Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 23, 2023

Trends in grains market during Russian-Ukrainian war

The Russia-Ukraine war has had a significant impact on European

countries. From the perspective of migration movements, Poland has

received about 1.5 million refugees from Ukraine. Heavily dependent

on Russian coal, gas, and oil, Europe is facing a major energy

crisis. Laboriously rebuilt supply chains after the COVID-19

pandemic have been broken again and must be reorganized. The

hostilities in Ukraine have also destabilized the global grain

market.

The agriculture market is a specific one as the supply in the

market for agricultural products is less flexible than in the case

of industrial goods. Manufacturers are unable to respond to large

changes in demand or prices, since the flexibility depends mainly

on natural factors such as climate, soil, and topography of the

region.

In connection with the above, there is monopolistic competition on

the grain market and the main producers can influence the price on

the world market through a properly conducted trade policy.

Currently, because of the Russian invasion of Ukraine, the supply

of grains in the world market has been limited, resulting in an

increase in the price, hence creating a new equilibrium. Shortage

of supply in this market results in food problems in Middle Eastern

and North and Sub-Saharan African countries. These problems may

lead to further migration movements.

It can be said that Eastern Europe was one of the leaders in grain

exports. As a result of the war, Ukraine is unable to start full

production because ports and warehouses were destroyed. Supply

chains by sea across the Black Sea have also been disrupted. In

addition, Russia has reduced grain exports to foreign markets.

Russia and Ukraine, apart from a significant share in the global

wheat market, are also known for the export of sunflower oil, corn,

and barley. These articles require properly prepared storage

conditions (which is associated with high costs) and the

organization of appropriate distribution. The impact of the war on

the grain market is presented below, especially considering the

role of Ukraine as the main producer.

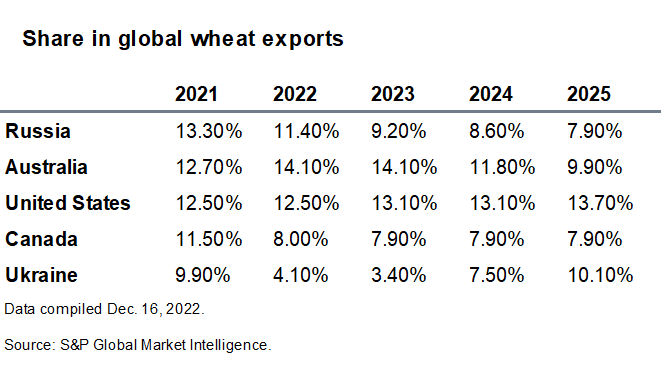

The grain market is one of the sectors hit the hardest by the

Russian invasion of Ukraine — the two countries together

accounted for 23.1% of global wheat exports in 2021. At the same

time, Australia and the United States account for 25.3% of global

wheat exports. Together these four countries account for half of

the world's exports. Our latest forecasts show that by 2025,

Russia's exports will decrease and reach 7.9% and this country will

lose its first ranking in the list of world exporters of wheat,

whereas Ukraine's share in global wheat exports will increase and

reach around 10.1%, placing it at the second place. This is of

course subject to change, depending on the time and course of the

ongoing conflict.

So far, part of the EU wheat production, mainly from France,

Germany, Romania, as well as Bulgaria and Poland, has been exported

to foreign markets, mainly to countries in Africa and the Middle

East. The exports of the above-mentioned countries accounted for

18.9% of world wheat exports in 2021. However, the domestic

shortage of other grains makes these countries less likely to

export as they need to satisfy the domestic market, and wheat can

be a very expensive supplement on the feed market. The main

recipients of Ukrainian wheat were Egypt, Indonesia, Turkey,

Morocco, and Pakistan, while Russia exported mainly to Turkey,

Egypt, Azerbaijan, Kazakhstan, and Nigeria.

Ukraine is the largest European corn exporter and the third in the

world after the United States and Argentina. In 2021, corn exports

from Ukraine accounted for 11.8% of world exports. It needs to be

highlighted here that unlike wheat, the European Union is a net

importer of maize, which is essential for feed production. Because

of supply chain disruptions, the European Union will have to import

maize from the United States, Argentina, and Brazil, which together

accounted for 66.4% of world exports in 2021. In general, until

2025 there will be not significant changes on that market.

