Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Mar 07, 2024

Trade downturn continues to ease in February

The following is an excerpt from the monthly S&P Global Monthly Global Trade Monitor, produced with GTAS Forecasting. Read the latest on Connect™ by S&P Global.

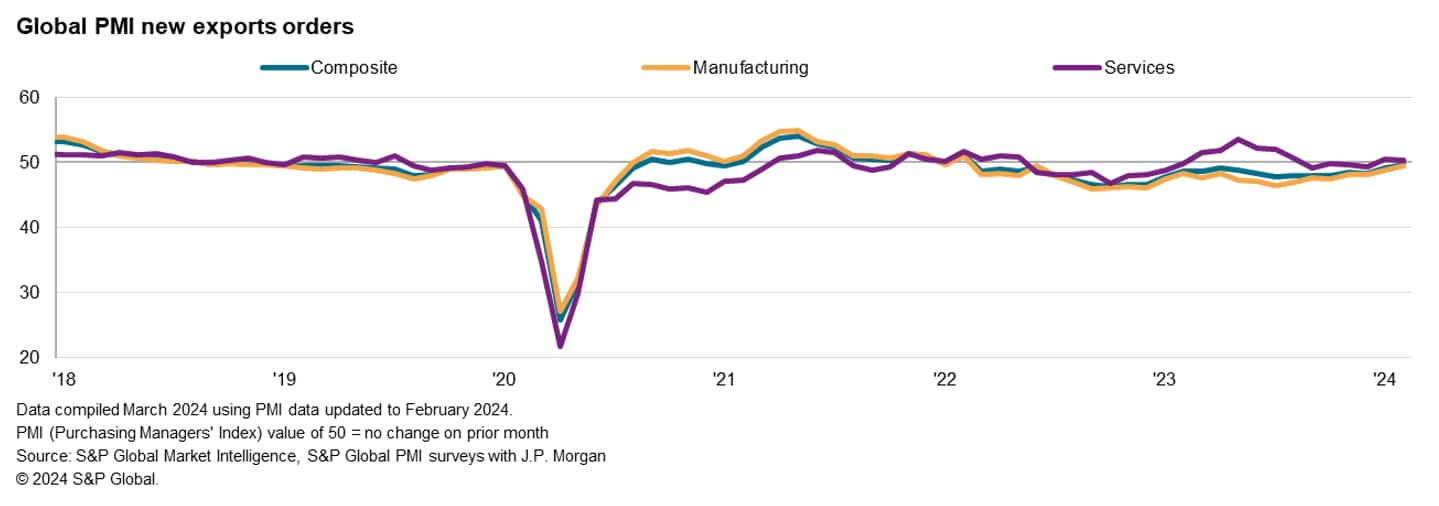

The worldwide Purchasing Managers' Index (PMI) surveys compiled by S&P Global Market Intelligence indicated a further deterioration of global trade in February, thereby extending the current sequence of decline to two years. That said, the rate of contraction eased for a second straight month to the weakest seen over this period. The seasonally adjusted PMI New Export Orders Index posted 49.6, up from 49.2 in January, rising slightly above the series average.

Manufacturing trade downturn slows while services exports rise again

The downturn in global trade remained centred on the manufacturing sector in February, albeit with the rate of decline moderating. In contrast, the exchange of services continued to expand, though at a slightly softer rate compared to January, thereby reflecting a greater convergence in conditions.

Manufacturing new export orders weakened again midway through the opening quarter of 2024, thereby stretching the current sequence of decline to two years. That said, the rate of contraction eased from January and was only marginal. Furthermore, the pace of reduction was the weakest seen since June 2022. This was accompanied by a renewed rise in overall goods demand in February; the first in 20 months. Looser financial conditions, reduced recession fears and robust labour markets were cited as reasons for the uptick in global demand, while manufacturing conditions also benefitted from signs that destocking activity among clients had subsided. Although Red Sea shipping disruptions continued to exert upward pressure on manufacturing prices, lead times for inputs did not lengthen further in February, thus showing only a modest impact on supply chains and prices so far.

By broad product category, consumer goods makers saw new export orders rise for the first time since April 2023. This also marked the third time that foreign demand for consumer goods had expanded in the past two years. Moreover, the pace of growth was the sharpest in nearly two-and-a-half years. Both intermediate and investment goods trade remained under pressure, however, but the former saw conditions deteriorate at a softer pace.

