Strong dividend growth in Singapore amid uncertainty

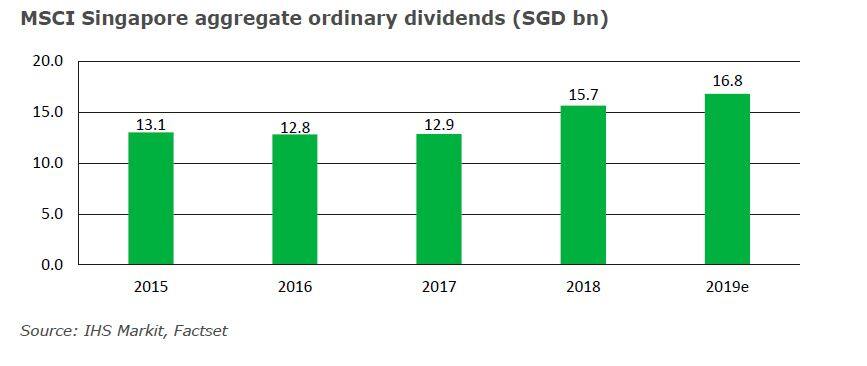

• Constituents in MSCI Singapore set to pay SGD 16.8bn in

ordinary dividends for 2019, up 7.4% on 2018

• Banks drive dividends in Singapore, offset by lower payouts from

Financial Services, Media and Travel & Leisure sectors

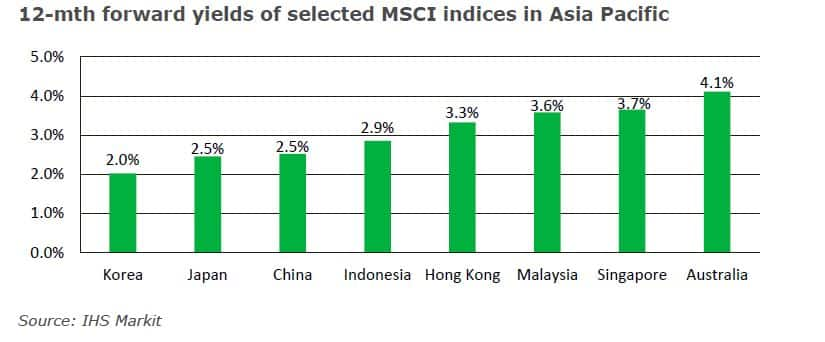

• MSCI Singapore trades at a dividend yield of 3.6%, ranked second

among indices within the Asia Pacific region

Against a backdrop of uncertainty stemming from global trade

tensions, authorities in Singapore downgraded their forecast for

economic growth to a range between 1.5% to 2.5%. The modest outlook

is in line with the latest PMI reading, which showed a contraction

in Singapore's manufacturing industry for the second consecutive

month. The dividend outlook however, illustrates a contrasting

picture as we are projecting ordinary dividends from MSCI Singapore

companies to grow for the third consecutive year to SGD 16.8bn in

2019. Including special payouts, we are expecting total dividends

to come in at SGD 17.3bn.  Banks, telecommunications and

property-related companies anchor dividends from MSCI Singapore,

accounting for almost three-quarters of the payouts from the

25-member index. The estimated 7.4% jump in ordinary dividends is

primarily attributed to our bullish forecasts on the payouts from

banks, although we are seeing muted dividend growth from the second

and third largest dividend paying sectors.

