Published January 2021

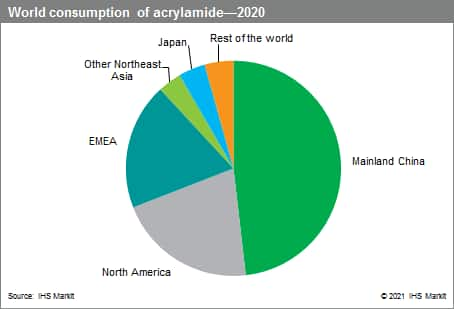

Acrylamide is a water-soluble monomer, industrially produced by the hydration of acrylonitrile. The principal acrylamide derivatives are polyacrylamides (both homopolymers and copolymers) that have varying water solubility characteristics. These polymers are used widely in water treatment, petroleum production, pulp and paper production, mineral processing, and numerous small-volume applications. The bulk of the production and consumption of acrylamide is concentrated in mainland China, the United States, and Western Europe, with mainland China accounting for over half of the global production capacity. The merchant market of acrylamide is believed to be rather small, as most producers consume the monomer directly at the site for polyacrylamide manufacture.

The following pie chart shows world consumption of acrylamide:

The acrylamide business is global, as manufacturers locate world-scale production facilities closer to the consumption locations and exploit lower-cost production locations and process efficiencies through new technology and downstream integration. The top five acrylamide producers accounted for just more than half of global capacity in 2020. International producers such as SNF, Kemira, and Solenis/BASF operate facilities in multiple regions of the world, including North America, Europe, and Asia.

The water management, oil and gas, and pulp and paper industries are the major consumers of acrylamide/PAM, accounting for more than 85% of total consumption in 2020. Water management is the leading segment in the United States and Western Europe, while paper uses dominate the Asian market. EOR will continue to be the largest segment in mainland China market, followed by water treatment.

The outbreak of COVID-19 and the resulting lockdowns and travel restrictions led to a collapse of the oil market in 2020, with a sharp decrease in oil prices, as well as reduced industrial output and manufacturing. This has heavily impacted demand in most regions of the world, which led to low utilization rates (averaging 50–55%) in 2020 and further exacerbated the oversupply in the market. Recovery to prepandemic consumption levels is not expected before 2023. Future growth in demand will be driven primarily by the increasing use of polyacrylamide in the water management sector in India and mainland China. Use in paper is expected to have limited growth in developed economies, whereas it should increase faster in Asia (excluding Japan). The North America acrylamide market should see some recovery in petroleum processes such as hydraulic fracturing and EOR, after oil markets recover.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook – Acrylamide is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook – Acrylamide has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability