Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 05, 2024

Global PMI signals persistent elevated selling price inflation in May

Average prices charged for goods and services rose worldwide at a slightly increased rate in May, reflecting persistently elevated services price increases combined with accelerating price growth in manufacturing. However, there are signs of rates of inflation cooling in Europe. In the US, the PMI data are consistent with inflation falling closer to the Fed's target in the coming months.

Persistent global price inflation

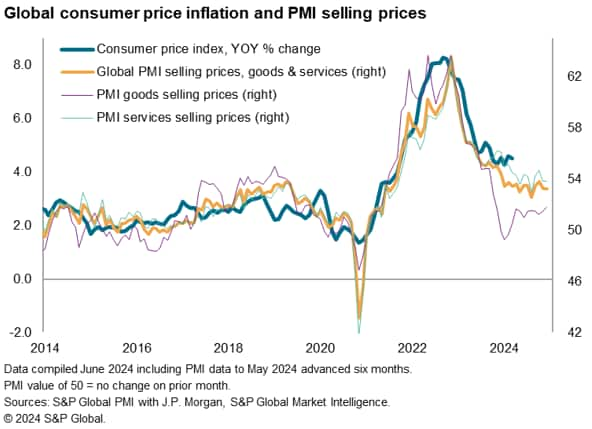

Worldwide PMI survey data compiled by S&P Global for J.P. Morgan showed average prices charged for goods and services having risen globally at a marginally increased rate in May. The composite PMI Prices Charged Index edged up from 53.2 in April to 53.3, a level only very marginally below the 53.4 average seen over the past year - a period which has seen the index stuck in a tight range and stubbornly elevated by historical standards. By comparison, this index averaged just 51.2 in the decade preceding the pandemic; a time when global consumer price inflation averaged 2.7%. The recent PMI readings are consistent with global inflation running at roughly 3.5%.

With the PMI data tending to lead changes in the annual rate of global consumer price inflation by around six months, the suggestion from the PMI is that global inflation looks likely to remain at an elevated level by historical standards as we head into the second half of 2024.

Stubborn service sector inflation accompanied by higher goods prices

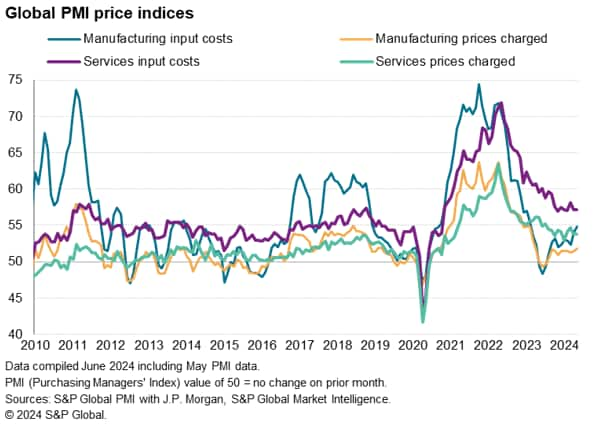

The main area of persistent global price pressure remains the service sector, where the rate of inflation was unchanged in May at a pace well above the pre-pandemic average, albeit down markedly on a year ago and far below the peaks seen in the pandemic. Global service sector input cost inflation - a major element of which is wages and salaries - likewise remained unchanged from April in May, also running well above its pre-pandemic average.

The was also some discouraging news in the global fight against inflation from the manufacturing sector. Average prices charged for goods rose worldwide at the fastest rate for 14 months in May. Good prices have now risen for ten successive months, driven by a commensurate increase in factory input costs. The latter have notably risen at a markedly increased rate so far in the second quarter, the rate of input price inflation hitting a 15-month high in May to hint at a possible further acceleration of selling price inflation in the coming months, as firms seek to pass higher costs on to customers.

In short, global services inflation continues to be stuck at a persistent elevated level by historical standards, and the helpful disinflationary impact from the manufacturing sector is being replaced by renewed upward pressure on goods prices.

