Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 11, 2022

The obstacles to better analytics adoption in private equity

Private equity has made many achievements in putting data and technology to effective use in the investment management process. However, the industry has a long way to go, particularly in finding ways to use more sophisticated data analytics to get a competitive edge in deal sourcing.

Our recent survey of senior executives from US PE firms, conducted by Mergermarket on behalf of S&P Global Market Intelligence, revealed significant growing pains in technological and analytical sophistication at many firms.

In the current competitive deal environment, investment in the tools needed to spot new market trends may decide the winners. A growing interest in the power of data, with 83% of respondents saying the subject of "big data" has become more important at their firm over the past two years, points toward a shift in the search for profitable deals.

Advanced analytics have yet to be adopted in deal sourcing

Respondents confirm that data analytics are bearing fruit in selected phases of the investment lifecycle, particularly due diligence (40%) and buyer negotiations (37%). "Investments in data analytics significantly reduce the challenges of due diligence," reported one respondent. "Data checks are completed sooner and we can analyze the information much faster."

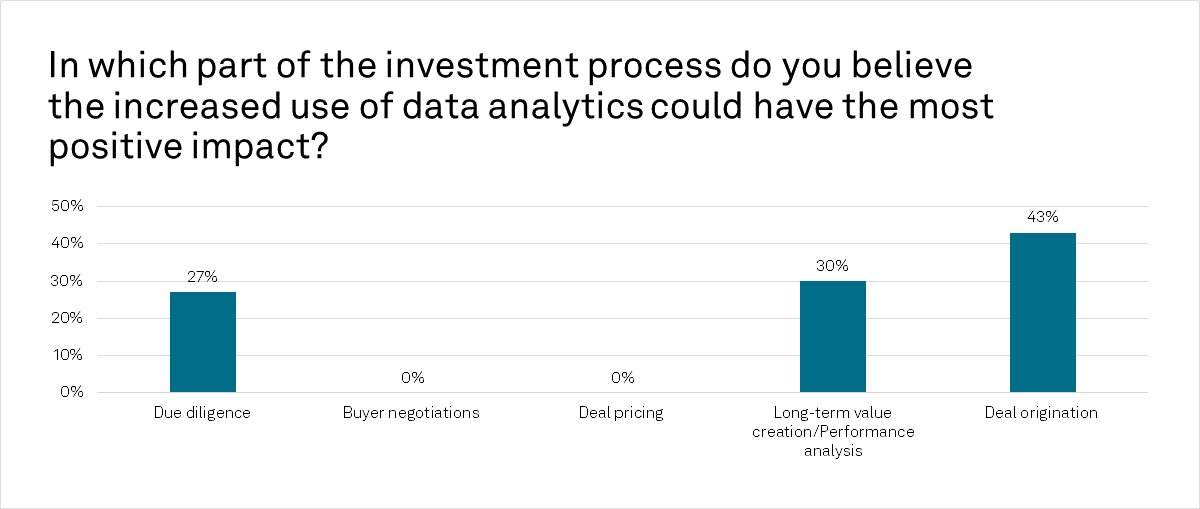

Progress has been much slower in extending new approaches into other areas of the investment process. Deal sourcing is a standout: although 43% of respondents said that better data analytics could bring the biggest benefit there, only 3% leverage it. Similarly, only 10% of respondents incorporate data analytics into deal pricing.

"We would be interested to see the use of data analytics applied more strongly to deal origination," says one respondent. "There are some challenges because of unsupported and unstructured data, but advanced methods can improve the deal origination process."

Variable quality and consistency of data hygiene makes like-for-like comparisons between target companies an imprecise science; accurate data is fleeting. "We cannot always get the kind of real-time information that we anticipate," explains one respondent. "Data tends to become stale very quickly because of fast market developments and internal changes in companies."

Organizational culture and resourcing slow progress

Internal obstacles make data analytics progress slow across the industry. For example, 30% of respondents cited insufficient collaboration between investment decision-makers and data scientists as the biggest roadblock to extracting value from available data sources.

At the same time, the culture of dealmaking is slow to change and PE deals are heavily relationship-based. The perception still hangs that scouting companies and conducting due diligence require human insights, rather than those derived from technology or automation.

Organizational inertia appears more often in firms with AUM over US $26bn, where 87% of respondents said problems with stakeholder buy-in are the greatest impediment. "The biggest hurdle is convincing decision-makers," says one respondent. "They rarely contemplate the long-term value of investing in new technology resources. They think more about the immediate expense."

At smaller firms, scarce resourcing is a bigger problem, with few staff dedicated to technology or analytics tools to support investment teams. With only one exception, respondents from firms with AUM between US$6bn-US$25bn reported they employ five or fewer people in these functions.

Preparing for a data-rich future

As the deal-impacting data available today becomes increasingly robust, dynamic, and time-sensitive, PE firms must continue to assess ways to put it to use effectively in order to maintain a competitive edge. Firms that manage to close the data gap and identify advanced tools for extracting key insights will differentiate themselves in tomorrow's market.

Download the whitepaper to read full results.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-obstacles-to-better-analytics-adoption-in-private-equity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-obstacles-to-better-analytics-adoption-in-private-equity.html&text=The+obstacles+to+better+analytics+adoption+in+private+equity+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-obstacles-to-better-analytics-adoption-in-private-equity.html","enabled":true},{"name":"email","url":"?subject=The obstacles to better analytics adoption in private equity | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-obstacles-to-better-analytics-adoption-in-private-equity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=The+obstacles+to+better+analytics+adoption+in+private+equity+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fthe-obstacles-to-better-analytics-adoption-in-private-equity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}