Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 21, 2023

World Trade Grain Outlook — Trends and Forecast

The year 2022 was marked by food crises caused by prices rising for a long time. The factor that contributed significantly to price increases was the Russian aggression against Ukraine. As of mid-2022, it was estimated that 50 million people lived on the edge of famine, according to David Beasley, the head of the UN World Food Program. The situation had improved, thanks to the Black Sea Grain Initiative signed in July 2022, which operated until July this year, when Russia decided not to extend it. During the operation of the initiative, more than 33 million metric tons of grain and other food products were transported from Ukrainian ports, reaching dozens of countries. About 78% of the exported goods were assigned to the two main agricultural goods exported from Ukraine — corn and wheat.

The war between the two big exporters of grains has not only affected prices in the region, but also the world prices of this commodity and caused a stir mainly in the Middle Eastern and African countries, which were the main importers.

Cereals, unlike other products, require a special climate and specific soil to be able to bring a bountiful harvest. They also do not have simple substitutes. Flour can be produced from cassava, but it will not replace traditional products and house cricket flour, which was approved on the EU market on Jan. 24, 2023, will not gain much popularity among consumers in the short term.

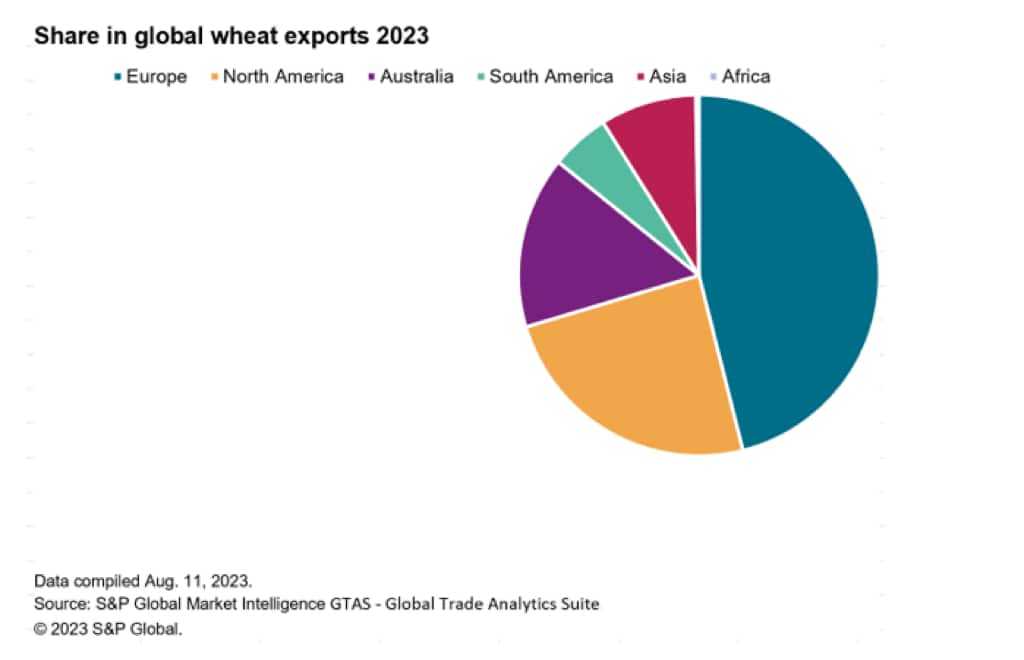

The main exporter of wheat over the years has been Europe, followed by North America and Australia. Combined exports from these three continents amounted to 85% of world exports in 2022. The year 2022 is special not only because it is the so-called post-COVID-19 year, but also because of the Russian-Ukrainian war, which had a huge impact on prices but also led to some shifts in grain trade flows. As a result of these changes, Europe is still a major exporter, but its share of world trade has declined from 59% in 2020 to 47% in 2022 and is projected to reach 48% in 2025. The second continent in terms of export volume was North America, whose share in global exports amounted to 22% in 2022 and will remain at a similar level during this period. As a result of the changes taking place in the northern hemisphere, Australia seized its opportunity in the market and its share increased from 5% in 2020 to 15% in 2022, which was the result of record wheat production and ample export.