According to the GTAS Forecasting current

assumptions, Ukraine should regain its position by that time, but

of course there is still a lot of uncertainty about the continuing

war and thus the forecast may be subject to change. The main

recipients of Ukrainian corn were mainland China, Spain, the

Netherlands, Egypt, and Iran in 2021.

Apart from corn and wheat that we already mentioned, we would also

like to focus on sunflower with its two main directions of

production: cultivation for seeds for direct consumption and oil

processing. The sunflower is the fourth-largest crop among

oilseeds. The seeds are used to produce food and fodder, while the

dried stems and oil can be used to produce biofuels.

Ukraine plays an important role when it comes to sunflower seeds,

rapeseed, and colza seeds. It is the main exporter in Europe and

the third in the world after Canada and Australia. Ukraine's share

in world exports was 11.4% in 2021. Currently, GTAS Forecasting estimation is

that the share of Ukraine exports of sunflower seeds, rapeseed, and

colza seeds would increase to 5.8% in 2024 from 4.9% in 2023. It

should also be noted that owing to Ukraine's geographical location,

it was an important exporter of this product to the Middle East and

European markets. In addition, numerous mills located in Ukraine

produced significant amounts of sunflower oil. The main buyers of

Ukrainian sunflower were Germany, Holland, Belgium, Pakistan, and

France.

In 2022, the European Union launched the "Solidarity Lanes"

initiative for Ukraine, which has allowed for exports of over 15

MMt of grains, oilseeds, and related products (60% of Ukrainian's

grain since the start of war). "Solidarity Lanes" is aimed at

promoting the export of agricultural products to enable connection

between European shippers and producers in Ukraine. The essence of

this plan is to support the transport capacity of rail/road/barge

vehicles.

According to the Ministry of Agrarian Policy and Food of Ukraine

statistics, the following grains were transported in 2022: corn,

sunflower seeds, soybean oil, sunflower oil, wheat, turnip, soy,

and barley by road (10.9% of total volume), by rail (21.0%), by

ferry/barge (0.6%), and by sea (67.5%).

In July 2022, Russia, Ukraine, and Turkey signed the Black Sea

Grain Initiative to establish a humanitarian maritime corridor to

allow export of grains and fertilizers through the Black Sea from

three key Ukrainian ports — Chornomorsk, Odesa, and

Yuzhny/Pivdennyi. According to S&P Global Market Intelligence

Commodities at Sea, total agricultural bulk export shipments from

Ukraine (on vessels above 10,000 DWT) the Black Sea safe passage

deal has allowed stood at around 10 MMt of grains and other

food.

According to the GTAS data, Ukrainian exports of grains (including

wheat and meslin; corn (maize); sunflower seeds, whether or not

broken; sunflower seed, safflower, or cottonseed oil, and their

fractions, whether or not refined but not chemically modified; and

barley) reached 22.5 MMt from March until October 2022. The main

recipients of the abovementioned grains were Romania, Turkey,

Poland, Spain, Hungary, Italy, Bulgaria, mainland China, and

Egypt.

There is hope that land and river transport will develop more

because the European Union significantly stimulates the development

of the "Solidarity Lanes" so that grain from Ukraine reaches its

final recipients, mainly Africa, to avoid further migration waves

from this continent and to prevent social unrest.

Learn more about our Global Trade Analytics Suite (GTAS).

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrends-in-grains-market-during-russianukrainian-war.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrends-in-grains-market-during-russianukrainian-war.html&text=Trends+in+grains+market+during+Russian-Ukrainian+war+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrends-in-grains-market-during-russianukrainian-war.html","enabled":true},{"name":"email","url":"?subject=Trends in grains market during Russian-Ukrainian war | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrends-in-grains-market-during-russianukrainian-war.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Trends+in+grains+market+during+Russian-Ukrainian+war+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftrends-in-grains-market-during-russianukrainian-war.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}