulators in other regions, including the SEC in the US and MAS in Singapore, are also developing or implementing similar measures.

Compliance with these requirements and standards presents a variety of challenges. In many cases, firms do not currently capture the required data. For example, they may not have complete sustainability data for all their liquid investments. This problem is magnified for investments in alternative asset classes, for which access to good-quality data can be even more challenging. When data is available, it is often siloed, kept in different formats, and varying in quality. The large volumes involved (spanning thousands of fields per investment) can make manual processes untenable.

During a recent webinar, specialists from across S&P Global provided an update on the evolving regulatory landscape and shared insights into the approaches market participants are adopting to operationalize their regulatory reporting. The panel explained how we are helping firms streamline their compliance by combining our Sustainable1 datasets (including ESG and climate data at both the entity and asset level) with our data management software capabilities and professional services. This includes helping our clients create centralized hubs of standardized, validated data for their reporting, which draw on our Sustainable1 data as well as data from third parties and proprietary sources.

Data and Operational Challenges

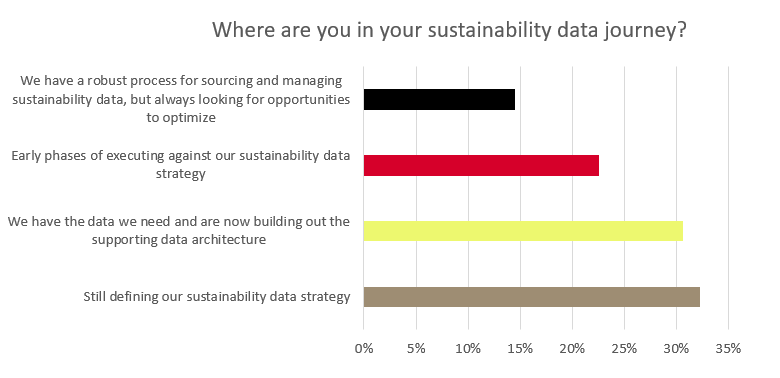

The webinar highlighted that many firms are still in the early stages of addressing sustainability reporting requirements (a live poll showed that almost one third are still defining their sustainability data strategy and only 15% have a robust process in place today for sourcing and managing their sustainability data). As they progress, they are encountering a range of data and operational challenges including:

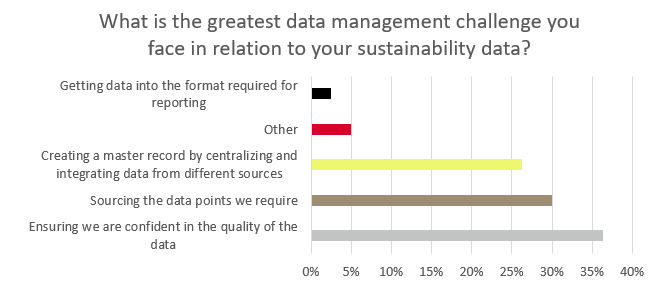

1. Data Collection and Management: One of the main challenges is the collection, management, and quality assurance of relevant sustainability data. This was underlined in another poll of webinar attendees, which found that sourcing the required data points is the greatest challenge for 30% of firms, while 36% cited a lack of confidence in the quality of their data as the biggest issue.

2. Data Classification and Reporting: Another challenge is the classification and reporting of sustainability data in accordance with the specific requirements of each framework. Firms can face difficulties determining which data is relevant, material, and reliable, and how to effectively classify and disclose it in compliance with the guidelines. This requires robust internal processes, data mapping, and alignment with reporting standards.

3. Data Integration and Systems: Many firms may also encounter challenges integrating sustainability data into their existing systems and processes. This may involve incorporating data into risk management, investment decision-making, and reporting systems, as well as ensuring data consistency across different departments and functions within the organization.

4. Lack of Standardization: The absence of consistent standards and frameworks for sustainability reporting creates challenges for firms trying to comply with multiple requirements, such as SFDR and CSRD, and other regional or industry-specific mandates. This can lead to duplicative work.

5. Resource Constraints: Sustainability reporting frameworks have the potential to increase pressure on data and ops resources, particularly if firms attempt to rely on manual processes to support their compliance. However, there are many opportunities to relieve this pressure by automating what is a data-intensive process.

6. Evolving Regulatory Landscape: The regulatory landscape for sustainability reporting is constantly evolving, with new requirements, guidelines, and standards being introduced or revised over time. As a result, firms are beginning to think strategically about not only addressing the latest requirements, but also preparing the infrastructure to respond to future regulations in the space.

We are helping financial firms overcome these challenges by bringing together our industry-leading domain expertise, in-depth sustainability data, software and services in a modular, end-to-end solution for sustainability regulatory reporting. By the combining the breadth and depth of our Sustainable1 datasets with the capabilities of our EDM data management platform, we are helping firms address the challenges highlighted during the webinar, while preparing for a future in which sustainability continues to be a major focus in the industry. Learn more here

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstreamlining-sustainability-reporting-through-effective-data-m.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstreamlining-sustainability-reporting-through-effective-data-m.html&text=Streamlining+Sustainability+Reporting+Through+Effective+Data+Management+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstreamlining-sustainability-reporting-through-effective-data-m.html","enabled":true},{"name":"email","url":"?subject=Streamlining Sustainability Reporting Through Effective Data Management | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstreamlining-sustainability-reporting-through-effective-data-m.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Streamlining+Sustainability+Reporting+Through+Effective+Data+Management+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fstreamlining-sustainability-reporting-through-effective-data-m.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}