The main exporter was the U.S. over the years with its share declining from 24% in 2005 to 13% in 2020, and according to the Market Intelligence GTAS Forecasting its share will reach 12% in 2025. The war in Europe is negatively affecting Russia's exports, which seems obvious because of the sanctions imposed on that country. Nevertheless, Russia managed to maintain its third position and its share in 2022 was 11%, which is 7 percentage points lower than in 2020 (the major importers of wheat from Russia were Turkey, Egypt, Kazakhstan, Azerbaijan and Nigeria in 2022, whereas in 2023, according to Market Intelligence, major importers will be Turkey, Egypt, Kazakhstan, Azerbaijan and Nigeria).

As for rye exports, Europe is the main exporter, its share in 2022 was 87%, down 7 percentage points from 2020. The second-largest exporter is North America, which accounted for 12% of global exports in 2022. In the longer term, both continents will dominate global exports and their combined share in 2025 will reach 100%.

The top five global rye exporters in 2022 were Poland, Germany, Canada, Russia and Latvia. Poland is the top exporter of rye; its share of world exports accounted for 27% in 2022, a significant decrease from 2020 when Poland's share was 55%. In the longer term, it seems that Poland will continue to be a leader among rye exporters, but its share will not return to that of 2020, and according to Market Intelligence GTAS Forecasting it will reach 31% in 2025. Germany and Canada, on the other hand, doubled their shares in global exports, and so in 2022 Germany's share was 25% while Canada's was 12% and in 2020 13% and 6%, respectively.

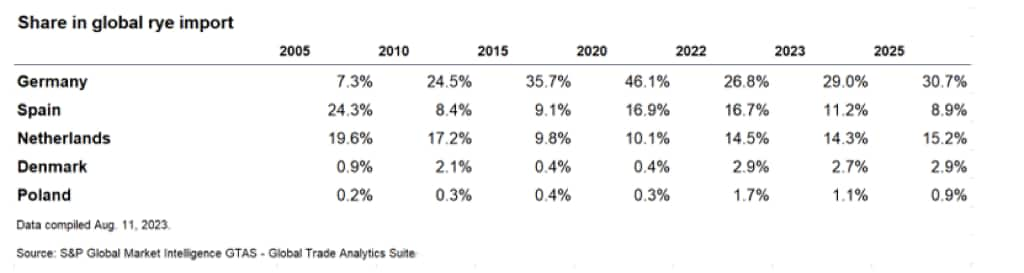

Looking at the major importers of rye, the market situation is different from what we observed on the wheat market. The main importer is Germany. Its share of global rye imports was 27% in 2022, and according to Market Intelligence, it will reach 31% in 2025. It should be noted that Germany is the world's largest producer of rye and the second-largest exporter of rye after Poland. The question arises as to why Germany is among both the world's top importers and exporters of rye? The answer to this question is not straightforward. One factor is the country's geographical location. Germany exports rye via the Port of Hamburg, while it imports it mainly from the Netherlands and Denmark. The distorted statistics may be a result of the Amsterdam-Antwerp effect (in fact we could call it "Hamburg-Bremerhaven effect"), but another explanation is that this country exports grain of higher quality while importing grain of lower quality for industrial purposes.

Market Intelligence GTAS Forecasting statistics, Spain is next in the line among major rye importers, followed by the Netherlands with shares of 17% and 15%, respectively, in 2022. This trend will be reversed, so that in 2025 the Netherlands will be the second-largest importer (15% of share) and Spain will be the third (9% of share).