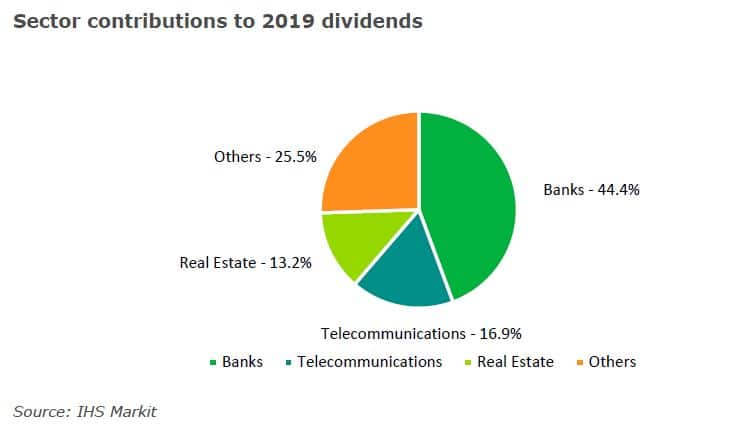

Banks, telecommunications and

property-related companies anchor dividends from MSCI Singapore,

accounting for almost three-quarters of the payouts from the

25-member index. The estimated 7.4% jump in ordinary dividends is

primarily attributed to our bullish forecasts on the payouts from

banks, although we are seeing muted dividend growth from the second

and third largest dividend paying sectors.  Banks continue to drive dividend

growth

Banks continue to drive dividend

growth

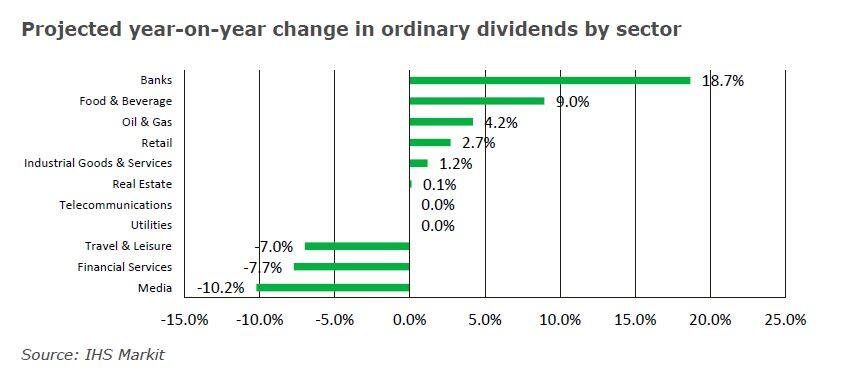

Singapore's dividend trajectory is heavily influenced by the big three Singapore banks as these lenders contribute 44.4% of payouts from MSCI Singapore. On the back of strong fundamentals and a positive earnings outlook, ordinary dividends from DBS Group Holdings (DBS), United Overseas Bank (UOB) and Oversea-Chinese Banking Corporation (OCBC) are projected to reach a multiyear high of SGD 7.5bn, which translates to a year-on-year increase of 18.7%. Total dividends will however, fall by 1.4% due to the absence of a SGD 1.3bn one-off special dividend, announced by DBS in February last year.

Dividends from property developers are stable; Real Estate Investment Trusts (REITs) outlook is positive

Dividends from property developers account for around 32.5% of the sector dividends in 2019. Distributions from Capitaland Limited (Capitaland), City Developments Limited (City Developments) and UOL Group Limited (UOL) were either flat or higher in recent years. This underscores their intention to pay dividends on a sustainable basis and is supported by their high level of recurring income. For 2019, we are forecasting ordinary dividends from these three property developers to amount to SGD 721m or SGD 829.9m if we were to include the regular special dividends from City Developments.

We are forecasting distributions from REITs to amount to SGD 1.5bn this year, translating to a year-on-year increase of 0.5%. The modest growth is mostly due to the decline in distribution from Capitaland Mall Trust (CMT), attributed to an advanced distribution announced in October last year.

Distributions from Telecommunication sector subdued

The telecommunication sector is represented by Singapore

Telecommunications (Singtel) and accounts for 16.9% of aggregate

dividends. We are expecting Singtel to keep its ordinary dividends

flat for the fifth consecutive year and are forecasting the company

to pay SGD 2.5bn in dividends this year. This is consistent with

guidance from the company, which states Singtel will maintain its

dividends at SGD 0.175 per share till FY20.  Dividend cuts from three sectors

- Financial Services, Media and Travel & Leisure

Dividend cuts from three sectors

- Financial Services, Media and Travel & Leisure

The Financial Services sector is represented by Singapore Exchange and we are projecting dividends to fall by 7.7% to SGD 321m. This is however due to the split pattern of its dividends and not a reflection of any deteriorating fundamentals.

The media sector is represented by Singapore Press Holdings (SPH); we are expecting total dividends to come in at SGD 161.5m in 2019, reflecting our expectation that dividends will fall for the sixth consecutive year.

Dividends from the Travel & Leisure sector have been erratic, due to the volatility in Singapore Airlines (SIA)'s distributions. Elsewhere, both ComfortDelgro Corporation and Genting Singapore Limited have a history of growing its dividends steadily and we expect this practice to continue going forward. We are pencilling in a 0.9% increase in dividends from these two companies to SGD 652.6m in 2019

How does MSCI Singapore perform against other indices?

MSCI Singapore trades at a dividend yield of 3.7% and is ranked second among indices around the region. MSCI Australia generates the highest yield at 4.1% and this suggests that on average, companies in these two countries are more generous when it comes to rewarding shareholders.

To access the report, please

contact dividendsupport@ihsmarkit.com

To access the report, please

contact dividendsupport@ihsmarkit.com

Chong Jun Wong, CFA, Senior Research Analyst at IHS Markit

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.