Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 22, 2022

Week Ahead Economic Preview: Week of 25 April 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

A string of Q1 GDP data will be released in the coming week across the US, eurozone, South Korea and Taiwan. The Caixin China General Manufacturing PMI will also offer a first look into China's manufacturing health amid the latest COVID-19 disruptions. The flash eurozone inflation reading will also be eagerly awaited while Australia and Singapore CPI figures will likewise be released. The Bank of Japan meanwhile convenes and updates their forecast figures.

As the equity markets continue to grapple with the implication of higher inflation amid the string of Q1 earnings releases, we see next week offering some return of the focus to fundamentals with a series of tier-1 economic data updates. Specifically, both the US and eurozone will release flash estimates for first quarter GDP, a period that had seen easing COVID-19 restrictions and the Ukraine war having had mixed effects upon growth. The extent of slowdown from the fourth quarter of 2021 amid increasingly uncertain conditions will be watched.

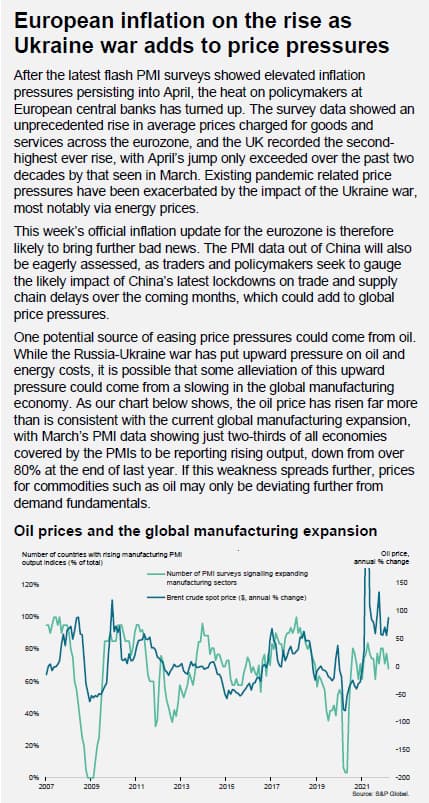

Flash inflation data from the eurozone will also be due in the week following the S&P Global Flash Eurozone Composite PMI release, which offers a first look into the price trends in April. The inflation update comes as ECB policymakers are increasingly worried about anchoring inflation expectations. Likewise in Australia and Singapore, inflation numbers will be updated with particular focus on the Australia Q1 CPI given recent remarks from the Reserve Bank of Australia with regards to faster inflation and the potential for quicker rate-rises.

In APAC, China's COVID-19 conditions remain severe and the April China Manufacturing PMI will offer the earliest insights into manufacturing sector conditions amid persistent stringent measures to deal with the spread of the Omicron variant. The Bank of Japan will be the sole central bank meeting held in this part of the world. Although no changes are expected on the monetary policy front, the central bank's projections will be closely scrutinised.

© 2022, IHS Markit Inc. All rights reserved. Reproduction in whole or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-april-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-april-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+25+April+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-april-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 25 April 2022 | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-april-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+25+April+2022+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-25-april-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}