Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 02, 2024

Final PMI signals fastest factory production growth in the US since May 2022, but also steeper price rise

The final PMI data for US manufacturing showed the production cycle moving up a gear at the end of the first quarter, but also indicated that pricing power has likewise revived, especially in relation to consumer goods. Coming as the Federal Reserve seeks to pivot to looser policy, these two developments underscore the likely bumpy path in bringing inflation down to the Fed's 2% target.

Faster factory output growth

The final S&P Global Manufacturing PMI signaled a further encouraging improvement in business conditions in March, adding to signs from the earlier flash PMI that the economy looks to have expanded at a solid pace in the first quarter. The headline PMI - a composite index based on five different survey variables - registered 51.9 to signal a third successive month of improving conditions after eight straight months without growth.

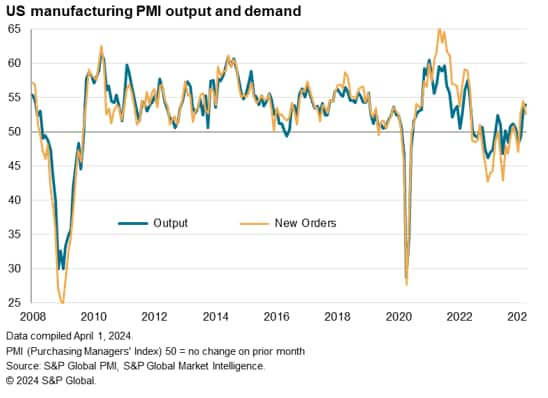

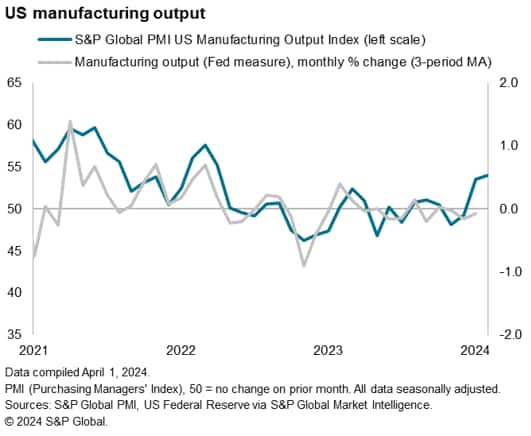

A key development in recent months has been the broadening-out of the economic upturn recorded by the PMI from services to manufacturing, with the goods-producing sector reporting rising output for a second successive month in March. Moreover, the latest increase in production was the largest recorded since May 2022.

Comparisons with official production data suggest that the recent survey data are indicative of manufacturing output growing at an average monthly rate of 0.5%, meaning the goods-producing sector likely contributed to a further GDP rise in the first quarter.

Resurgent demand, buoyed by renewed capex spending

Producers reported that the production increase was fueled by a further rise in new orders. Manufacturers have now reported rising orders for three straight months, representing the strongest upturn in demand for goods seen since the first half of 2022.

While domestic demand provided the main stimulus to new orders growth, new export orders also rose for a second month in a row, albeit only modestly.

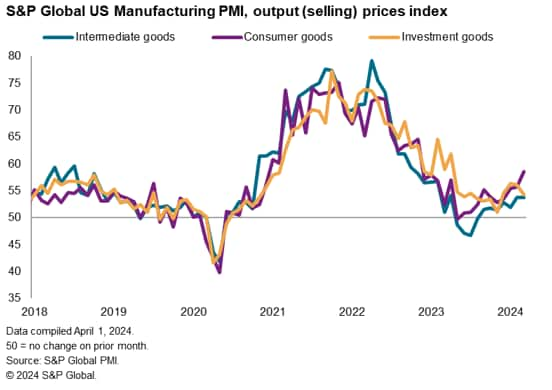

By product type, the upturn in new orders has become more broad-based and importantly, now also encapsulates the previously-lagging investment goods sectors (which produce capital equipment such as such as plant and machinery). Having seen a steeper drop in demand compared to consumer goods and intermediate goods in 2023, investment goods producers reported the largest rise in new orders for 22 months in March, the rate of increase only marginally exceeded by that seen for consumer goods.

The renewed growth of demand for investment goods seen in recent months is especially encouraging as it points to rising capex spend by companies.

Firms pass higher costs on to customers, especially for consumer goods

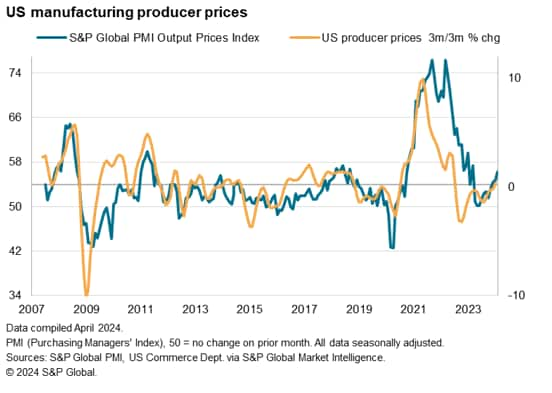

The upturn is, however, being accompanied by some firming of pricing power, both among suppliers and manufacturers. Input costs rose for a ninth month running, increasing at one of the sharpest rates seen over the past year. Average selling price inflation consequently lifted higher as producers passed these higher costs on to customers, the rate of inflation reaching the highest for 11 months.

The survey data therefore suggest that rising goods prices are adding to broader inflationary pressures in the economy after having provided a major disinflationary boost in 2023. Although the rate of selling price inflation remains well below the highs seen during the pandemic, at 56.3 in March, the index is elevated compared to the pre-pandemic ten-year average of 52.7, pointing to above-trend price pressures in the goods-producing sector.

Worryingly, from a consumer inflation perspective, the steepest rise in prices reported in March was recorded in the consumer goods-producing sector, where the rate of inflation hit a 16-month high.

Access the full press release here.

Chris Williamson, Chief Business Economist, S&P Global Market Intelligence

Tel: +44 207 260 2329

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuspmi-signals-fastest-production-growth-since-may-22-apr24.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuspmi-signals-fastest-production-growth-since-may-22-apr24.html&text=Final+PMI+signals+fastest+factory+production+growth+in+the+US+since+May+2022%2c+but+also+steeper+price+rise+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuspmi-signals-fastest-production-growth-since-may-22-apr24.html","enabled":true},{"name":"email","url":"?subject=Final PMI signals fastest factory production growth in the US since May 2022, but also steeper price rise | S&P Global &body=http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuspmi-signals-fastest-production-growth-since-may-22-apr24.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Final+PMI+signals+fastest+factory+production+growth+in+the+US+since+May+2022%2c+but+also+steeper+price+rise+%7c+S%26P+Global+ http%3a%2f%2fqa.www.spglobal.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fuspmi-signals-fastest-production-growth-since-may-22-apr24.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}