Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 10, 2023

Taiwan economy hit by slump in exports

Taiwan's export-driven economy has been hit by slumping exports, resulting in GDP contracting by 0.9% year-on-year (y/y) in the fourth quarter of 2022. A key factor driving the export slowdown has been weak demand from mainland China, due to the impact of COVID-19 restrictions during 2022. With the US and European Union (EU) also forecast to experience weak growth in 2023, Taiwan's economic outlook is for some moderation in the pace of economic growth in the near-term.

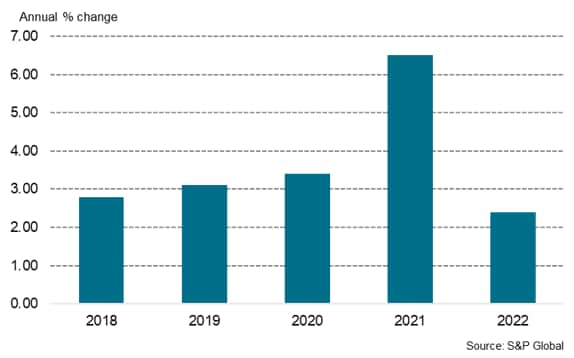

Taiwan economy moderated in 2022

After very rapid growth at a pace of 6.5% y/y in calendar year 2021, Taiwan's GDP growth rate moderated to an annual pace of 2.4% y/y in calendar year 2022. The strong growth rate recorded in 2021 was the fastest pace of annual economic growth since 2010, boosted by export growth of 29% y/y, with exports of semiconductors up by 27% y/y.

A key factor driving the moderation in growth momentum in 2022 was the intensifying slowdown in the global electronics industry during the second half of 2022. Taiwan's real GDP contracted by 0.9% y/y in the fourth quarter of 2022 and fell sharply by 4.2% quarter-on-quarter (q/q) measured on a seasonally adjusted annualized rate. Real exports of goods and services fell by 5.1% y/y in the fourth quarter, although private final consumption remained resilient, rising by 2.9% y/y.

Taiwan GDP growth rate

Weakening growth momentum in mainland China due to COVID-19 related restrictions increasingly impacted on Taiwan's exports during the second half of 2022, with new export orders from mainland China and Hong Kong SAR down 37.7% y/y in December. This was a key factor driving the 23.2% y/y decline in Taiwan's total export orders in December.

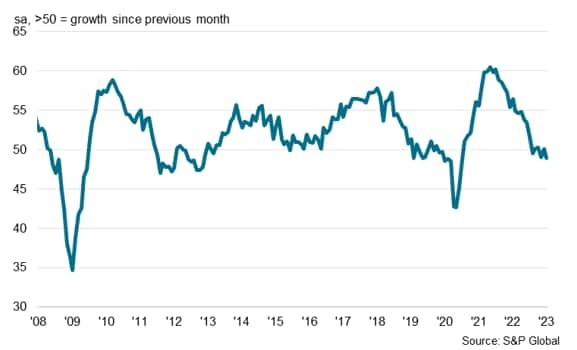

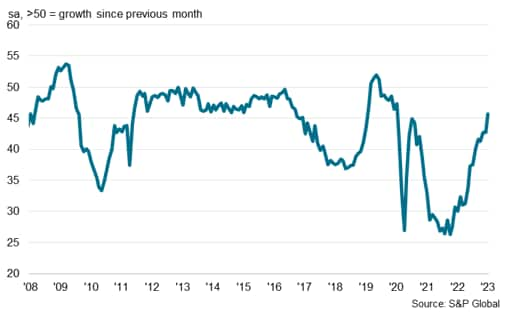

The S&P Global Taiwan Manufacturing Purchasing Managers' Index (PMI) edged down from 44.6 in December to 44.3 in January, to signal continued contractionary business conditions for the eighth consecutive month. The pace of contraction was among the steepest seen since the survey began nearly two decades ago.