Meanwhile services trade improved for a second successive month, albeit with the pace of growth easing slightly from the start of the year. Overall, new business across the global service sector remained in steady growth territory in February. Prices have risen again in the service sector in February, however, to keep global cost inflation elevated and this will be worth watching moving forward.

More detailed sector data showed that any improvements in new export business were mostly limited to services sub-sectors, led by tourism & recreation. Although the household & personal use products sector saw renewed growth in export orders, and the beverage sector also recorded another expansion, the vast majority of manufacturing sub-sectors continued to see reduced export demand. The automobile & auto parts sector experienced the most pronounced fall in export orders during February.

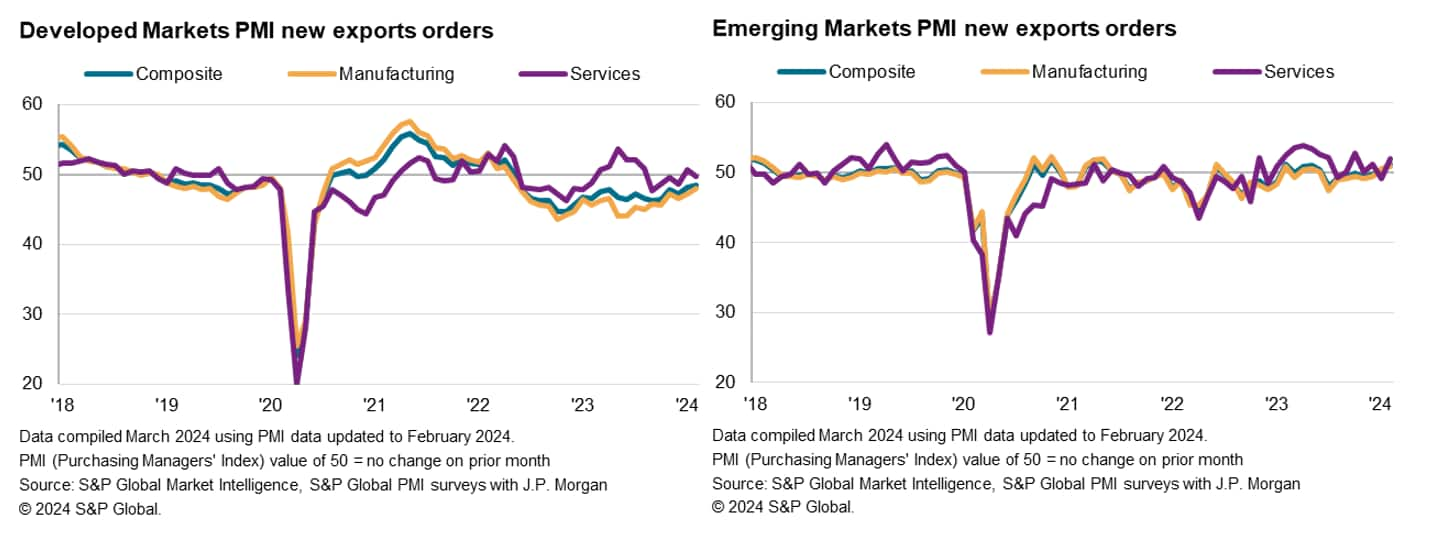

Developed and emerging market divergence

February's PMI data also showed that the divergence in export conditions between developed and emerging markets extended into February. While developed markets recorded a twenty-first monthly decline in trade activity, emerging markets trade expanded at the fastest rate in a year. The improvements in emerging markets was supported by broad-based growth in both manufacturing and services sector exports. In contrast, developed markets registered a sustained decline in manufacturing sector trade and a marginal fall in service sector exports.

