Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 02, 2024

Worldwide manufacturing upturn gains momentum in March as recovery broadens out

PMI surveys showed manufacturing business conditions improving at an increased rate in March, gaining further momentum to signal the sector's strongest performance since the first half of 2022.

The upturn has also broadened out since the initial upturn seen in February, now extending to 17 of the 31 economies covered by the PMI surveys. The improvement is also reflective of a widening out of the demand recovery from consumer goods to intermediate goods, with signs also that spending on investment goods may likewise return to growth soon.

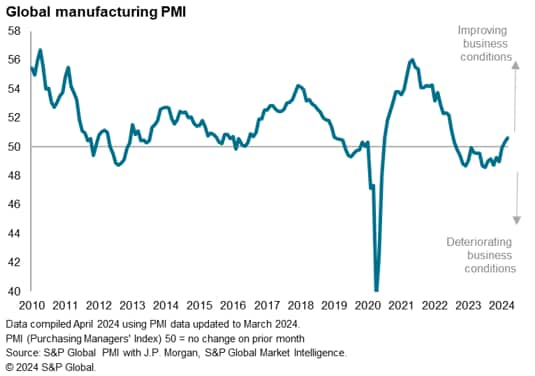

PMI at 19-month high

The Global Manufacturing PMI, sponsored by JPMorgan and compiled by S&P Global Market Intelligence, rose from 50.3 in February to 50.6 in March, its highest since July 2022. The upturn signals a marginal improvement in the health of the goods-producing sector for a second successive month, hinting at a nascent recovery from stagnation at the start of the year and contraction in the prior 16 months.

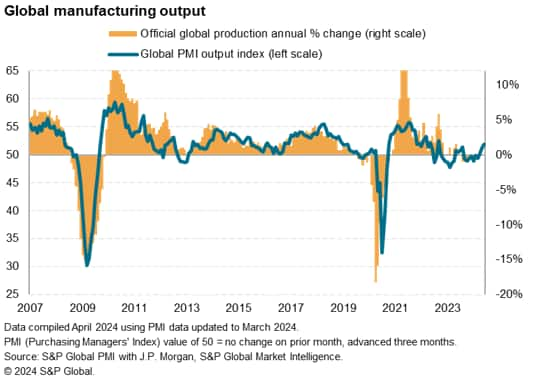

Resurgent output

The survey's sub-index of production, which tracks actual factory output changes, signaled a third successive monthly expansion of production, registering the largest increase since June 2022.

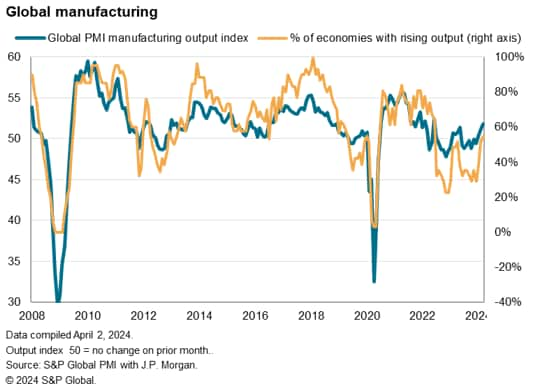

Broader geographical upturn

In addition to the overall level of manufacturing output rising globally in March, the number of economies reporting higher output increased to 55%, representing the highest proportion since June 2022 to indicate a broadening-out of the upturn geographically.

In total, output rose in 17 of the 31 economies tracked by the S&P Global PMI surveys in March, led once again by India, which has now led the rankings for nine successive months. Especially strong output gains were also recorded in Greece, Indonesia, Russia and Brazil.

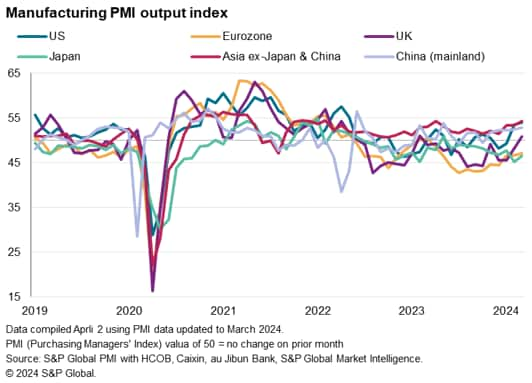

Robust expansions were also seen in the US and mainland China, where growth rates hit 22- and 21-month highs respectively, as well as Mexico and Spain.

The latter consequently reported the strongest growth in the eurozone, helping to ease the single current area's downturn to the softest in 11 months. The region nevertheless remained the biggest drag on the global manufacturing economy, linked to a further steep production decline in Germany and close neighbours Austria, the Czech Republic and Poland.

Especially sharp declines were also recorded in Australia and Japan.

Rising demand

New orders meanwhile rose worldwide for a second month in a row, increasing at the sharpest rate since May 2022. The demand upturn was aided by a near-stabilization of global goods export orders, which showed the smallest decline for 25 months.

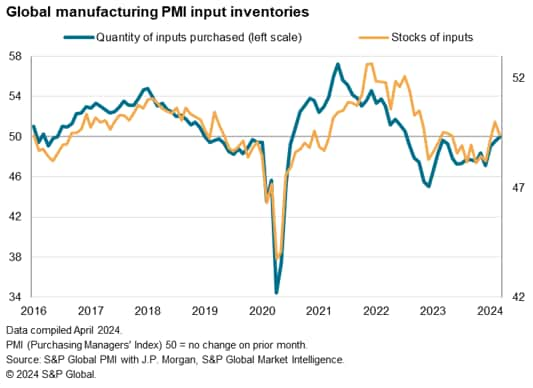

The strongest upturn in global new orders was recorded for intermediate goods, which rose for a second month after 22 months of continual decline to show the sharpest increase for just over two years. The improved demand for intermediate goods largely reflected increased purchasing of inputs by other manufacturers in response to higher production requirements, as well as a further move away from deliberate inventory reduction policies. March was notable in being the first month since July 2022 that manufacturers globally did not cut their purchases of inputs.

New orders for consumer goods also rose to support the broader manufacturing upturn, rising globally for a third straight month in March after four months of decline.

While new orders for investment goods, such as machinery and equipment, continued to fall, the decline was only marginal the smallest recorded for a year, hinting at an imminent return to growth of global capital spending on equipment.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-manufacturing-upturn-gains-momentum-in-march-Apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-manufacturing-upturn-gains-momentum-in-march-Apr24.html&text=Worldwide+manufacturing+upturn+gains+momentum+in+March+as+recovery+broadens+out++%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-manufacturing-upturn-gains-momentum-in-march-Apr24.html","enabled":true},{"name":"email","url":"?subject=Worldwide manufacturing upturn gains momentum in March as recovery broadens out | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-manufacturing-upturn-gains-momentum-in-march-Apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Worldwide+manufacturing+upturn+gains+momentum+in+March+as+recovery+broadens+out++%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworldwide-manufacturing-upturn-gains-momentum-in-march-Apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}