Firms signalled further substantial declines in both output and new business amid reports of weaker global demand conditions. Moreover, the downturn in new export orders quickened in January, with firms noting that high inventory levels at some clients and weak global economic conditions had weighed on sales. This led companies to cut back on their purchasing activity and inventories again at the start of 2023. When assessing the 12-month business outlook, manufacturers generally anticipate output to decline further.

S&P Global Taiwan Manufacturing PMI

Strong exports had been a key driver of Taiwan's rapid economic growth during 2021 and the first half of 2022. However, export growth slowed in the second half of 2022. In December 2022, the value of Taiwan's exports fell by 12.1% y/y, following a 13.1% y/y contraction in November. Exports to mainland China and Hong Kong SAR fell by 16.4% y/y in December due to weak economic growth in mainland China as a result of ongoing COVID-19 restrictions. Mainland China is Taiwan's largest export market, accounting for 28% of Taiwan's total exports, while Hong Kong SAR accounts for a further 14% of Taiwan's total exports.

Subdued demand conditions and a lack of new work to replace current orders enabled firms to reduce their levels of unfinished business in January. The rate of backlog depletion was considerable and quicker than that seen in December.

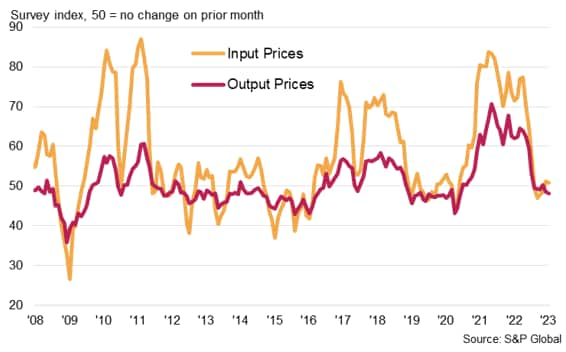

Manufacturing input price pressures were also relatively muted at the start of the year. Average input costs rose only slightly, linked to higher prices for some raw materials. Meanwhile, goods producers cut their selling prices for the second month in a row as a result of customer requests and efforts to pass on any cost savings to clients.

Taiwan Manufacturing PMI input and output prices

Taiwan's CPI inflation rate rose by 2.7% y/y in December, while core CPI excluding energy and food rose by 2.7% y/y, slightly lower than the 2.9% y/y pace in November. Taiwan's central bank has acted pre-emptively with a series of modest tightening steps in 2022 to contain inflation pressures. The central bank increased its benchmark rate by 12.5 basis points on December 15th, to 1.75%, following a 12.5bp hike on September 23rd, a 12.5 bp increase in June and 25bp hike at its March monetary board meeting.

The March 2022 tightening step had been the first rate hike since June 2011, with the previous most recent change to policy rates having been a rate cut in March 2020 in response to the global COVID-19 pandemic.

Global headwinds facing electronics industry

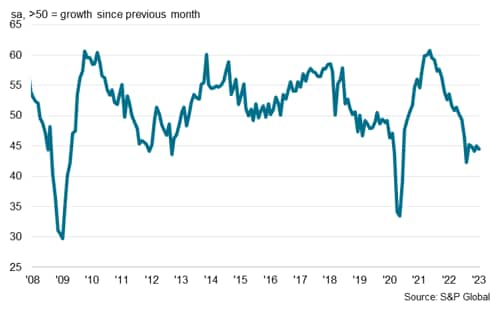

The headline seasonally adjusted S&P Global Electronics PMI has slowed significantly since mid-2021, although the headline figure for December 2022 was at 50.4, up from 49.1 in November. This signalled a marginal improvement in operating conditions across the global electronics manufacturing sector at the end of 2022.

S&P Global Electronics PMI

However, the two principal sub-components of the Global Electronics PMI - new orders and output - both remained in contraction territory during December. Global electronics production continued to contract at the end of 2022, thereby extending the current sequence of decline to six months. The fall in output was only marginal, however, and the slowest since July.

