Published December 2021

This report discusses the two major categories of specialty films—engineering films (polyester, nylon, and polycarbonate) and high-performance films (fluoropolymer, polyimide, polyethylene naphthalate, cyclo-olefin copolymer/polymer, and developmental). Although they are consumed in much lower quantities than engineering films, high-performance films receive greater emphasis in this report because of their high prices and high value in use.

Developmental films include a variety of commercial and semicommercial films with low annual consumption volumes and high selling prices. The term developmental does not necessarily refer to product life-cycle position, but reflects the films’ niche market status. Most of these films are performance driven and encounter relatively low levels of intermaterial competition.

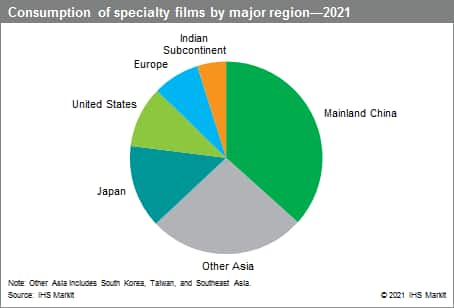

The following pie chart shows consumption of specialty films in the United States, Europe, mainland China, Japan, the Indian Subcontinent, and Other Asia (South Korea, Taiwan, and Southeast Asia) on a value basis:

The United States fabricates and consumes large volumes of engineering films (polyester, nylon, and polycarbonate) and fluoropolymer films. Major fabricators of engineering films, such as DuPont, Honeywell, SABIC, and Covestro, are generally back-integrated to resin production.

Suppliers of engineering films are well established in Europe. Most of the major polyester and polycarbonate films fabricators are global companies such as Toray Films Europe, Agfa, Covestro, and SABIC, and they are also mostly back-integrated. Nylon film producers were historically independent fabricators, but back-integration is increasing because of the price advantage.

Japan also has a well-established engineering films industry. Besides that, the country has historically had a leadership position in the fabrication and consumption of polyimide and developmental films. The electronics industry is well developed in Japan and the local companies (e.g., film suppliers and end users) have been able to form cooperative agreements for the development of new applications. Toray, Kaneka Corporation, and Sumitomo Bakelite were among the major suppliers of polyimide and developmental films in the country. Many end users of specialty films have moved their production to other Asian countries.

The mainland Chinese industry is well established, especially for biaxially oriented PET (BOPET) and nylon films. For polycarbonate, fluoropolymers, and polyimide films, domestic demand, which is growing very rapidly, still relies on imports. Consumption of PVDF films, PFTE films, and polyimide films is growing particularly fast, driven by the developing electronic, photovoltaic, and water treatment industries. However, except for fluoropolymer and polyimide films, the high-performance films industry is still not developed.

Compared with other businesses covered in the report, the polyester film business is large, global, and very competitive. A large number of companies supply polyester film, and some maintain fabrication facilities in more than one geographic region. Packaging represents the largest end use for BOPET film, followed by industrial and electrical/electronic applications, which also include optical film for flat-panel displays (FPDs).

The nylon film business is less global than most of the other classes of specialty films. Over 80% of the film consumed goes into flexible packaging (primarily food and medical) applications.

A number of companies, the most successful of which are in Japan, have developed new types of films from various high-performance resins during the past decade. Consumed in very small volumes, most of these films are produced in small volumes. Suppliers are seeking niche markets that can benefit from a combination of the films’ price and performance characteristics, which generally lie between those of polyester and polyimide films. Japanese companies have made significant strides in commercializing these films because of two factors—the well-developed electronics industry, which is a key market for these films, and the fact that suppliers and end users work closely together to develop applications globally. The long-term prospects are mixed for these small, niche films because they are very expensive and face competition from other specialty films. Among developmental films, PPS, aramid, and LCP films are the largest in terms of consumption volumes.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Specialty Films is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Specialty Films has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets