Weekly Pricing Pulse: Equity markets rise despite fresh trade salvo but commodity prices take a hit

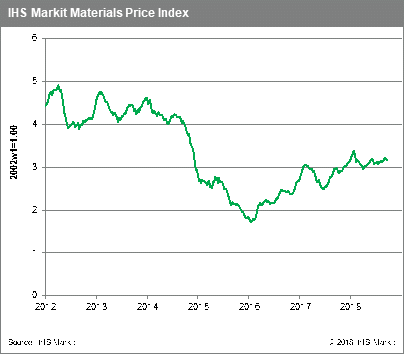

Although the US announced 10% tariffs on an additional $200 billion of Chinese imports, statements late in the week led stock markets to take heart that this latest trade salvo may turn out better than expected. The result was that various global equity indexes pushed higher, including Dow and S&P 500, both of which hit record highs. Commodity markets remain a bit more pessimistic, however, with our IHS Materials Prices Index (MPI) dipping 0.7% last week, its second consecutive decline.

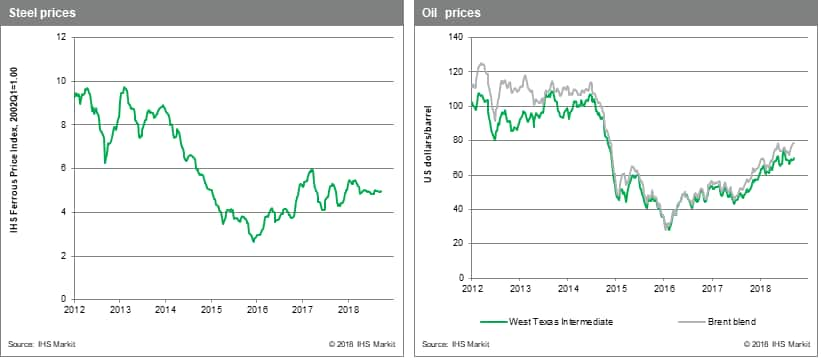

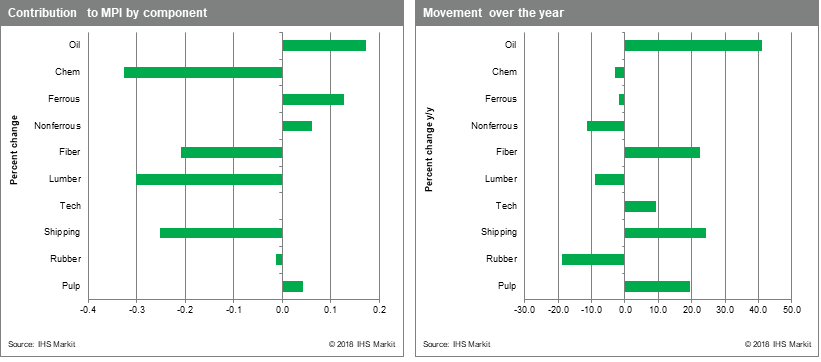

Five of the MPI's ten components fell last week with some major moves related to Hurricane Florence. Lumber prices fell 12.9% in reaction to a two main factors: fading storm related fervor and lackluster housing market data. Chemicals price dropped 1.3% and fiber prices dropped 3.2%, in part because of a lack of buying in areas impacted by Florence. To the upside, Brent crude posted a fresh four-year high of $80.94 /bbl last Monday and 0.9% for the week after Opec decided to resist further increases in production.

For this week, the reaction in commodity markets to the anticipated Fed Funds rate hike will be interesting. Although widely expected, this third rate increase this year (to be followed by yet another increase in December) will reinforce the more challenging environment facing commodities as financial market normalize. How prices move may provide a clue as to whether commodity markets view the near future as a glass half full or half empty.