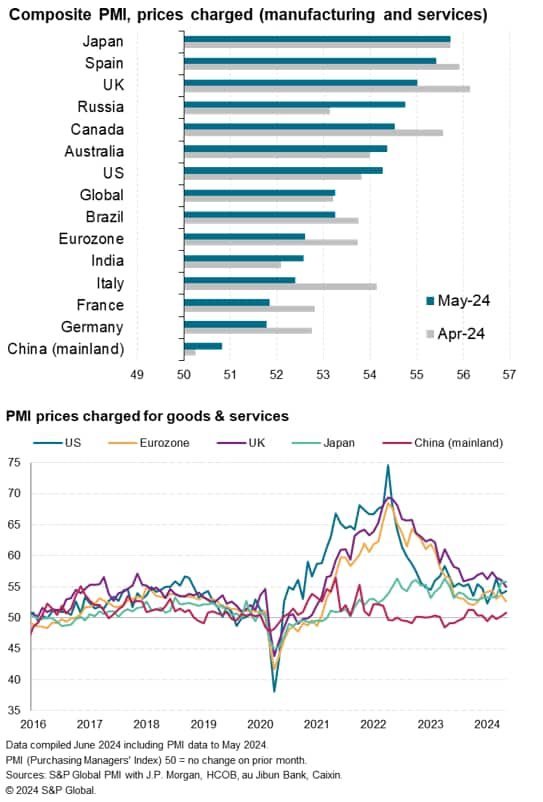

Japan, Spain and UK see steepest selling price inflation

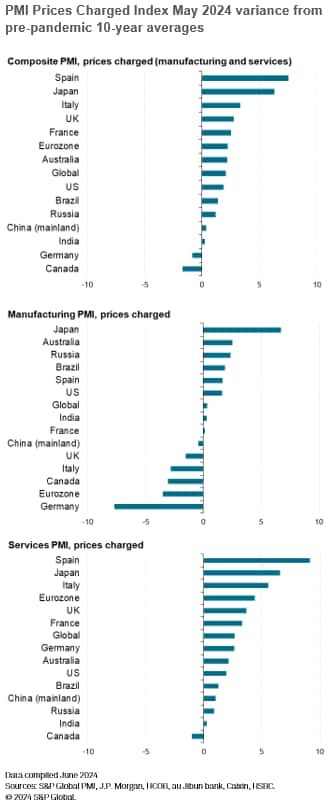

Geographically, especially steep rates of selling price inflation were recorded in Japan, Spain and the UK in May, with Spain's reading a stark contrast to the sub-50.0 pre-pandemic average, thanks mainly to service sector inflation. Rates of selling price inflation nevertheless cooled across the eurozone as a whole, down to a six-month low, as rates eased in all four largest member states. The rate of increase likewise moderated in the UK, down to a 39-month low. The PMI selling price index is now just 2.2 points above its per-pandemic decade average in the eurozone (and is notably 0.8 points below the pre-pandemic average in Germany), and is 2.7 points higher in the UK.

In contrast to the easing trend seen in Europe, selling price inflation ticked higher in the US, still running just 1.9 points above its pre-pandemic ten-year average. Input cost inflation has also turned higher in the US, both for services and goods, the latter now up to a 13-month high.

Europe is therefore seeing signs of elevated inflation rates moderating closer to ranges that would encourage central banks into feeling comfortable about targets being met to sustainable degrees, but the data flow in the coming months will be important to add more confidence to this assessment. In the US, while even at current levels the PMI hints at some further downward pressure on the Fed's preferred core PCE price gauge, progress in further reducing inflation looks less certain given the recent upward input cost growth.

The weakest price growth of the world's largest economies was again meanwhile recorded in mainland China, though here the rate of increase rose to a seven-month high to run just ahead of the pre-pandemic decade average.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-persistent-elevated-selling-price-inflation-in-may24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-persistent-elevated-selling-price-inflation-in-may24.html&text=Global+PMI+signals+persistent+elevated+selling+price+inflation+in+May+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-persistent-elevated-selling-price-inflation-in-may24.html","enabled":true},{"name":"email","url":"?subject=Global PMI signals persistent elevated selling price inflation in May | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-persistent-elevated-selling-price-inflation-in-may24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+PMI+signals+persistent+elevated+selling+price+inflation+in+May+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fglobal-pmi-signals-persistent-elevated-selling-price-inflation-in-may24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}