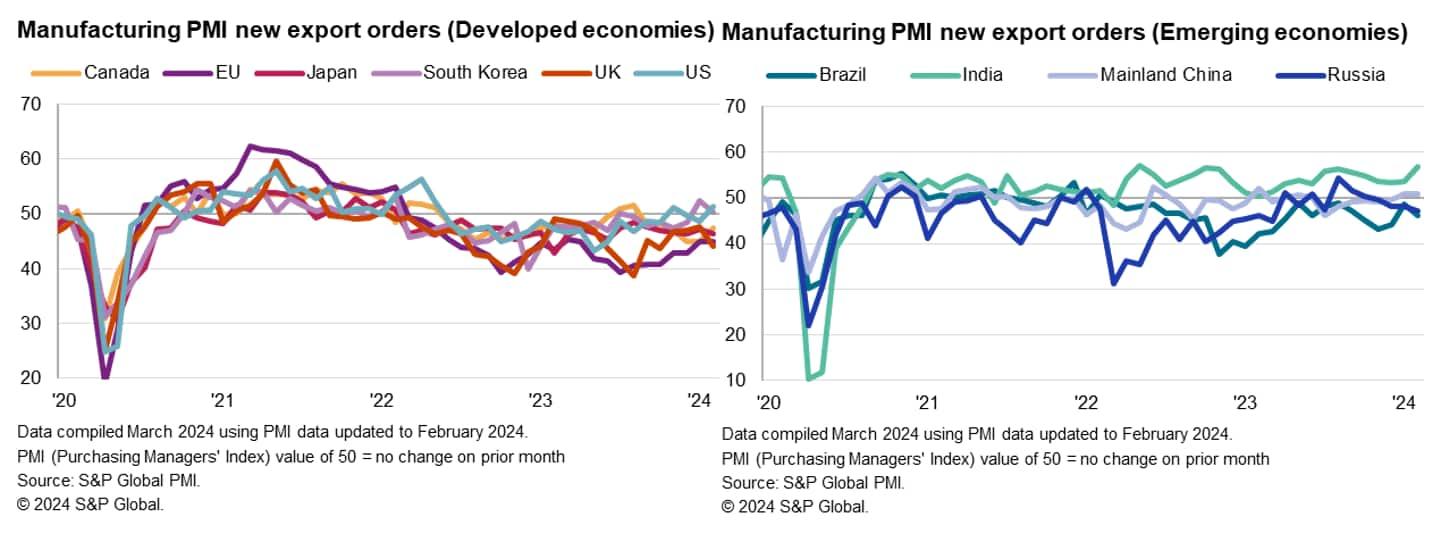

Most developed markets record lower trade, led by the eurozone

Measured across both goods and services, trade mainly improved in two APAC economies - India and mainland China. In comparison, most developed economies continued to see trade conditions weaken, though the US was an exception, recording a marginal improvement in February.

Stronger manufacturing conditions in the US was the key driver for the overall rise in new export orders in February, as new export business across the service sector declined. New export orders at US manufacturers rose for a second time in 21 months and at the fastest pace since May 2022. Anecdotal evidence suggested that greater confidence and the replenishment of inventories supported the latest rise in demand for US manufactured goods, with customers based in Europe and Canada reportedly placing more orders in February.

Meanwhile, Japan and the UK saw overall export orders remain in contraction territory. Although moderate, the rates of decline in both cases accelerated from January. On the other hand, the EU and Canada saw rates of reduction ease compared to the start of 2024. Despite being the worst performer, the rate at which new export business shrank across the EU was the slowest since April 2023, supported by softer declines at both manufacturers and service providers.

India remains the emerging market star performer, though mainland China also sees improved export performance

Turning to emerging markets, India remained the best performer in February, with new export business expanding at the steepest rate in six months. This was driven mainly by an improvement in the manufacturing sector, where export orders increased at a substantial pace that was the quickest since May 2022. Manufacturers in India suggested that demand strengthened across several countries and regions including Australia, Bangladesh, Brazil, Canada, mainland China, Europe, Indonesia, the US and UAE. External demand for services in India also rose solidly, though growth softened slightly from January.

Mainland China also recorded an upturn in overall new export business midway through the opening quarter, supported by firmer external demand for both goods and services. However, unlike India, services exports grew at a faster rate than that seen in the manufacturing sector, with service providers often citing better external demand conditions.

Finally, Russia and Brazil both saw new export orders weaken in February, with rates of decline accelerating from the prior survey period. Measured across both manufacturing and service sectors, Brazilian firms registered a steeper deterioration in trade conditions compared to that seen in Russia.

Access the Global PMI press release.

Jingyi Pan, Economics Associate Director, S&P Global Market Intelligence

jingyi.pan@spglobal.com

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-downturn-continues-to-ease-in-february-Mar24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-downturn-continues-to-ease-in-february-Mar24.html&text=Trade+downturn+continues+to+ease+in+February+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-downturn-continues-to-ease-in-february-Mar24.html","enabled":true},{"name":"email","url":"?subject=Trade downturn continues to ease in February | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-downturn-continues-to-ease-in-february-Mar24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trade+downturn+continues+to+ease+in+February+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrade-downturn-continues-to-ease-in-february-Mar24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}