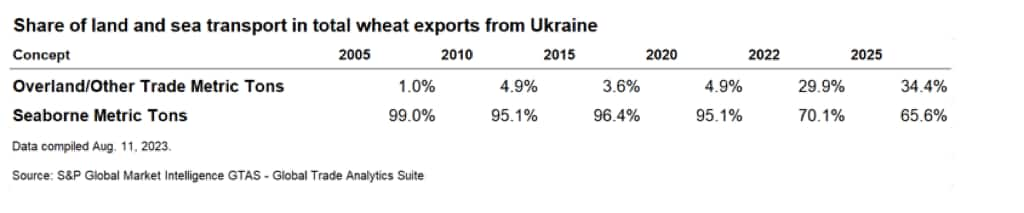

The outbreak of the war in Ukraine led to a visible collapse of Ukrainian grain exports. In 2022, wheat exports amounted to just under 10 million metric tons, compared with 19 million metric tons in 2020. Interesting changes took place in its structure. Over the last decades, the share of inland trade in Ukrainian agricultural exports has been very limited. Even in 2015, the share of overland trade in total wheat exports was only less than 5% with seaborne transport responsible for the rest. The situation changed dramatically with the beginning of the war. In 2022, overland exports accounted for almost 30% of wheat, 26% of corn and 31% of rye exports.

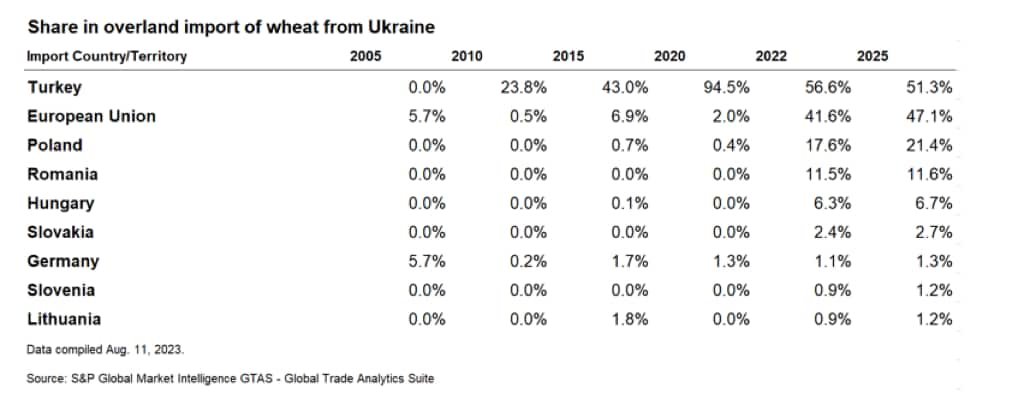

If we break down Ukraine's inland exports by the countries to which they are directed, we can see a decrease in the percentage share of Asian countries (specifically Turkey, which in 2020 accounted for 95% of Ukrainian land exports of wheat) and increase in Ukrainian exports to the EU (from 2% to almost 42% of wheat exports).

At the same time, the volume and structure of seaborne exports also have changed. Wheat exports fell from 17 million metric tons in 2020 to less than 7 million metric tons two years later. Among the importers of wheat, the European Union countries also began to play a greater role. The percentage share of exports to Asian countries decreased significantly and remained unchanged to African countries (despite the substantial decrease in volume).

As for corn export, as in the case of other cereals, an increase in the importance of exports by land is noted; however, it is slightly less substantial than in the case of wheat. A significant increase in the importance of land trade led to changes in its structure, which were similar to structure of exported wheat — an increase in the importance of exports to European countries, mainly Central Europe.

The world is changing both in technology through the introduction of artificial intelligence and also in the perception of our lives through the post-COVID-19 period and a large-scale war in. All these factors affect global trade of cereals; in the longer term, however, the most significant impact on world trade will not be consumer trends or war, but climate change, which will make grain (mainly wheat) a rare good because it will not be able to be grown in those countries that are currently the largest exporters/producers.

Learn more about our Global Trade Analytics Suite (GTAS).

Subscribe to our monthly newsletter and stay up-to-date with our latest analytics

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-trade-grain-outlook-trends-and-forecast.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-trade-grain-outlook-trends-and-forecast.html&text=World+Trade+Grain+Outlook+%e2%80%94+Trends+and+Forecast+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-trade-grain-outlook-trends-and-forecast.html","enabled":true},{"name":"email","url":"?subject=World Trade Grain Outlook — Trends and Forecast | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-trade-grain-outlook-trends-and-forecast.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=World+Trade+Grain+Outlook+%e2%80%94+Trends+and+Forecast+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-trade-grain-outlook-trends-and-forecast.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}