Published May 2023

Methanol (or methyl alcohol) is a colorless liquid primarily produced from natural gas or coal. Methanol is a commodity product, which can either be used directly or further transformed to produce a wide range of chemicals that ultimately find applications in diverse sectors (construction, textiles, packaging, furniture, paints, coatings, etc.). Methanol markets are fairly fragmented; formaldehyde synthesis remains methanol’s single-largest outlet. Other major outlets include the production of olefins, methyl tert-butyl ether/methyl tert-amyl ether (MTBE/TAME), blending component for gasoline, bunker fuel, and dimethyl ether (DME). The methanol demand pattern is relatively complex and influenced by several distinct market forces, including fuel prices, fuel consumption, environmental policies, biofuel mandates, chemical demand, plastics consumption and housing markets.

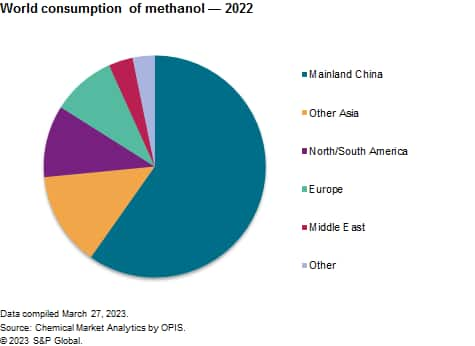

The following pie chart shows world consumption of methanol:

Since 2001, while methanol demand has broadly stagnated in most regions of the world, it has grown at a fast pace in Northeast Asia. Fast-rising fuel demand in mainland China, as well as the development of unconventional chemical production plants (MTO) have primarily driven methanol consumption in Northeast Asia. The sizeable development of global methanol production has created an opportunity for mainland China to diversify away from conventional naphtha cracking to produce olefins. Methanol demand for fuel applications has recently slowed, primarily because of decreasing demand for fuel applications, but new developments within the chemical industry have filled the gap. Despite the recent impact of the RussiaUkraine conflict on methanol markets globally, world consumption of methanol is projected to continue to increase during 2022–27.

The methanol production landscape is highly fragmented; the world’s top 10 producers account for less than 30% of global capacity. Methanex is the methanol market leader, with production assets in the Americas, Africa and Asia, and benefits from a comprehensive supply chain network to distribute methanol on a global scale. This report further provides a detailed overview of all major producing companies by region, including capacity, location and feedstock used.

Global methanol capacity is forecast to further grow, with mainland China and the United States accounting for most of the new increases. Methanol trade flows are projected to remain of major importance to balance global markets, but some key shifts are anticipated in the coming years. Uncertainties brought about by the Russia-Ukraine conflict and its fallouts, geopolitical tensions between the United States and mainland China, the reimposition of US sanctions on Iran, as well as heightened economic and security concerns in certain regions, have cast a shadow over the global economy, and this report includes the latest economic and industry forecasts.

For more detailed information, see the table of contents, shown below.

S&P Global’s Chemical Economics Handbook –Methanolis the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key Benefits

S&P Global’s Chemical Economics Handbook –Methanol has been compiled using primary interviews with key suppliers, organizations and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence, expert insights into industry dynamics, trade and economics.

This report can help you:

- Identify trends and driving forces influencing chemical markets

- Forecast and plan for future demand

- Understand the impact of competing materials

- Identify and evaluate potential customers and competitors

- Evaluate producers

- Track changing prices and trade movements

- Analyze the impact of feedstocks, regulations, and other factors on chemical profitability