Weakening economic growth momentum in the US and EU has impacted on consumer demand for electronics, with the economic slowdown in mainland China during late 2022 also contributing to the downturn in new orders.

Overall, total new export orders for Taiwan's consumer electronics products fell by 20.9% y/y in December, while orders for information and communications products fell by 21.4% y/y.

S&P Global Electronics PMI output

S&P Global Electronics PMI new orders

Global electronics producers continued to show significant delays in suppliers' delivery times in December. However, the extent of delays has diminished in recent months as electronics demand has cooled. Where longer lead times were reported, global electronics firms often mentioned the lingering impacts of COVID-19, input shortages among suppliers and shipping delays.

December data indicated a further marked deterioration in vendor performance across electronics manufacturing. Delays to input deliveries were commonly linked to logistics issues, material shortages including semiconductors, and COVID-19 lockdowns in mainland China.

S&P Global Electronics suppliers' delivery times

Economic outlook

After rapid economic growth in 2021 and continued albeit moderating expansion in 2022, Taiwan's economic growth rate is expected to moderate further in 2023. A key factor is expected to be soft export growth momentum to the key US and EU markets, due to the economic slowdown underway in both export markets. However, this is expected to be mitigated by improving exports to mainland China, as economic growth gradually strengthens during 2023 due to the easing of COVID-19 restrictions.

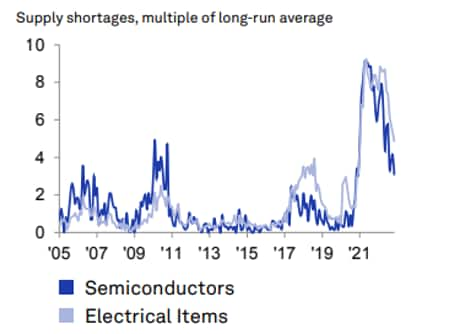

The slowdown in the global electronics industry has been a key factor impacting on Taiwan's industrial economy during the second half of 2022 and early 2023 due to its importance in overall industrial production and exports. Global industry supply shortages for the semiconductors and electrical product industries have moderated in recent months, but still remain above their long-run average, although these shortages have continued to ease in recent months.

Global Electrical and Electronics Industry supply shortages

Taiwan's medium-term outlook remains for sustained positive expansion at a moderate pace, underpinned by global electronics demand. The impact of the COVID-19 pandemic has accelerated the pace of digital transformation due to the global shift to working remotely, which has boosted demand for electronic devices, such as computers, printers and mobile phones.

The medium-term outlook for electronics demand is underpinned by major technological developments, including 5G rollout over the next five years, which will drive demand for 5G mobile phones. Demand for industrial electronics is also expected to grow rapidly over the medium term, helped by Industry 4.0, as industrial automation and the Internet of Things boosts rapidly growth in demand for industrial electronics. Taiwan's electronics industry will continue to benefit from its leading role in production of advanced semiconductors as well as from its production of a wide range of other electronics products for consumer and industrial electronics.

Access the full press release here.

Rajiv Biswas, Asia Pacific Chief Economist, S&P Global Market Intelligence

Rajiv.biswas@spglobal.com

© 2023, S&P Global Inc. All rights reserved. Reproduction in

whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwan-economy-hit-by-slump-in-exports-Feb23.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwan-economy-hit-by-slump-in-exports-Feb23.html&text=Taiwan+economy+hit+by+slump+in+exports+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwan-economy-hit-by-slump-in-exports-Feb23.html","enabled":true},{"name":"email","url":"?subject=Taiwan economy hit by slump in exports | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwan-economy-hit-by-slump-in-exports-Feb23.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Taiwan+economy+hit+by+slump+in+exports+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftaiwan-economy-hit-by-slump-in-exports-Feb23.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}